Wealth management firm Coutts (part of NatWest) is pulling £2bn out of the UK equity market as it shifts from a home bias to a global approach.

The King’s bank, which has served the royal family since the time of George IV, is revamping the asset allocation of its six Personal Portfolio funds by cutting exposure to UK stocks and UK investment-grade bonds. It is also introducing a new benchmark, the MSCI All Countries World Index ESG Screened Select Index.

Coutts said it aims to improve diversification as well as long-term returns, but this adjustment will reduce the weight of UK equities from 33% to a mere 2%.

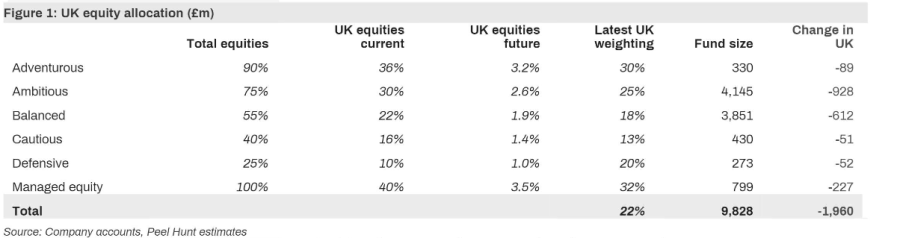

As such, the wealth management firm is poised to sell £1.96bn worth of UK equities, which represents 0.08% of the overall UK market. While it is a small amount, investment bank Peel Hunt warned that it is “very material” in the context of UK outflows.

Allocations to UK equities in Coutts' portfolios

According to figures from Calastone, outflows from UK equities reached £8bn in 2023 and this trend has persisted into 2024.

UK funds suffered net retail outflows of £1.3bn in the first quarter of this year, the Investment Association revealed.

In March alone, British investors withdrew £823m from their domestic equity market, Calastone found. This marked the 34th consecutive month of net selling for UK equity funds.

Charles Hall, head of research at Peel Hunt, said: “This news from Coutts represents a material increase in outflows in the short term. This will inevitably put further selling pressure on the UK market at a time when valuations are already depressed.”

The globalisation dynamic in wealth management portfolios is not exclusive to Coutts; it has been a consistent theme across the industry for the past decade.

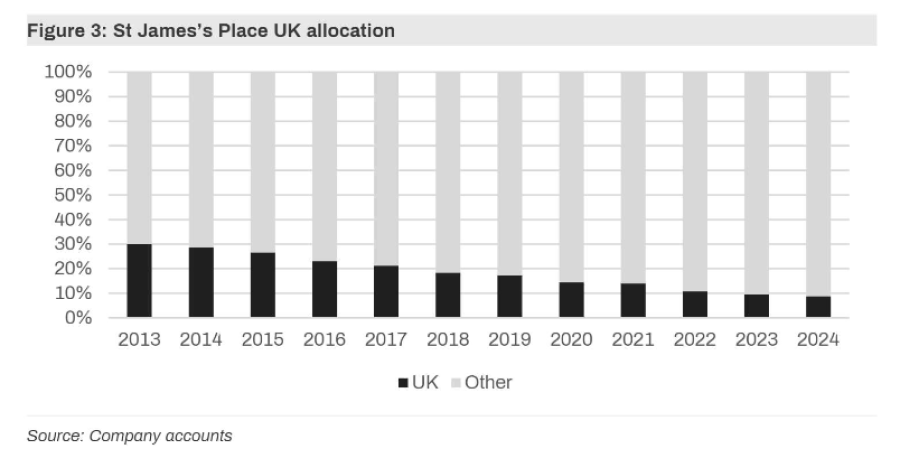

For instance, St. James's Place's assets under management (AUM) have surged from £44bn to £179bn since 2013. However, the level of assets held in UK equities has barely changed over the past 10 years. As a result, St. James's Place's allocation to UK equities has fallen from 30% in 2013 to 9% today.

Hall noted that UK retail investors are also abandoning their domestic equity market. On investment platform Hargreaves Lansdown, the total of UK equities, UK equity income and UK small- and mid-sized companies funds fell from 50% in 2015 to approximately 30% at the end of 2023.

As a result, Peel Hunt has urged the government to take action to encourage investors to buy British. The investment bank suggested pension reforms, a British ISA and the removal of stamp duty to incentivise UK investors to return to their home market.

Hall concluded: “If we do not have policies that encourage UK investment, then it is not surprising that there are outflows from the UK and that UK companies underperform.”

Laith Khalaf, head of investment analysis at AJ Bell, was sceptical about how much of an impact a British ISA can make, however. “A wildly unrealistic hope would be that the UK ISA creates an additional £4bn of inflows into UK equities every year. Currently UK equity funds are seeing withdrawals of that order every quarter,” he said.

“Active fund managers plying their trade in UK equities might well be weighing up some mid-life retraining opportunities.”