Bonds have been a tricky place for investors to make money over the past few years as rising interest rates have forced prices higher and left many funds nursing losses.

But with yields now higher than they have been for more than a decade, fixed income is viewed by many as an attractive option.

For those interested in the asset class, picking the right fund is imperative. To that end, Trustnet has looked at the three main Investment Association sterling bond sectors over five years, looking at their rolling 12-month returns. Overall there are 61 periods in total.

Schroders stood out for having delivered the most bang for investors’ bucks over that time. The asset management house topped the IA Sterling Strategic Bond and Sterling Corporate Bond sectors for funds with the highest average alpha, or the highest active returns generated on top of their benchmarks’ passive growth (beta).

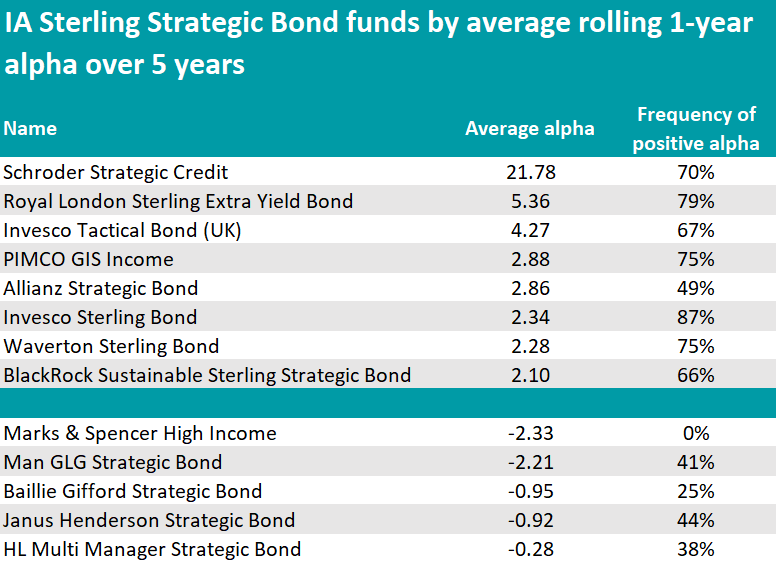

Beginning in the strategic sector, the first up was a fund that stood out heads and shoulders from the crowd – the five FE fundinfo Crown-rated Schroder Strategic Credit, which had a remarkable average alpha of 21.78 measured against its benchmark, the ICE BofA Sterling 3-Month Government Bill index.

The strategy is a flexible, short-dated corporate bond fund managed by Peter Harvey, who focuses on the higher-quality end of sub-investment grade credit – historically resulting in an “attractive” income stream, according to Square Mile analysts.

“The mindset is one of minimising drawdowns, which is reflected in the manager's ‘cash plus’ performance target. To this end, the fund also has the flexibility to invest in bonds issued by governments or government agencies as well as investment grade bonds,” they said.

“The fund can suffer substantial volatility at times of credit stress, but Harvey, who has managed the fund since its launch in 2006, has proved himself adept at maintaining the fund's value over longer time periods and has delivered an impressive dividend profile on the fund.”

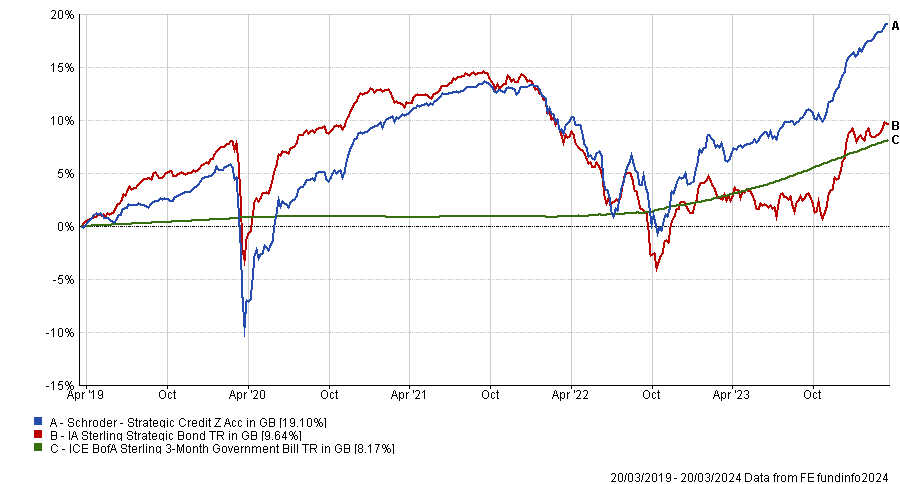

The current yield is 6.29% and in the past five years, the fund has returned 19.1%, 10 percentage points more than the average peer, as the chart below illustrates.

Performance of fund against sector and index over 5yr

Source: FE Analytics

It’s a big jump down to the next-best strategy, Royal London Sterling Extra Yield Bond, which had an average alpha of 5.36 against the FTSE Actuaries UK Conventional Gilts Over 15 Years index, but stood out for its higher yield of 6.9%.

