A resurgence in environmental, social and governance (ESG) investing, continued outperformance from tech stocks and buying gold as portfolio insurance could be some of 2024’s investing trends, according to RBC Brewin Dolphin.

The past few years have presented investors with a constant stream of challenges, including – but not limited to – the Covid-19 lockdowns, the global reopening, conflict in Europe and the Middle East, surging inflation and interest rate hikes.

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, said: “The central prognosis for 2024 from the majority of economists is that inflation will continue to ease and interest rates will start to fall – we don’t know when and by how much, but there is largely consensus on those two points. If you accept that as the starting point for next year, then there are a few trends that seem likely to follow.”

Below, he explores four of these trends while offering suggestions for funds that could benefit from them.

A green rebound

The first theme highlighted by RBC Brewin Dolphin is sustainability. Prior to the Covid-19 pandemic, investing in stocks with strong sustainability credentials was a growing trend, with ESG funds posting robust returns and attracting healthy inflows.

While these strategies continued to perform strongly while interest rates were at historic lows, they struggled when central banks started hiking interest rates to curb inflation. As a result, investors have been pulling their money out of ESG funds more recently.

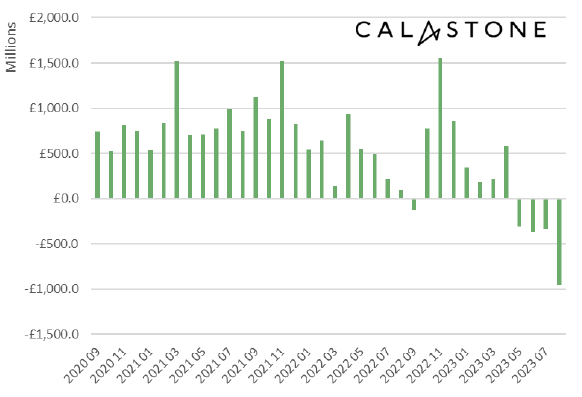

Net flows of ESG equity funds over 3yrs to end of Sep 2023

Source: Calastone

However, Burgeman said: “Could next year be better for that area? Probably, yes. The drivers behind these investments are still there.

“While there was a wave of investment going into a range of different technologies, not all of them will work out, some were overly reliant on subsidies, valuations became unrealistic and there was inevitably going to be some sort of correction. But a lot of that has been flushed out and this segment of the market will be stronger for it.”

Funds that the wealth manager likes for this theme include Schroder Global Energy Transition, which invests in companies involved in the energy transition ranging from renewable technology to electric vehicles and chemicals, and FTSE 250-listed investment trust JLEN Environmental Assets, which invests in areas such as wind and solar electricity generation infrastructure, waste and wastewater processing, anaerobic digestion and battery storage facilities.

A broader tech recovery

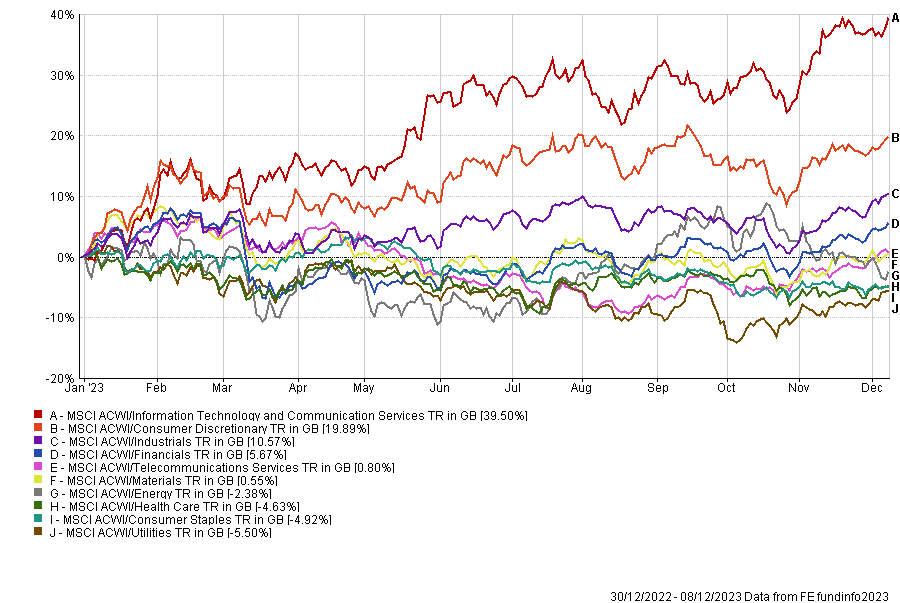

Having been the darlings of the post-financial crisis bull market, tech stocks were hammered in 2022 as rising interest rates sent investors fleeing growth stocks. However, as the chart below shows, they have regained market leadership this year.

