Technology has richly rewarded investors since the global financial crisis of 2008 and, more recently, developments in artificial intelligence (AI) have led to surge in US mega-cap tech stocks.

As beneficiaries of the tech boom and AI exuberance, Allianz Technology Trust and Polar Capital Technology Trust were among the top 10 most bought investment trusts on interactive investor’s platform last month.

Below, we’ve analysed both investment trusts individually and asked experts which of the two portfolios they would back.

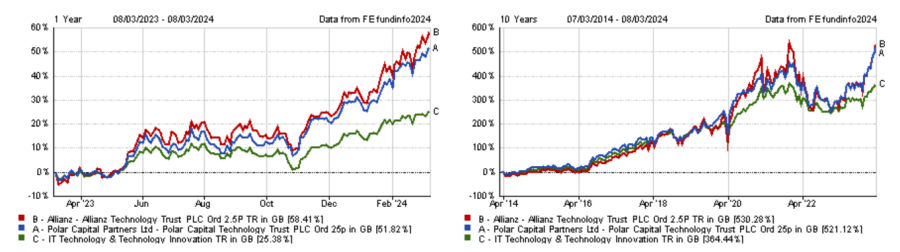

Performance of trusts over 1yr and 10yrs vs sector

Source: FE Analytics

Allianz Technology Trust

Allianz Technology Trust looks to capture several secular themes within the technology sector through a bottom-up approach.

Historically, the trust has had a bias toward mid-cap stocks, enabling it to spot companies with high growth potential early on.

This strategy has paid off as Allianz Technology Trust did slightly better than Polar Capital Technology Trust over the past decade.

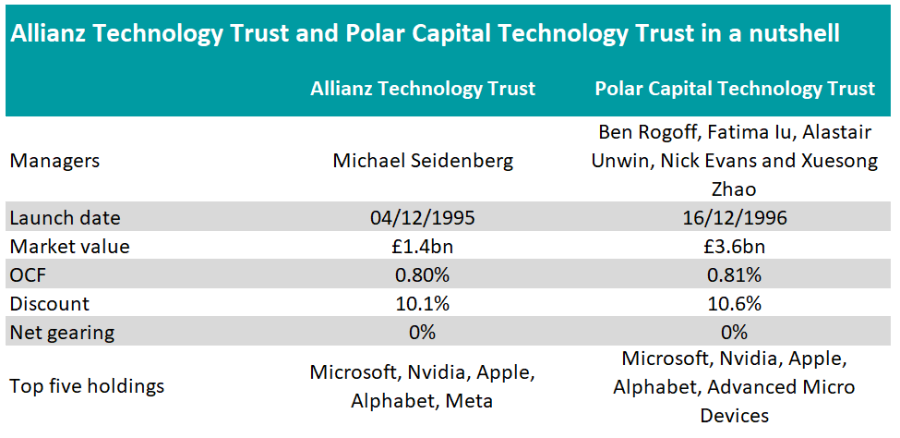

Yet the current manager, Michael Seidenberg, has only been in charge since July 2022, succeeding Walter Price.

Nonetheless, Ryan Lightfoot-Aminoff, investment trust research analyst at Kepler Partners, noted that Seidenberg recently proved his ability to pick stocks, as he identified Nvidia early on and benefited from the stock’s impressive subsequent performance.

However, he warned that the trust’s mid-cap bias could lead to higher volatility and that relative performance could suffer when the market is driven by a handful of the largest index constituents.

One advantage that Seidenberg and his team have is their location in Silicon Valley, close to where the action takes place.

Shavar Halberstadt, equity research analyst at Winterflood, said: “The team’s analysis is sense-tested through frequent contact with investee company management as well as IT spend decision-makers that will offer an indication of near-term adoption or rejection of technology trends.”

Polar Capital Technology Trust

While Polar Capital Technology Trust is London-based, it benefits from a strong analyst team, with Ben Rogoff, Fatima Iu, Alastair Unwin, Nick Evans and Xuesong Zhao all co-managing the portfolio.

The trust has taken a big bet on AI, with 80% of the portfolio invested in companies believed to be AI-enablers or beneficiaries, according to Richard Williams, an analyst at QuotedData. In fact, manager Ben Rogoff described himself as an AI-maximalist.

Lightfoot-Aminoff stressed, however, that Polar Capital Technology Trust has a more benchmark-aware approach than Allianz Technology Trust.

He said: “Polar Capital Technology has a diversified portfolio of around 100 companies, offering broad technology exposure with the opportunity to outperform by allocating more to companies that can generate above average growth. This means it is likely to have a lower risk profile.

“However, the benchmark-aware approach means that Polar Capital Technology Trust may miss out on higher growth opportunities from smaller companies. Furthermore, Rogoff is willing to pay up for growth, meaning the portfolio may be on a valuation premium to the market.”

Rogoff explained that he has less exposure to mid-caps currently because he is adjusting the investment process to the market environment.

For instance, last year’s market was particularly narrow and only favoured a handful of large-cap stocks.

“Large companies have natural monopolies and incredible scale advantages, so we allowed our investment process to be pragmatic enough, so that we've not been too badly wrong footed by the narrowness of the market,” he explained.

“If the market becomes more permissive and broader, we'll apply our growth-centric investment style to a broader universe and be more forgiving of some of those assets.”

Source: FE Analytics

Which trust do experts back?

On balance, Lightfoot-Aminoff believes Alliance Trust Technology is the better option, as manager Michael Seidenberg invests in more off-benchmark names, implying he has, therefore, a better chance of outperforming the benchmark over the long term.

This is also one of the reasons why Halberstadt picked Allianz Technology Trust. He explained that it would perform particularly well if there is a dispersion of market leadership as interest rates come down.

Numis also prefers Allianz Technology Trust, with the geographical location of the investment team being a huge factor in this decision.

Ewan Lovett-Turner, head of investment companies research at Numis, said: “The team attends various trade shows and industry conferences to attain investment ideas and also gain exposure to management teams, while it is also supported by ‘Grassroots Research’, an internal research company that conduct various independent surveys and reports on behalf of the management team in relation to company specific and thematic ideas.

“We note the significance of ‘word-of-mouth’ in generating investment ideas through talking to IT buyers to help to identify breakthrough companies and sectors, and believe that the team are well placed to capture this.”

However, Williams favoured Polar Capital Technology Trust, as Rogoff and his team have taken a bigger bet on AI.

He noted, for instance, the trust’s overweight exposure to Advanced Micro Devices, one of Nvidia’s rivals, that could start taking market share as AI infrastructure spend and chip demand continue to soar.