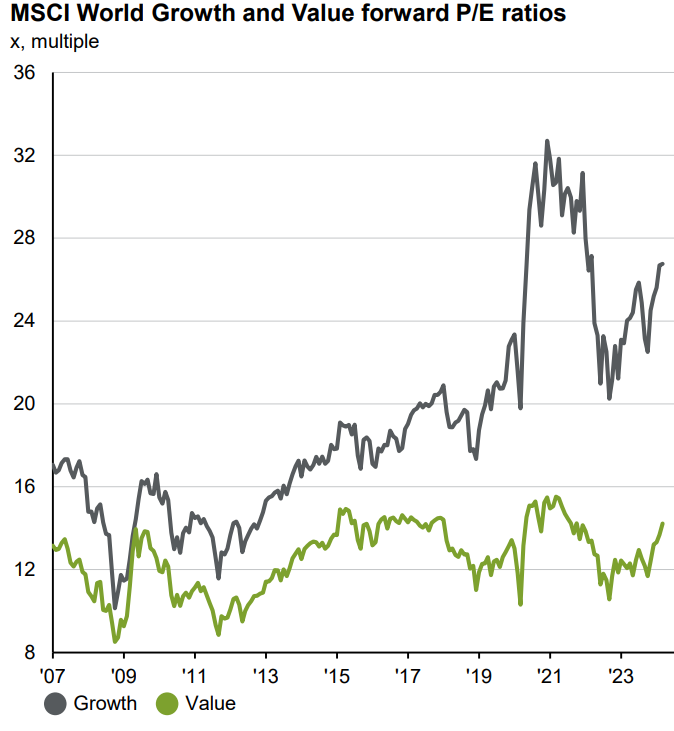

Value investing has outperformed growth over the very long term but has spent much of the past decade in the doldrums.

The difference between the valuations of growth and value stocks is more extreme now than at the height of the dot.com bubble, according to Simon Adler, who co-manages the Schroder Global Equity Income and Schroder Global Recovery funds.

Sources: JP Morgan Asset Management, LSEG Datastream and MSCI, data as of 24 Apr 2024

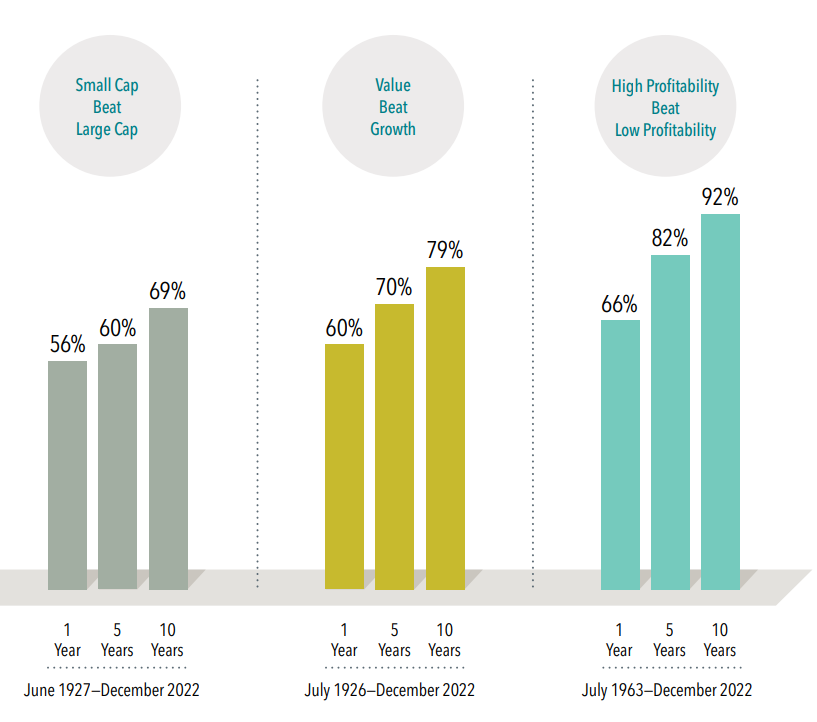

The undisputed fact that value stocks are deeply out of favour comes despite ample evidence that value beats growth over the very long term.

In fact, Dimensional Fund Advisors analysed a myriad of factors and styles going back decades and discovered that only three consistently work: value, the small-cap premium and high profitability stocks outperforming low profitability stocks.