Performance of global equity sectors in 2023

Source: FE Analytics

But Burgeman added: “That rally has not been very broad. The so-called Magnificent Seven – Alphabet, Amazon, Apple, Microsoft, Nvidia, Meta and Tesla – have dominated S&P 500 returns, while others in tech have continued to struggle in the face of higher interest rates. That could be about to change next year as interest rates go into reverse and some of the longer-term tech plays come back into fashion.”

Investors looking to play this theme could consider active strategies such as Polar Capital Technology Trust and Allianz Technology Trust, which invest in many of the same names including the big US players such Apple, Microsoft and Meta. BlackRock Next Generation Technology, meanwhile, has Nvidia and Tesla among its top holdings as well as less familiar names such as Lattice Semiconductor.

Burgeman also said a Nasdaq tracker, such as the iShares Nasdaq 100 ETF, could be “the straightforward way to get exposure to tech”, although investors will need to be mindful of its concentration as the top five holdings account for around 40% of the index.

A closing gap between large- and small-caps

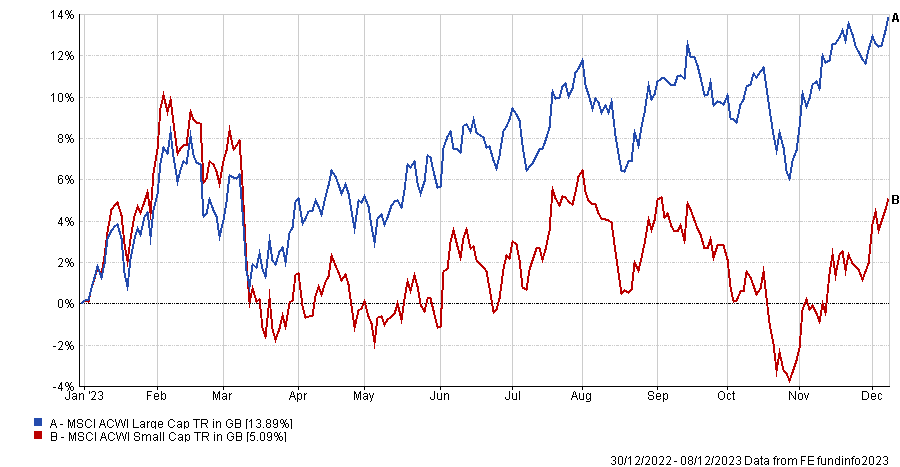

RBC Brewin Dolphin’s third investment theme for 2024 is a catch-up by smaller companies, which have underperformed their larger peers by a wide margin this year.

Smaller companies tend to be more vulnerable when interest rates are rising as they are more susceptible to the economic environment and the cost of debt. However, this dynamic could ease as central banks reach peak interest rates.

Performance of global large-caps and small-caps in 2023

Source: FE Analytics

Burgeman pointed active investors in the direction of abrdn UK Smaller Companies. Although it has had a tough 2023, the senior investment manager said “all things being equal, [it] should benefit as interest rates fall and the economic picture in the UK improves”.

A passive option such as iShares MSCI World Small Cap ETF would also provide investors with more of an international spread of small-caps and exposure to more than 3,300 stocks.

A golden lining

The final theme for 2024 is gold, according to the wealth management firm. The yellow metal, which recently hit a new record high, has long been favoured by investors who are nervous about the health of the economy and the stock market.

“If the world economy falls into disrepair, gold will ultimately have limited use. The last time I checked, you can’t pay for your shopping with precious metals,” Burgeman said. “But it is a form of insurance policy and usually warrants a place in most people’s portfolios.”

For exposure to the precious metal, he prefers a gold spot ETF such as WisdomTree Physical Gold, iShares Physical Gold or Amundi Physical Gold, rather than buying gold mining companies, which often operate in difficult parts of the world and come with a degree of political risk.