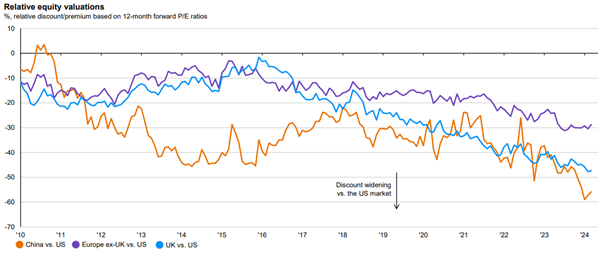

European equities have underperformed the soaring, tech-led American market but the gap in relative performance should start to narrow for three reasons: improving consumer confidence and pent-up savings; government spending; and attractive valuations, according to Karen Ward, chief market strategist for Europe, the Middle East and Africa at JPMorgan Asset Management.

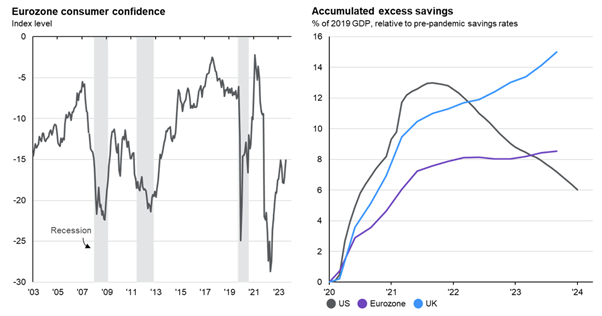

Inflation is coming down, real wages are increasing and consumer confidence in the UK and Europe is rising – which should all help the market to catch up to its US rival.

Sources: FTSE, IBES, LSEG Datastream, MSCI, S&P Global, JPMorgan Asset Management. Valuation is price to 12-month forward earnings. Data as of 12 Mar 2024.

During the pandemic-related lockdowns, people built up savings because they could not go out and spend money. In the past year, US consumers felt confident enough to spend down their cash piles but in Europe, with a “war on our doorstep” and soaring energy bills, people felt more pessimistic and continued to save.

Now the economy is improving, Ward expects European consumers to start spending – and they have deeper pockets than US consumers who have already used up some of their savings, as the chart below shows. This should cause the growth gap between Europe and the US to narrow.

Sources: BEA, Eurostat, LSEG Datastream, ONS, JPMorgan Asset Management. Excess savings calculated relative to savings rates in the fourth quarter of 2019. Data as of 12 Mar 2024.

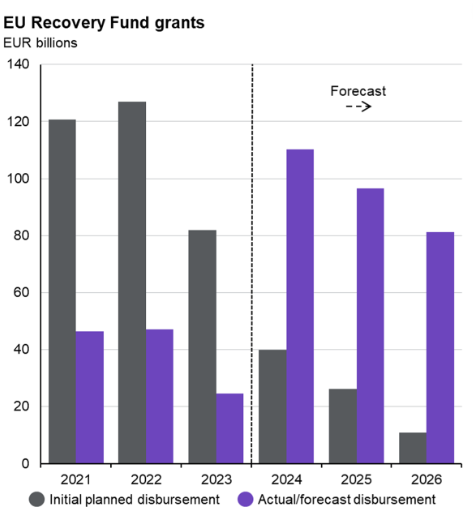

Lavish government spending has underpinned US economic resilience, with the Inflation Reduction Act, the CHIPS and Science Act and the Jumpstart Our Business Startups (JOBS) Act.

By contrast, many of the grants and loans from Europe’s Recovery and Resilience Facility have yet to be spent. Therefore, much of the uplift from Europe’s post-Covid stimulus is still to impact the economy, as the chart below shows, which is another reason for European and US growth convergence.

Sources: JPMorgan Asset Management, European Commission. The grants disbursed in 2024-2026 are based on JPMorgan Asset Management estimates. Data as of 12 Mar 2024.

Having disappointed expectations for much of last year, the euro zone’s economic indicators are starting to surprise on the upside, as the chart below shows.

Source: JPMorgan Asset Management’s Guide to the Markets, Bloomberg, Citi. Data as of 12 Mar 2024.

Ward thinks there is too much pessimism over the European economy and, consequently, European and UK equities are too heavily discounted.

Granted, the US is expensive because of its much larger tech sector, but even on a like-for-like basis – comparing equivalent sectors or comparing companies in Europe to similar ones based in the US – Europe still looks undervalued, Ward said.

Over in the US, Ward is sceptical about how long the ‘Magnificent Seven’ tech companies’ “spectacular earnings” can persist. She has learned three lessons from witnessing “tech miracles”.

The first is that investors have a tendency to over-extrapolate the impact tech innovations can have on the broader economy. The second is that investors expect earnings to stay higher for longer than they usually do. And third, picking the eventual winners is really difficult.

Nonetheless, Ward thinks there are a lot of attractive investment opportunities within the S&P 500 but “you have to be careful of what you are buying”.

In equities generally, she thinks investors should look at areas where expectations are not overblown. “Focus your attention outside of the suspects that have delivered all of the returns so far,” she said.