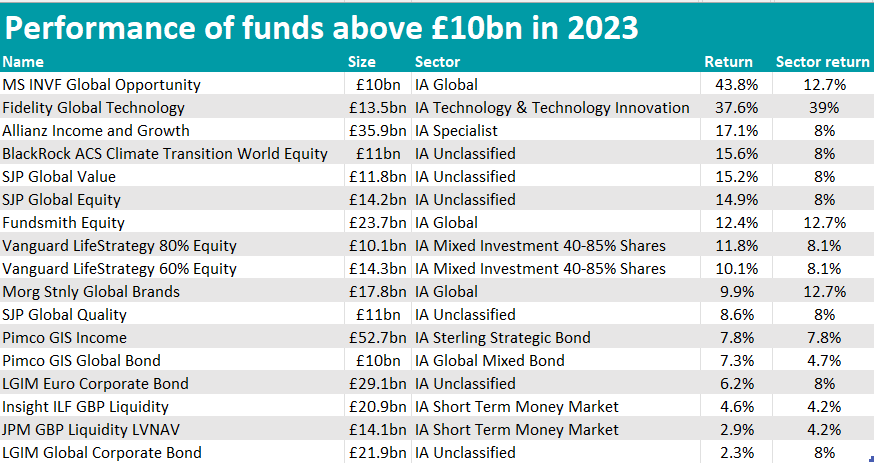

The largest funds around are sometimes perceived as a safe bet for investors for their sheer size. In 2023, FE Analytics data showed that the majority of those with £10bn or more of assets under management (AUM) achieved above-average returns, but six were the exceptions.

Starting with the most recognisable name, FE fundinfo Alpha Manager Terry Smith’s Fundsmith Equity only slightly disappointed – its 12.4% return being 0.3 percentage points below that of the IA Global sector.

FE Investments analysts attributed this to the initial struggle of technology stocks as inflationary conditions started to change in 2022, but Smith’s “superior” stock selection “has supported the fund in times when his style has been out of favour”.

“In relative terms, the fund remains impressive, only being challenged by a few other funds with similar investment strategies,” they said.

“We like the low turnover nature of the strategy and this inactivity is a result of buying strong companies; however, it does leave us questioning the cost of the fund, which – relative to its peers with similar strategies – is on the more expensive side.”

Source: FE Analytics

Morgan Stanley Global Brands was 2.8 percentage points below the average peer, as Alpha Manager William Lock’s concentrated portfolio (only 26 stocks with a strong business franchise and intangible assets as their strengths) didn’t convince in 2023.

Another mild underperformer in relative terms, Fidelity Global Technology returned 37.6%, not enough to catch up with the very high average 39% return of the IA Technology & Technology Innovation sector.

Led by Alpha Manager Hyunho Sohn, the strategy focuses on growth, cyclical and special situations opportunities, investing 60.1% of its assets in technology companies. Microsoft, Apple and Taiwan Semiconductor are the top three holdings.

The worst performer of the list was LGIM Global Corporate Bond, which made 2.3%. It sits in the IA Unclassified sector, but funds in the IA Global Corporate Bond sector made 5.4% on average, more than double its return. However, the European version, LGIM Euro Corporate Bond was better, returning 6.2%.

It was followed by JPM GBP Liquidity LVNAV (2.9%) and Insight ILF GBP Liquidity (4.6%). Of the two IA Short Term Money Market funds, only the latter beat the sector average return of 4.2%.

On the flip side, the main outperformer was MS INVF Global Opportunity, which made 43.8% and beat the IA Global sector by 31.1 percentage points – the largest distance of any of the other giant funds.

Managed by Alpha Manager Kristian Heugh, the fund invests in high-quality, undervalued global companies with good environmental, sustainability and governance (ESG) credentials. Its largest sector holding is telecom, media and technology and its first stock Uber Technologies.

FE fundinfo five-Crown rated Allianz Income and Growth was another winner, as was BlackRock ACS Climate Transition World Equity – an exception at first sight, given that ESG strategies generally suffered in 2023, but its top 10 holdings are all large-cap technology companies.

The passive vehicles Vanguard Lifestrategy 60% Equity and 80% Equity defended their popularity again in 2023, ending the year with a relative outperformance of 2.1 and 3.8 percentage points versus their IA Mixed Investment 40-85% Shares sector peers.