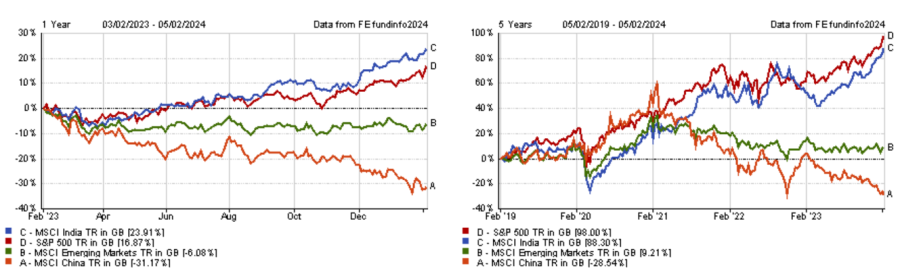

Indian equities have richly rewarded investors in recent years, rivalling the vaunted US S&P 500 and eclipsing its emerging markets peers, in particular its struggling Chinese rival.

Over five years the MSCI India has returned more than 88.3% and has made an impressive 20% over 12 months and investors have taken note, with Jupiter India appearing in the lists of most-bought ISA funds in January of both Fidelity International and Hargreaves Lansdown (HL).

HL savers showed even more enthusiasm than their Fidelity peers, as Jupiter was the most-bought fund in ISA, Junior ISA (JISA) and Lifetime ISA (LISA) portfolios. Kotak India Growth was also popular among JISA investors.

Performance of indices

Source: FE Analytics

Darius McDermott, managing director of Chelsea Financial Services, said: “Retail investors on platforms, whether we like it or not, tend to follow past performance. India has been a very strong market over the past one, three and five years. So, the primary reason why India is so popular is because it's continued to be one of the best performing markets.”

Tom Stevenson, investment director at Fidelity International, also noted that a new generation of domestic investors have put their money to work, which has supported the local market in addition to inflows from overseas investors.

He added: “India’s economy appears to have returned to pre-Covid levels of activity and is anticipated to grow by around 6.5% in both 2024 and 2025.”

An advantage for India is its demographics, which contrasts with the ageing population of Europe, Japan and even China.

McDermott said: “Having millions of people coming into workforce every year is very positive for growth. Also, a large number of this young Indian population is going to be educated.

“Moreover, India is behind the curve with respect to China and average earnings. India is just starting to see that acceleration of average earnings. That's another positive element for growth.”

While India has a strong secular growth story of its own, it has also benefited from China’s woes. Chinese equities have been suffering from growing trade tensions with the US, various interventions from the government in the economy that have caused companies to lose a lot of value almost overnight and a troubled property sector.

Therefore, Simon Evan-Cook, fund manager at Downing, suggested India may have become the one emerging market that is “acceptable” to a majority of Western investors.

He added: “When Western investors are looking at where to put their non-domestic money, India comes across as a favourable destination, given that it doesn’t face those geopolitical tensions and hasn't had these big top-down interferences. Also, it's a largely English-speaking market, which means a friendlier place for money.”

One aspect some investors may find concerning however is the high valuations Indian equities are trading at, although Evan-Cook said people should refrain from trying to time the market, noting some called the market expensive a year ago, but it has still marched higher.

Which funds for India?

