The typical investor’s portfolio currently has the same value after inflation it did in 2016 despite stock markets across the globe reaching new record highs, research by Asset Risk Consultants (ARC) suggests.

The investment consultancy found inflation has “dented” the value of private client portfolios after it caused the real wealth of the typical sterling private client investor to fall by 15% from its 2021 peak. This was compounded by the re-adjustment of bond yields in 2022, which resulted in a “one-time downward shift” in the wealth of investors.

Graham Harrison, chairman ARC Group, says: “Thinking that recovery in nominal terms means their portfolio is back on track is accepting an illusion. This may make an investor feel more comfortable when their portfolio recovers to a previous numerical high, but the ‘real’ question is at what point previous purchasing power recovers.”

Source: ARC

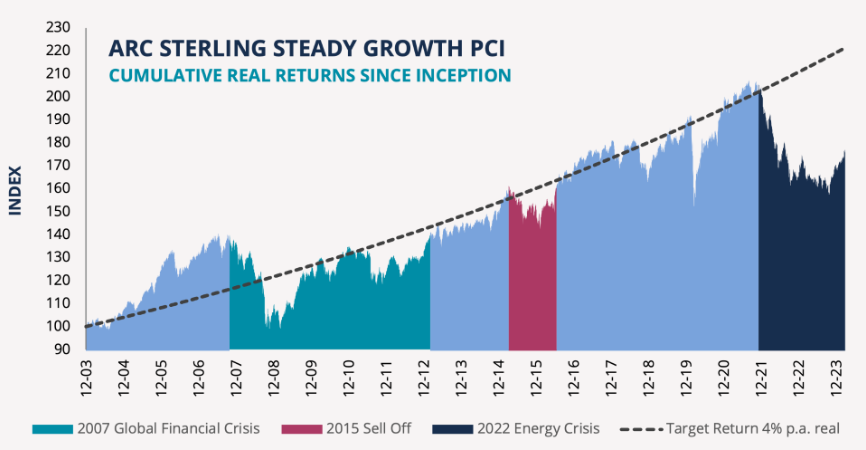

The analysis is based on the performance of the firm’s ARC Sterling Steady Growth Private Client Index (based on the most common risk profile run by discretionary investment managers), adjusted for inflation. This can be seen above.

Since inception, the index has made an annual real return of 4% but the recent dip means it needs to achieve returns of 7.3% over inflation per year for the next decade for real wealth to be restored to the trend line.

Investors make regular withdrawals from their portfolios should consider whether now is the time to “tighten their belts” as the sustainable withdrawal level is probably around 20% lower today than it was at the start of the decade.

In addition, ARC suggested investors take another look at their investment risk appetite and asset allocation mix given the changes in the investment backdrop.

“Over the past decade, the optimal portfolio consisted solely of equities, a viewpoint encapsulated in the acronym TINA (There Is No Alternative), as equities were driven ever higher by excess liquidity and bond yields moved to ultra-low or even negative levels,” Harrison finished.

“The 2020s are surely going to be the decade when TARA (There Are Reasonable Alternatives) once again comes to the fore. The return of positive real interest rates in bond markets means that multi-asset class investing should once again offer both risk diversification and positive real returns.”