More than 30% of its exposure is to unrated bonds, while the rest is predominantly on the lower investment-grade spectrum (B to BBB).

In the list, the strategy with the highest frequency of positive alpha was Invesco Sterling Bond, which avoided negative alpha territory in 53 of the 61 periods in consideration.

Source: FinXL

At the bottom of the table, Marks & Spencer High Income has an average alpha of -2.33 and failed to produce positive alpha in any month over the past five years. In the whole sector, four more strategies had negative average alphas – Man GLG Strategic Bond, Baillie Gifford Strategic Bond, Janus Henderson Strategic Bond and HL Multi Manager Strategic Bond, all of which are benchmarked against the sector average.

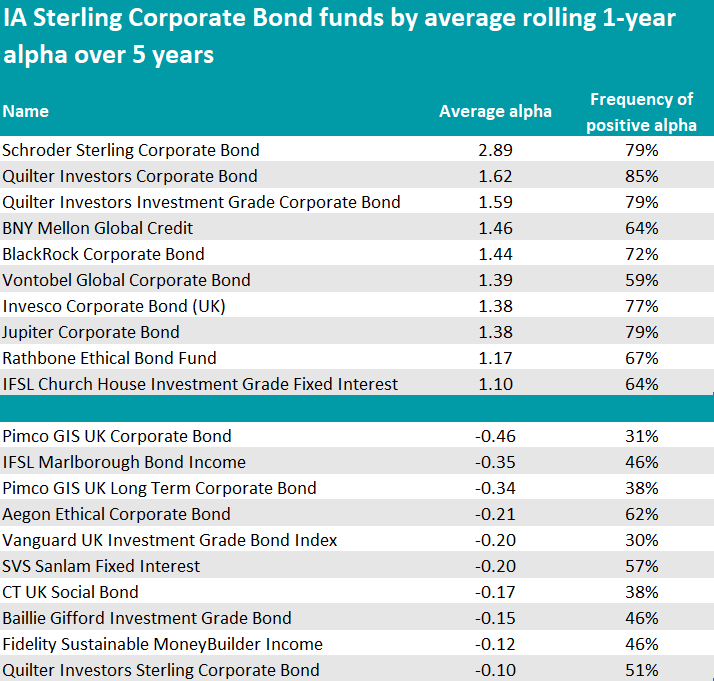

In the corporate bond space, it was again a Schroder fund to take the lead – the quality core investment-grade bond fund Schroder Sterling Corporate Bond managed by Daniel Pearson and Julien Houdain, which maintained a 2.89 average rolling alpha against the ICE BofA Sterling Corporate & Collateralized index.

The investment philosophy is based on the view that there are no shortcuts to producing returns and that in order to deliver exceptionally, the team needs to implement a disciplined, iterative process and employ Schroders’ “significant resources” as their “distinct advantage” over most of their competitors, RSMR researchers explained.

“Security selection and credit quality decisions within the framework of investment themes are typically more important drivers of excess returns than other factors. The mandate is wide-ranging and there are no positioning constraints relative to the fund’s benchmark index,” they said.

Source: FinXL

The second and third place are both Quilter’s, which stood out with its Corporate Bond and Investment Grade Corporate Bond funds, whose management is the responsibility of Premier Fund Managers and Invesco Asset Management, respectively.

Pimco Asset Management didn’t shine, with two of its strategies among those with the worst average alphas.

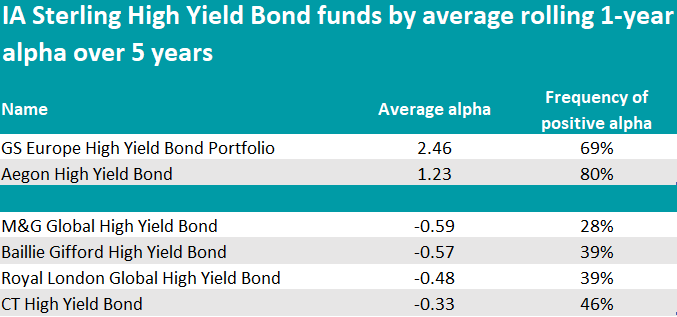

Moving over to high-yield, only two funds had an average alpha greater than 1 - GS Europe High Yield Bond Portfolio (2.46 against the ICE BofA European Currency High Yield Constrained Hedge GBP index) and Aegon High Yield Bond (1.23 against the sector average).

The former is a €131.5m vehicle led by Fiona Macnab, who is focused on sub-investment grade bonds primarily issued by European companies; the latter has “consistently impressed” Square Mile analysts for “the acumen of comanagers Tom Hanson and Mark Benbow and the active mantra they pursue within the fund,” they said.

“We view this as a higher risk option within the IA Sterling High Yield sector, as, the managers employ a high conviction strategy, with a focus on taking on credit risk where it is rewarded.” It currently yields 7.21%.

Source: FinXL

M&G Global High Yield Bond, Baillie Gifford High Yield Bond and Royal London Global High Yield Bond were the bottom three.

IA Sectors previously in this series: UK Equity Income, UK All Companies, Global, Global Equity Income.