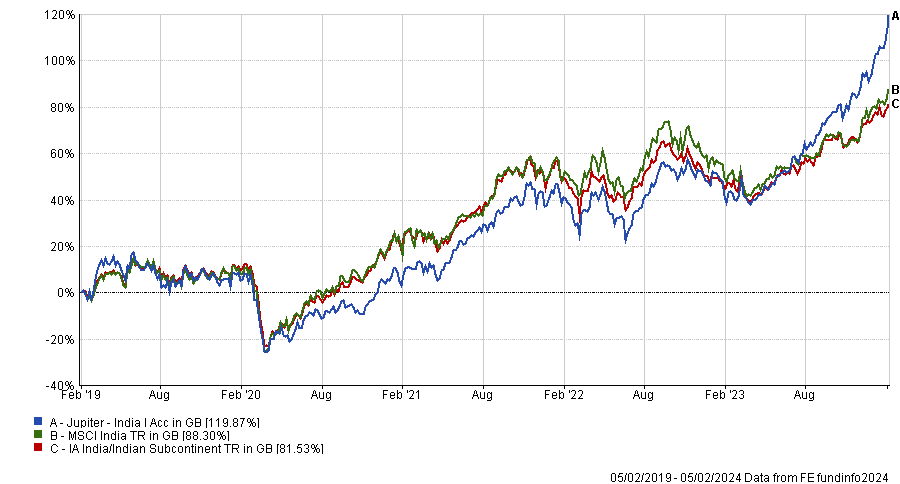

Both Fidelity and HL investors have unanimously opted for Jupiter India, a top-quartile fund in the IA India/Indian Subcontinent sector over five years that also appears in HL’s Wealth Shortlist.

However, it has also been the fourth most volatile fund of the sector over the same period, according to FE Analytics.

Ben Yearsley, director at Fairview Investing, said: “It’s a fund you want in a bull market as it tends to be more mid-cap focused. It’s an out and out stockpicking fund from a manager who knows the market inside out.”

Performance of fund over 5yrs vs sector and benchmark

Source: FE Analytics

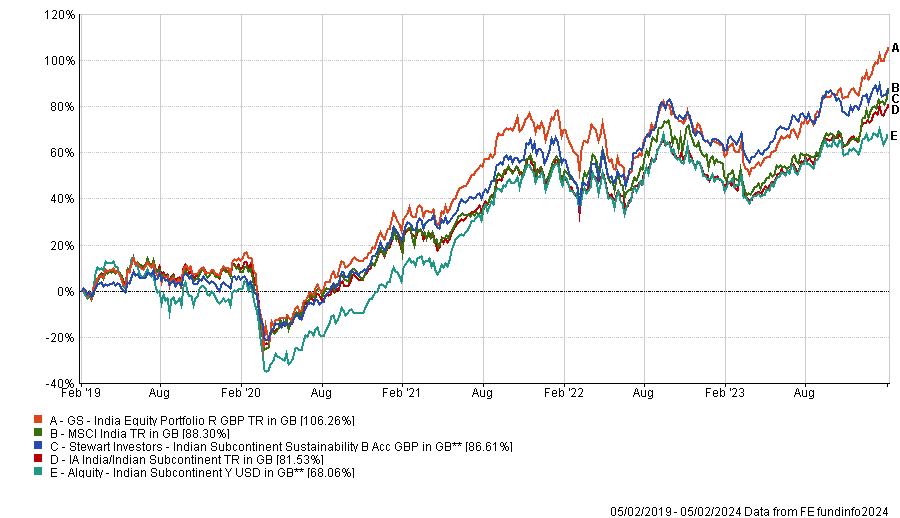

McDermott also mentioned the quality of manager Avinash Vazirani, but conscious of the fund’s volatility, he prefers Goldman Sachs India Equity Portfolio and Stewart Investors Indian Subcontinent Sustainability due to their higher consistency.

However, he stressed that Chelsea Financial Services uses Alquity Indian Subcontinent in its multi-asset funds range. The fund, run by Mike Sell, has a small- and mid-cap bias and tends to focus on domestic India rather than the large multinationals.

Performance of fund over 5yrs vs sector and index

Source: FE Analytics

Source: FE Analytics

Yearsley’s favourite fund to invest in India is Ashoka India Equity Investment Trust, launched in 2018 and run by Ayush Abhijeet and Prashant Khemka.

He said: “You have to hold your nose slightly with the fees as they can be chunky, but the trust is pretty unique. It goes slightly against the norm these days and has about 100 holdings. It looks for companies that can deliver superior returns and are scalable. Also, corporate governance is vital.”

Performance of trust over 5yrs vs sector and index

Source: FE Analytics

To invest in India, Evan-Cook uses Chikara Indian Subcontinent, which gives exposure to high quality and domestically focused companies in India.

Evan-Cook said: “It's a market that should be accessed through active management, as there are some lower quality companies in there that should be avoided. If you can find a manager to pick the wheat from the chaff, I think you can do very well in that market.

Performance of fund since launch vs sector and index

Source: FE Analytics

“We like the demographics of India and the fact that there are genuine entrepreneurial companies out there. It's a market we want exposure to for the long term and that we maintain permanently.”