Europe is home to reputable global companies exposed to important secular growth opportunities in areas such as semiconductors, biotechnology or consumer affluence.

The Stoxx Europe 600 index hit an all-time high recently but its performance has nonetheless trailed US and global equities, which is one of the reasons why European equities have not been as popular with UK investors.

While European economies are currently facing structural difficulties, CJ Cowan, portfolio manager at Quilter Investors, thinks European equities could start to close their gap with the US.

He said: “It is important to remain diversified. The US is home to many of the most dynamic companies in the world so we would not advocate being materially underweight, however, given the relative valuations of the two regions it is difficult to believe the magnitude of the US’s outperformance over the past decade will be repeated in the next decade.”

Below, experts explain which funds to choose to build a diversified exposure to European equities.

Fidelity European, BlackRock European Dynamic, Invesco European Equity Income, Invesco European Smaller Companies and Janus Henderson European Smaller Companies

Thomas Watts, investment analyst at abrdn Portfolio Solutions, suggested blending five funds covering income, quality, growth, value and core positions to obtain a “five-star outcome”.

For exposure to quality, Watts chose Fidelity European, managed by FE fundinfo Alpha Manager Sam Morse since 2009.

The fund focuses on companies capable of growing their dividends over time, with strong balance sheets, prudent management teams and above-average cash generation.

Although the companies reflecting those criteria normally trade on high multiples, Morse has a strong valuation discipline and will only buy growth at a reasonable price. Watts stressed, however, that this process often drives the team towards large-cap names.

BlackRock European Dynamic, managed by Giles Rothbarth, is the pure growth play in this allocation. The fund has a multi-cap approach, driven by stock picking and bottom-up fundamentals.

Watts said: “With growth being out of favour during the 18-month long rate hiking cycle we have endured, the fund should outperform in a rate cutting environment, dovetailing with other investment styles we have within the blend.”

As for Invesco European Equity Income, its role is to provide both income and exposure to the value factor.

Watts stressed that value has become increasingly important, especially after the “harsh” stylistic rotation that took place following Russia’s invasion of Ukraine.

He added: “The fund offers a genuine, long-term active option that adopts a bottom-up stock picking process, combined with a macro overlay in order to ensure decisions aren’t made purely in a vacuum.”

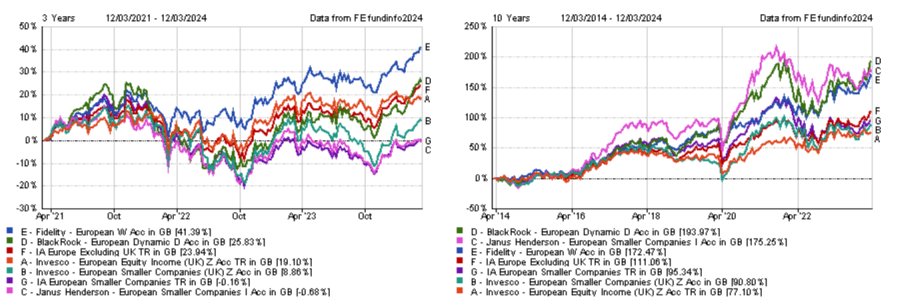

Performance of funds over 3yrs and 10yrs vs sectors and benchmarks

Source: FE Analytics

When it comes to small-caps, Watts prefers to split his exposure across two funds due to liquidity concerns because he wants to be able to move allocations without disrupting the funds.

He chose Invesco European Smaller Companies because of its experienced management team, research capabilities and tried and tested broker network.

The other European small-cap fund Watts uses is Janus Henderson European Smaller Companies, managed by Rory Stokes. The fund rarely invests in companies with a market cap in excess of €2bn, usually remains within the core or core-growth arena and never strays into the realms of growth at any price.

Watts said: “Valuation is a key component of their process even though they would describe themselves as ‘growth managers’.”

Stokes classifies his holdings into four buckets – Rockets, Growth, Mature and Turnaround – which characterise the stages of a company’s life cycle.

BlackRock European Dynamic, Comgest Growth Europe ex UK, VT Downing European Unconstrained Income and Barings Europe Select Trust

Mark Hinton, equity fund research manager at Square Mile Investment Consulting and Research, picked four funds to combine various strategies, styles and market capitalisations but also to access the skills of different portfolio management teams.

