Technology equity funds are going into the final month of 2023 with a substantial lead on their rivals, data from FE fundinfo shows, after their bull run intensified in November.

While investors went into 2023 with a sense of nervousness around inflation, rising interest rates and economic growth, the year so far has been largely positive after inflation started to ease and central banks slowed the pace of rate hikes.

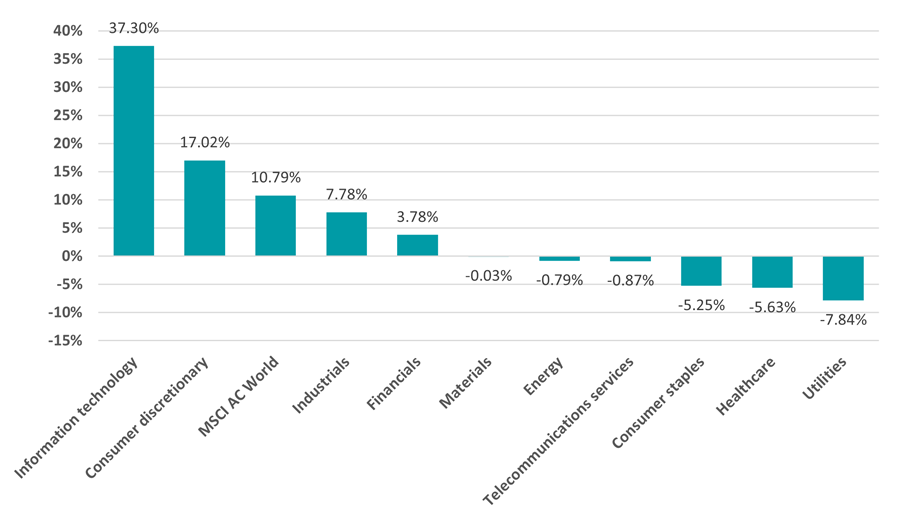

Add to this the rise of generative artificial intelligence and 2023 to date has been an especially good one for tech stocks – as shown in the chart below. Indeed, the companies responsible for the bulk of the US stock market’s gain as the ‘Magnificent Seven’ tech giants of Apple, Amazon, Alphabet, Nvidia, Meta, Microsoft and Tesla.

Performance of global stock sectors in 2023 to so

Source: FinXL

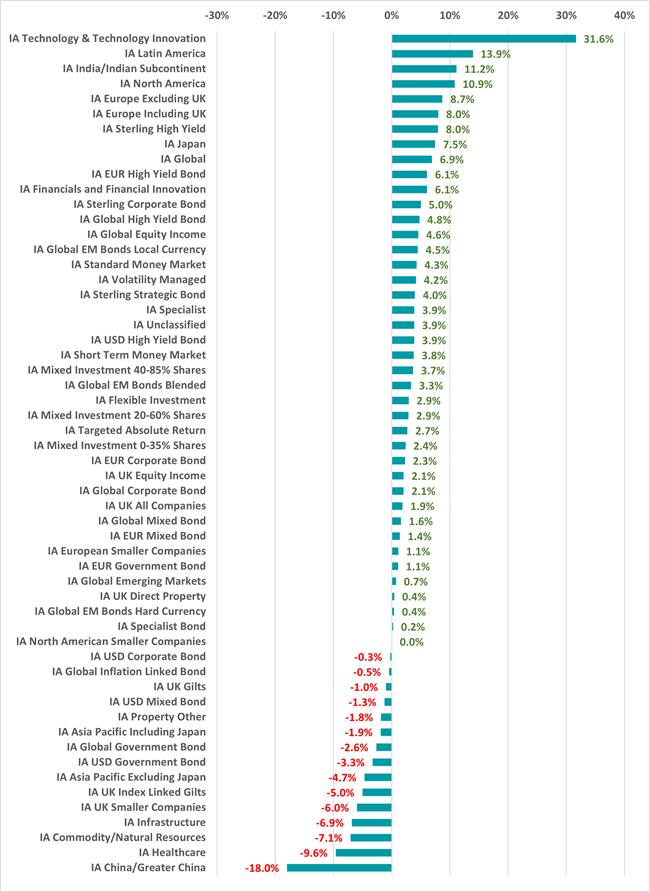

A market dominance of this extent is reflected in the performance of the Investment Association sectors over the first 11 months of the year. At the top of the leaderboard is the IA Technology & Telecommunications sector, where the average fund has made a 31.4% total return this year.

