Ferrari recently made headlines by signing Lewis Hamilton, but it has also caught the eyes of several growth managers.

They are not necessarily Formula One afficionados or fans of the British racing driver, but certainly enjoyed the performance of the company’s shares, which have returned 797.6% since its IPO in October 2015.

Performance of stock since IPO

Source: Google Finance

Another thing that growth managers like about the luxury car manufacturer is its capacity to thrive in different macroeconomic environments.

One of the secrets for this resilience is Ferrari’s tight control over its production.

James Hanford, co-portfolio manager of Comgest Growth Europe ex UK, said: “Ferrari carefully manages its fleet of vehicles through limited new model launches and shipments, alongside pre-owned cars which are increasingly sold through agreed dealers, which further helps to protect its value. As Enzo Ferrari famously said, ‘Ferrari will always deliver one car less than the market demand’.”

Those limited new model launches played an important role during the Covid lockdowns, as they enabled Ferrari to maintain its profitability in the direst of times.

Zehrid Osmani, head of the Global Long-Term Unconstrained team at Martin Currie, said: “Collectors buy those limited edition cars before production even starts and it was fortunate that Ferrari launched one in 2018. When Covid happened and demand for mainstream products weakened, the company was still able to deliver those limited edition cars that they had sold out in 2018. It boosted the top line, because those vehicles had a unit price of $1,000,000.”

Ferrari launched another limited edition in 2022 amid the global surge in inflation, which again sold out before production started.

Osmani added: “Instead of 500 units, it is going to be 1,000 units, and they are going to be sold at $2,000,000 per unit instead of $1,000,000.”

Those limited edition cars are not accessible to just anyone with deep enough pockets to afford one. Ferrari makes its wealthy customers jump though a few hoops, enhancing the prestige of its products and strengthening the company’s pricing power.

Hanford said: “Ferrari carefully manages the entire customer journey with a loyal base built on trust and respect for the brand. If a customer would like to purchase the limited edition range, they must already prove to be a good customer before being eligible, or invited, to buy the limited edition models. In fact, two thirds of customers who purchase a limited edition are already existing owners.”

However, limited edition cars and customers’ loyalty are not the only weapons in Ferrari’s armoury. Hanford highlighted that buyers are often willing to pay a high price for customisations.

He added: “Owning a Ferrari can be likened to owning a piece of art, a valuable collectable, and one that may actually increase in price versus devaluing like most consumer discretionary items. It’s this combination which helps the company to weather economic storms.”

What could push Ferrari off-track?

While Ferrari achieved record financial results last year and sold out of its cars until 2026, there are still challenges ahead, such as keeping a tight control on production quantity to avoid brand dilution.

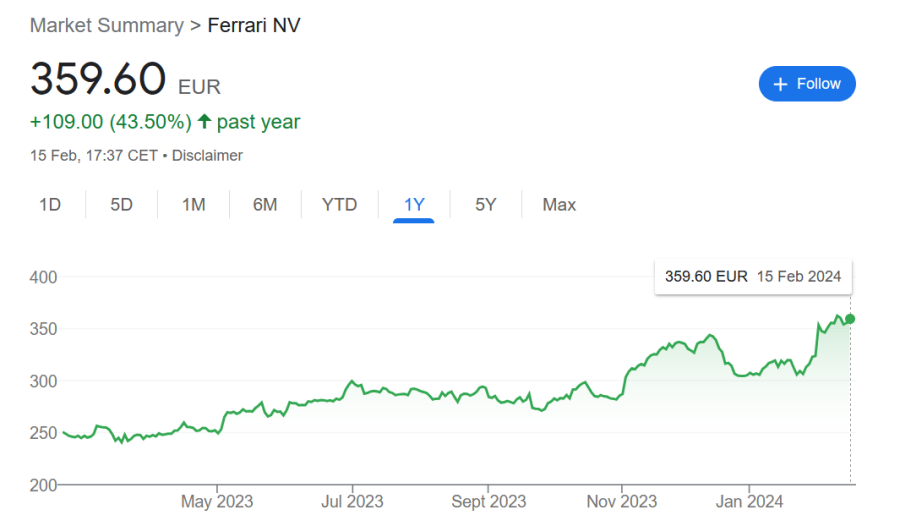

Performance of stock over 1yr

Source: Google Finance

Another challenge will be for Ferrari to maintain its dominant market position and keep the loyalty of its high net worth customers.

For instance, Hanford explained that the brand could perhaps become less coveted if a competitor were to launch a “truly outstanding” car whose sheer performance and appeal is enough to outweigh the heritage of Ferrari’s competing models.

Moreover, the company will need to adapt to new technologies and customer demands while maintaining its brand and legacy.

Ben James, portfolio director of Scottish Mortgage, said: “The company's commitment to staying true to its DNA while developing new powertrains, the main components that generate power, and carefully expanding its offerings will be key.

“Missteps along this journey may impact the company’s operational performance (in the short term at least).”

Another risk could come from the shift to electric vehicles, in the case there is less demand for electric Ferraris than for V8 combustion engines over the longer term.

Hanford said: “Ferrari already has a high number of sales of its hybrid cars, and this should give some comfort on their ability to make this transition. In addition, a new Ferrari factory will be ready by end June 2024 and its first fully electric car is due to be released at the end of 2025.”

Other potential hurdles highlighted by James are regulation and trade tensions, which are common to most luxury brands.

If you can’t buy the car, should you at least buy the stock?

Overall, Osmani, Hanford and James are confident on Ferrari’s prospects, despite some potential risks ahead.

Yet, the stock might not suit every type of investor, such as those looking for high growth companies.

James said: “This is an enduring growth opportunity, and as such it will never provide explosive growth like some of the transformational growth companies owned by Scottish Mortgage. Its role within our portfolio is that of quality compounder year after year.”

Moreover, the stock is expensive (just like the cars) and has always traded at a significant premium valuation to the market since its listing, according to Hanford. Therefore, Ferrari might not be a great fit for value investors.

He said: “The share price has performed well over the last decade despite having had this premium valuation in the past, but this is still something for investors to be aware of should they be concerned that the valuation premium versus the market might narrow.

“Hence, I would certainly not say Ferrari is a must-have for a ‘value investor’ who is more concerned with the optical valuation of a company on near-term price to earnings multiples.”