Airlines and banks aren’t usually thought of as growth areas, but they have the potential to surprise sceptical investors, according to Gary Channon, manager of the £190.7m Aurora Investment Trust.

Although he focuses on valuations, he admitted he has been “obsessing” about the growth potential of these industries.

For banks, the market is assuming a 13-14% return on equity, but the manager predicts they are in a good position to deliver well above consensus expectations.

“What really excites me about banks and airlines is that so many of these companies now have almost-impossible-to-replicate market positions and actually quite good growth prospects,” he said.

Another misconception around these companies is that they are of lower quality, but he disagreed and said their competitive positions are “very strong”.

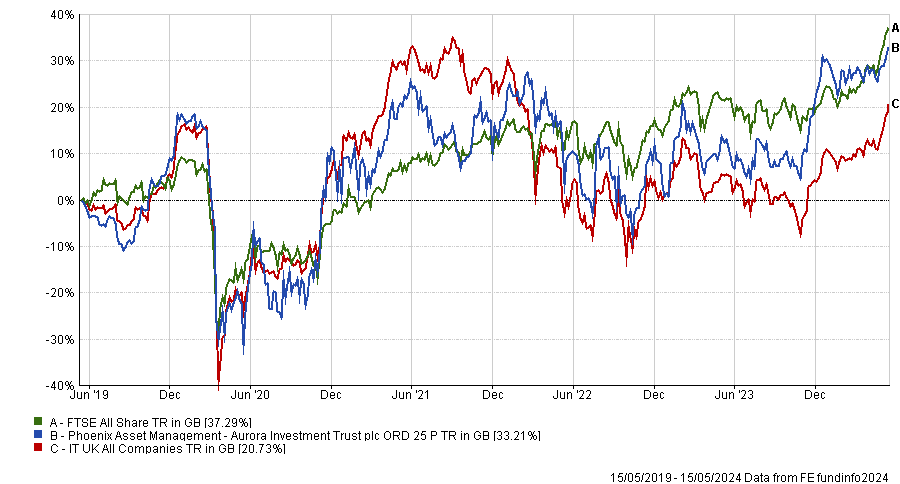

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Banks tend to grow in line with deposit growth and to consolidate their market shares over time, he noted.

“In the past 25 years, deposits have grown about 6% per annum in the UK. If banks grow deposits by 5% or 6%, their earnings growth is going to be 10-15%,” said Channon.

As for airlines, he used Delta as an example, whose revenue growth has been twice that of Procter and Gamble and the same as L'Oreal over the past 25 years, and its competitive position has improved.

The market is substantially underestimating the potential of banks and airlines, said the manager, and what’s even better, these stocks are trading at “incredibly” low multiples.

“The earnings progression is what makes me think that the absolute opportunity here is much bigger than people think,” he concluded.

Channon is not the only one bullish on banks. Hargreaves Lansdown equity analyst Matt Britzman cited four reasons why investors should consider buying the UK’s largest banks: defaults remain low; elevated interest rates are a tailwind; capital levels support strong shareholder returns; and the UK’s economic outlook is improving.

With first-quarter results strong across the board and economic data pointing to clement conditions ahead, banks “have a spring in their step”, Britzman said.

In the same vein, J O Hambro Capital Management’s James Lowen said banks have been one of the best performing parts of his JOHCM UK Equity Income fund during the past year, but he thinks they are still cheap and have further upside. He owns Barclays, Natwest and Standard Chartered.

Channon has chosen Lloyds Banking Group as his fourth-largest position, making up 7.9% of the portfolio.

The Aurora trust also holds include Ryanair and easyJet, which respectively account for 6.8% and 4.4% of its assets under management.

Channon follows a value-based approach to investing in high-quality UK-listed businesses and aims to buy stocks at prices that allow for strong returns.