As an article on Trustnet highlighted last week, this comes after tech funds benefited from a near-10% gain in November alone after investors upped risk on data showing that the US economy is stronger than expected and hope that interest rates have reached their peak.

The IA Technology & Telecommunications sector has a clear lead on IA Latin America for the year so far, which is in second place with a 13.9% gain. IA India/Indian Subcontinent and IA North America are the only other sectors to have made a double-digit average return in 2023.

Performance of Investment Association sectors of 2023 so far

Source: FinXL

But there are 15 sectors making a loss this year with IA China/Greater China being the biggest faller. The average fund in the sector has made a loss of 18%. The world’s second largest economy has been struggling in 2023 while investors remain nervous over regulatory crackdowns in several key sectors.

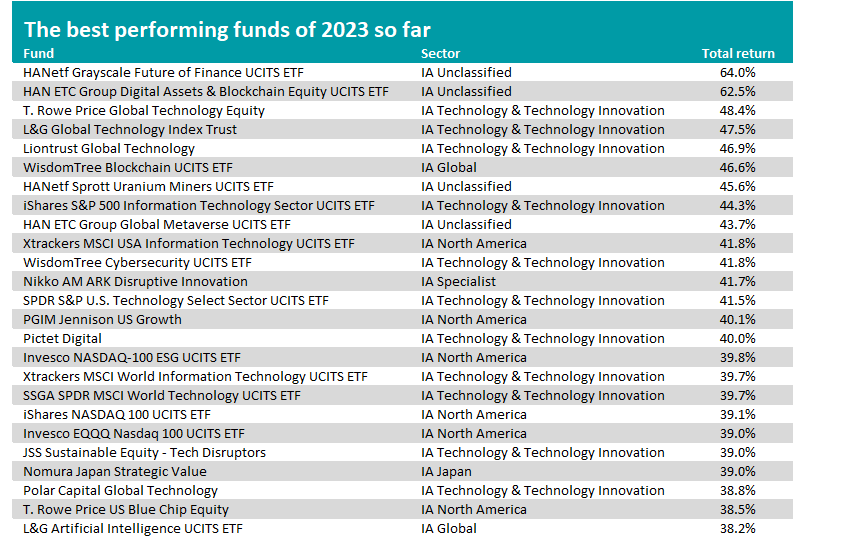

Turning to individual funds and the top of the performance table is packed full of tech funds – 21 of the 25 funds with the highest total returns dedicated to tech stocks.

Specialist exchange-traded funds (ETFs) have done particularly well, owing to their focus on specific parts of the market.

Source: FinXL

HANetf Grayscale Future of Finance UCITS ETF is the highest returner in the entire Investment Association universe with a 64% total return, following by the 62.5% from HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF.

WisdomTree Blockchain UCITS ETF, HAN ETC Group Global Metaverse UCITS ETF and WisdomTree Cybersecurity UCITS ETF are some other specialist tech ETFs making high returns this year.

Active tech funds can also be found in the leaderboard, including T. Rowe Price Global Technology Equity, Liontrust Global Technology, Nikko AM ARK Disruptive Innovation and Pictet Digital.

Outside of tech funds, 2023’s best performers include a couple that concentrate on US large-caps. This means they have significant exposure to the leading technology companies as well as those from other sectors.

Other funds in the top 25 are HANetf Sprott Uranium Miners UCITS ETF, rallying off a 15-year high in uranium prices, and Nomura Japan Strategic Value, reflecting the surge in Japanese stocks that is another of 2023’s investment themes.

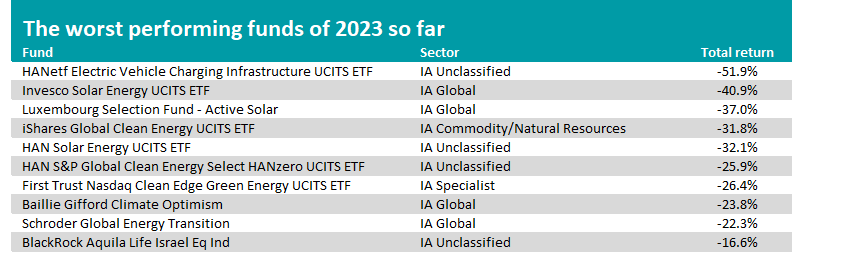

Source: FinXL

Specialist ETFs are also common at the very bottom of the performance table, again because of their focus on a narrow band of stocks.

Many of the worst-hit funds of 2023 invest in clean energy stocks. They are suffering under higher interest rates because of a reliance on debt to fund their projects.