Just as Watts did, Hinton selected BlackRock European Dynamic for its flexible approach and bias to both large- and mid-caps.

On the top of that, he added Comgest Growth Europe ex UK to benefit from its “distinct” bias to quality growth companies.

Hinton said: “This approach leads to style consistency across the market cycle, with a stable portfolio management team that invests in a concentrated portfolio of 30-35 companies across the market cap spectrum.”

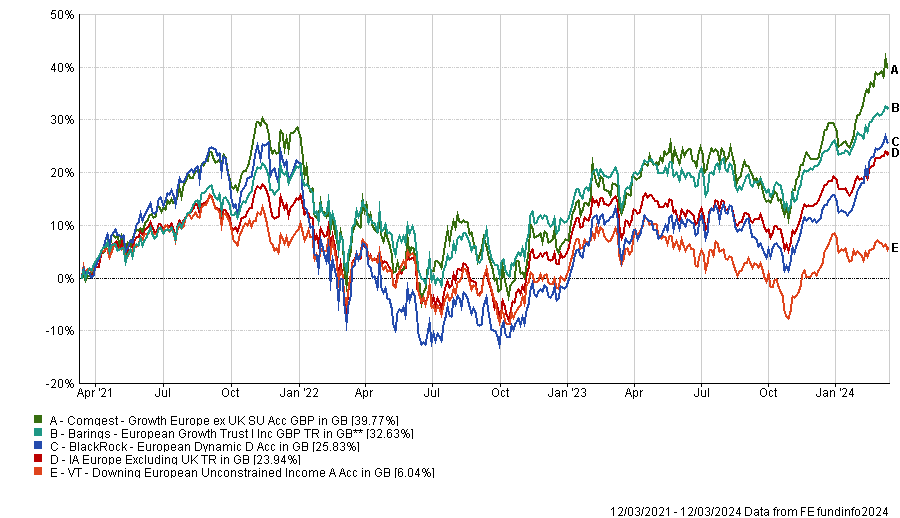

Performance of funds over 3yrs vs sector and benchmarks

Source: FE Analytics

For Income, Hinton’s choice is VT Downing European Unconstrained Income, which takes a contrarian approach.

Managers Mike Clements and Pras Jeyanandhan seek companies that they believe are of a high quality but buy them when they are out of favour or off other investors’ radars.

Hinton explained: “The resultant portfolio will have around 30-40 stocks chosen from across the market capitalisation spectrum, with a bias to smaller and mid-caps. The strategy has a differentiated approach, aimed at investors who are looking for a total return, value focused, concentrated European ex-UK vehicle.”

To enhance the exposure to European small- and mid-cap companies, Hinton suggested Barings Europe Select Trust, which typically holds between 80 and 110 stocks.

The emphasis is placed on identifying companies with strong balance sheets and high returns on equity.

FTF Martin Currie European Unconstrained, M&G European Strategic Value and Premier Miton European Opportunities

Quilter Investors’ CJ Cowan split his allocation to Europe ex-UK equities across three funds to gain access to quality, value and mid-caps.

FTF Martin Currie European Unconstrained’s role is to provide exposure to high quality and high growth companies through its portfolio of 20 large-cap stocks.

Cowan highlighted the “repeatable” research process, which emphasises cognitive diversity and the quality of the team’s debates. This is intended to help avoid group think when it comes to decision making.

For the value factor, Cowan pointed to M&G European Strategic Value, a low-turnover portfolio of around 80 large-cap names.

Analysing the cheapest quartile of each sector is an important part of the investment process, with price-to-book value being used as the primary valuation metric.

Cowan explained: “The team believes mispricing exists because of the increasing short-termism of investors and that share prices frequently overreact to negative events, creating long-term opportunities.”

Performance of funds over 3yrs vs sector and benchmarks

Source: FE Analytics

Finally, Cowan chose Premier Miton European Opportunities for its focus on mid-cap companies. He warned, however, that this fund is a “more bumpy ride” than the two previous large-cap options, but is likely to offer more potential upside.

“The manager looks for high quality companies with strong long-term earnings power, which have the scope to maintain their high earnings growth rates for longer than market pricing implies,” he said.