The end of the low interest rates era has curbed the outperformance of growth strategies. While the strategy benefited in the low interest rate, low inflation era of the 2010s, the past few years have reversed this trend.

Although nobody knows what the future has in store, the market seems to be embracing a “higher for longer” scenario.

Yet, it does not mean that it’s over for growth investing, according to Rob Burgeman, investment manager at wealth manager RBC Brewin Dolphin, who believes that there is always a place for investing in growth companies.

The nuance is that it will be more complicated for unprofitable companies to thrive as the costs of borrowing are now higher, while raising funds via the equity market is dilutive for investors. As a result, Burgeman recommended focusing on funds investing in the quality end of the growth spectrum.

Burgeman said: “As the global economy slows, we feel that growth will be at a premium and this will be reflected in share prices. Cash flow, too, is very important in weathering tighter financial conditions.”

A first example of such a fund is Fundsmith Equity, a quality-growth strategy built around the motto “buy good companies, don’t overpay, do nothing”.

Many of its investee companies are relatable to investors as they are businesses providing everyday goods and services. The fund avoids sectors that are either highly cyclical or “destroyers of capital”, such as airlines, mining, oil & gas.

Performance of fund since launch vs sector and index

Source: FE Analytics

Since launch in 2010, the fund has outperformed both the IA Global sector and the MSCI World index.

Burgeman’s next pick is Baillie Gifford Positive Change, a fund with an overt mandate to invest in companies that are aiming to address critical social and environmental challenges.

“This naturally leads to some of the more ‘blue sky’ companies, but this is an area in which Baillie Giford have extensive experience and expertise,” he said.

However, it could be viewed as a riskier strategy as it is fairly concentrated – holding between 25 and 50 stocks – and can have some sizeable positions. To ensure some diversification, no single position will account for more than 10% of the portfolio while the fund must also invest in a minimum of six countries and six investment sectors.

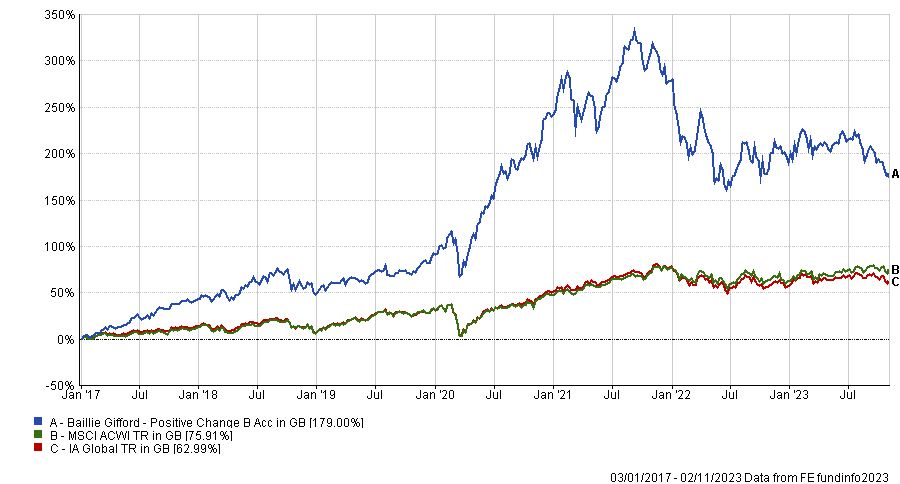

Baillie Gifford Positive Change has a fairly short track record, having been launched in January 2017. It has returned 179% to investors since then, beating its sector as well as its benchmark.

Performance of fund since launch vs sector and index

Source: FE Analytics

Burgeman’s third pick is the T. Rowe Price Global Focused Growth Equity fund, although he highlighted some differences with the previous portfolios.

He said: “It is a different fund to the others, in that it does actively move between sectors as they exhibit more growth characteristics. For example, it has added to oil holdings after avoiding the sector for many years, as shortages look to underpin demand for the next several years.”

The fund, run by FE fundinfo Alpha Manager David J. Eiswert, aims to beat the MSCI All Country World Index by 3% per annum over rolling five year periods. Over the past decadeit has managed to beat both its benchmark and sector, demonstrating its ability to deliver strong relative performance in rising markets.

Performance of fund over 10yrs vs sector and index

Source: FE Analytics

Burgeman’s final pick is a passive fund, the Invesco EQQQ Nasdaq 100 Tracker ETF, which aims to replicate the performance of the NASDAQ-100 Notional Net Return index.

He said: “It is perhaps the easiest way to put a growth tilt into portfolios. The Nasdaq index in the US is best known as being an incubator of businesses and is very tech heavy.

“However, over the years, it has attracted many companies and, aside from the magnificent seven, also includes companies like Pepsico, Costco and T-Mobile US amongst its top twenty.”

Over 10 years, the index fund has returned 513.7% to investors, slightly underperforming the index it tracks. It has been, however, one of the best performing funds of the past decade in the Investment Association universe, only lagging three funds: Fidelity Global Technology, L&G Global Technology Index Trust and SSGA SPDR MSCI World Technology.

While growth may still have a role to play in portfolios, Burgeman stressed that it is important to have exposure to a variety of investment styles.

“Markets have shown quite an ability in the past 18 months or so to move very quickly and so, with this background, we favour having a balanced approach, with exposure to growth and value rather than one or the other,” he concluded.