Last year returns in US equities were driven by an exceptionally concentrated group of companies. Close to 70% of returns in the S&P 500 came from just 10 stocks. A consequence of this was only 28% of companies outperformed the benchmark.

Overexuberance around AI stocks was partly responsible for this. However, another argument is that this is also being driven by passive flows, which are fuelling a giant momentum trade.

The US is less than 20% of global GDP but almost 70% of stock market value, with increasing allocations to market cap weighted passive funds driving this process.

Whatever the case, the US is not alone in being subject to the malformations that indexing can cause. Emerging markets (EMs) today are a prime example and are arguably increasingly unattractive to access via passive funds because of the manner in which indices are constructed.

This is true for a couple of key reasons. One is that China, although down from its near 50% weighting, remains predominant in emerging market indices, making up just over a quarter of the value of the MSCI Emerging Markets Index at the end of March.

Although there are still attractive opportunities in China, there is lots of political risk, both as it pertains to internal policy making and to relations with the US. The result is that many investors want to minimise their exposure to the country, whereas the index continues to give it a large weighting.

Another factor is that index rules mean that the emerging market index is now dominated by countries that arguably don’t offer the sorts of traits that investors are looking for – namely the potential for large-scale GDP growth and returns that are less correlated with developed markets.

For example, Taiwan and South Korea constitute close to 30% of the MSCI Emerging Markets Index combined. Both countries have per capita incomes and living standards that are on par with, or even surpass, what we would think of as the developed economies.

Moreover, their constituent companies – firms such as TSMC and Samsung – are deeply intertwined with the global economy. This means there is less opportunity for an endogenous growth story and a strong likelihood that returns are going to be correlated with stock markets in developed economies.

One trust that arguably provides an attractive counterbalance to this is BlackRock Frontiers. The trust’s investable universe takes both emerging and frontier markets. However, it the eight largest countries from the EM index.

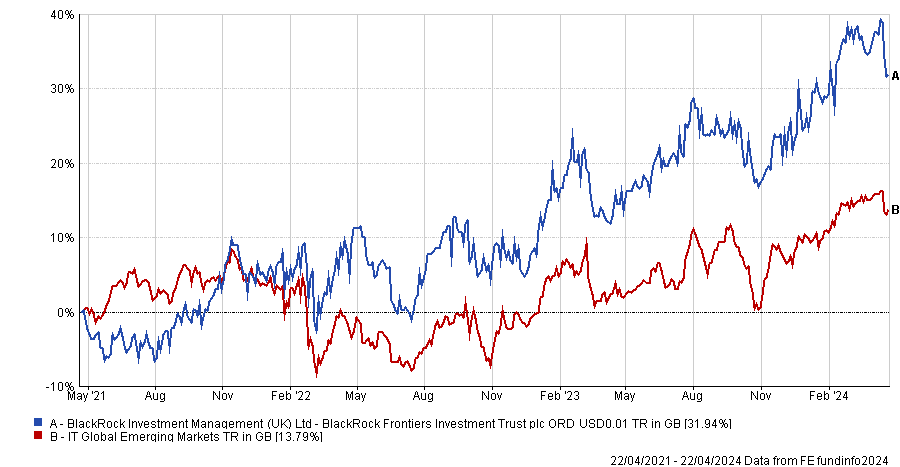

The result is that the trust provides exposure to the sort of growth stories that EM investors are typically looking for, as well as meaningful diversification. The proof has been in the pudding in this regard over the past three years, as the trust has delivered both meaningful outperformance as well as returns that look very different from those in developed markets.

Total return of trust vs sector over 3yrs

Source: FE Analytics

Another way of playing the emerging market theme is to invest in country-specific trusts. Ashoka India Equity may appeal here, in large part because of its fee structure. The trust charges no management fee, with a performance fee of 30% paid on any outperformance delivered against the benchmark over a three-year period instead. Half of that fee is paid in shares, which are locked up for a further three years.

Whether or not this has been the causal factor, the trust has been the best performer in its peer group since IPO in 2018, having delivered annualised returns of close to 20% to the end of March this year. It has also been one of only a small number of closed-ended funds to issue new equity over the past 12 months.

Vietnam Enterprise Investments is another country specialist and one of the only closed-ended funds that provides investors with dedicated exposure to Vietnam.

The country’s stock market has seen a downturn over the past couple of years. However, the wider macro picture remains strong, with FDI rising year-on-year by 32% in 2023 and GDP growth projected to exceed 6% in 2024.

That reflects a variety of trends, including increasing investment in infrastructure and companies moving manufacturing to a country that offers cheaper labour and is seen as more secure than China.

Like BlackRock Frontiers, it’s also worth noting that the countries Ashoka India Equity and Vietnam Enterprise Investments invest also offer the sort of GDP growth, driven more by domestic factors, that investors in EM are usually looking for. An index won’t give you that…

David Kimberley is an investment trust writer at Kepler Partners. The views expressed above should not be taken as investment advice.