Frequency of premium outperformance

Source: Dimensional Fund Advisors

That doesn’t mean value will beat growth every year or even every decade, as seen from the past 10 years.

Value vs growth over 10 years

Source: FE Analytics

The investment management industry – and human nature more generally – suffers from a recency bias. After watching growth stocks maintain the ascendancy for most of the past decade, it would take a brave investor to bet the farm on value. Not least because artificial intelligence (AI) and technological innovation, which favour growth stocks, are going nowhere.

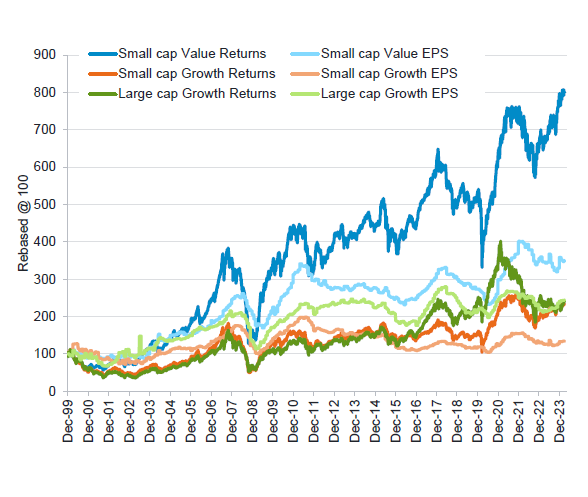

This is true across most regions. FE fundinfo Alpha Manager Nitin Bajaj, who runs Fidelity Asian Smaller Companies and Fidelity Asian Values, said it has been a decade of “swimming against the tide” despite evidence that small-cap value stocks in Asia grow their earnings faster, as the chart below shows.

Asia ex-Japan: Earnings and returns by style

Sources: Fidelity International, LSEG DataStream, 19 Apr 2024

Nonetheless, fortunes have reversed, even in recent times. Growth sold off in 2022 as the rapid interest rate hiking cycle drove up borrowing costs and the tech sector endured a bear market. Value stocks proved more resilient through this torrid period for equities, highlighting the importance of style diversification, as the chart below shows. Value stocks also rallied sharply after ‘Vaccine Monday’ in October 2020.

Value vs growth over three years

Source: FE Analytics

Yet last year, AI advances put growth and tech firmly back on the agenda.

All this has left the prices of value-oriented stocks languishing in the doldrums. Adler argues that, from such a low starting point, there is plenty of upside potential on a five-year view and attractive valuations alone should justify the inclusion of a value fund in a well-diversified portfolio.

Adler believes it is futile to search for a catalyst that could trigger a value rally or to try timing the market because stock markets move so quickly that investors who wait on the sidelines are likely to miss the start of the next rally.

Other industry participants more inclined to look for catalysts claim that the current macroeconomic environment of high inflation, high rates and resilient growth should favour sectors typically considered the purview of value investors, such as financials.

Furthermore, the unloved UK stock market, whose sector composition (financials, energy and commodities) has more of a value bent to it than the tech-oriented US, seems to have finally turned a corner and hit record highs at the start of this week.

One benefit of all this for value managers – especially those focused on the still-cheap UK – is that they can snap up high-quality companies at egregiously low prices.

Jonathan Winton, co-portfolio manager of Fidelity UK Smaller Companies and Fidelity Special Situations, said: “As a value investor, you really do not have to sacrifice quality at the moment and that’s not something I think value investors have been able to say over the past few decades.”

The average company is his portfolio is trading at 9-10x earnings. “These are businesses that we think can grow and generate decent and improving returns,” he said. “And we're not having to take the balance sheet risk that you might have had to if you wanted to find things that were very cheap in the past.”

Ultimately, the take home for investors is to check the style biases of any equity funds they hold and ensure they have a balance of value managers – bargain hunters who invest in underappreciated stocks they hope will recover – and growth managers, who buy great companies they think will exceed expectations.

Of course, there are a multitude of styles falling in between those extremes (for instance GARP, which stands for growth at a reasonable price, in other words fund managers who want to own great companies but do not wish to pay too high a price for them).

But the message stays the same: combining managers with divergent styles puts investors in good stead to withstand unpredictable market movements and benefit from a mean reversion in style-based performance if and when it does eventually happen.