October was an asymmetric month for investors who had to contend with some steep drops and were left with very few places to make positive gains, data from FE Analytics shows.

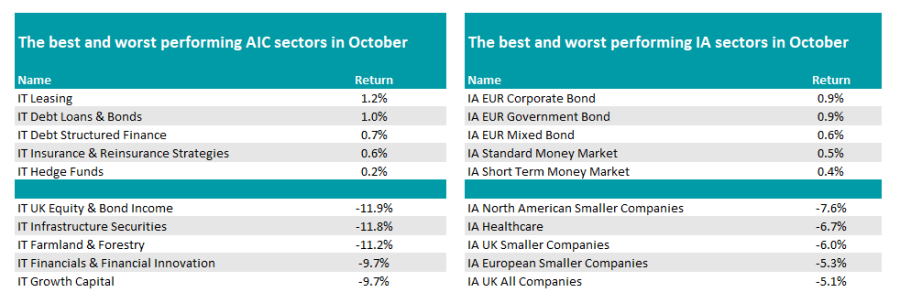

At a sector level, the only places in the Investment Association (IA) universe to make money during the month were low-risk assets.

European bonds made the best returns, with the IA EUR Corporate Bond, IA EUR Government Bond and IA EUR Mixed Bond sectors topping the charts with minimal gains: none made more than 1%, with the best up 0.9%.

Ben Yearsley, director at Fairview Investing, said the bond sectors were “probably helped by sterling’s 0.45% fall against the euro boosting returns”.

The IA Standard Money Market and IA Short Term Money Market rounded out the top five.

Source: FE Analytics

At the other end of the list, it was a poor month for small-cap funds, with IA North American Smaller Companies at the foot of the table. Here the average fund made a 7.6% loss. It was joined by IA UK Smaller Companies and IA European Smaller Companies, which also made losses above 5%.

IA Healthcare and IA UK All Companies were also among the five worst performing sectors in October.

It was a similar story in the trust space, as the above table shows. The top two sectors - IT Leasing and IT Debt Loans & Bonds – were the only ones to make a 1% or more gain over the month, while the three worst sectors – IT UK Equity & Bond Income, IT Infrastructure Securities and IT Farmland & Forestry – all suffered double-digit losses.

Away from finance, the biggest event of the month was the terrorist attack by Hamas on Israel, which along with the ongoing Russian Ukraine war, and a strong US economy putting doubts around whether the Fed has stopped hiking rates, all contributed to the “dire” month, Yearsley said.

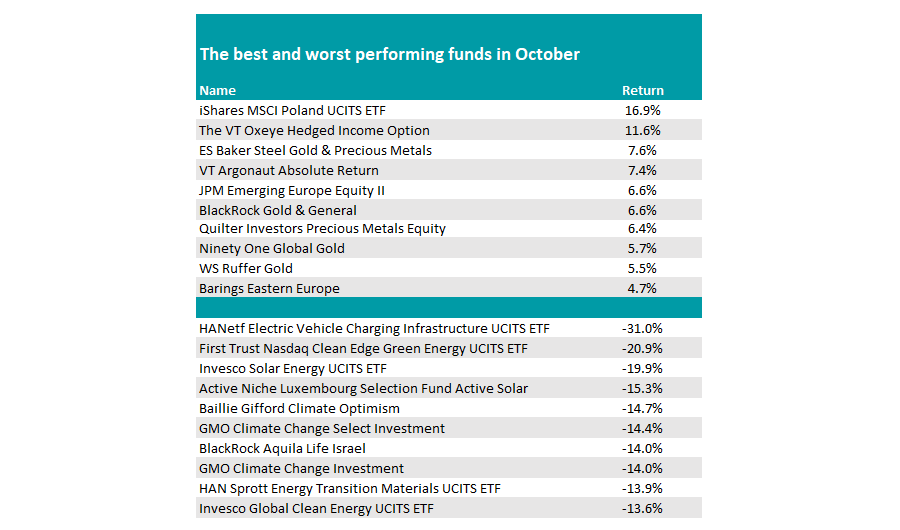

Turning to individual funds, iShares MSCI Poland UCITS ETF topped the list with a gain of 16.9%, while The VT Oxeye Hedged Income Option was second with a gain of 11.6%.

Meanwhile, on the back of gold nearing $2,000 an ounce, gold and precious metals funds had a good month, making up half of the top 10. Baker Steel Gold & Precious Metals led the pack, up 7.6% return. “Turmoil is good for gold,” Yearsley said.

Barry Norris’ VT Argonaut Absolute Return also appeared among the top funds, with a 7.4% gain during the month. Yearsley noted that it “paid to be anti-consensus” in October.

Source: FE Analytics

The manager has voiced his displeasure with investors backing the energy transition, a move that would have benefited the fund in October.

Indeed HANetf Electric Vehicle Charging Infrastructure UCITS ETF was the worst performer for the second month in a row, down another 31%, having lost 17% in September.

It was part of a clear move away from clean energy funds over the month, with First Trust Nasdaq Clean Edge Green Energy UCITS ETF, Invesco Solar Energy UCITS ETF, Luxembourg Selection Fund Active Solar and Baillie Gifford Climate Optimism rounding out the bottom five.

“If there was a story last month it was the pounding that green and clean energy got (this also helped the Argonaut fund to the top of the tables as these sectors are often shorted by the manager),” Yearsley noted.

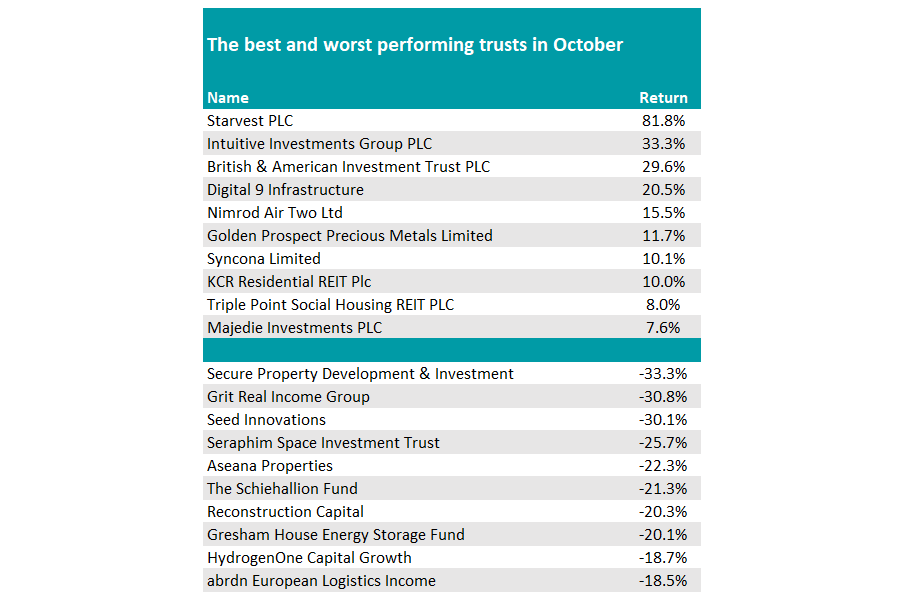

In the trust world, it was an idiosyncratic mix of portfolios at the top and bottom of the list. Starvest topped the charts, up 81.8%, after the board proposed a wind-up of the trust, while Digital 9 Infrastructure made gains of 20.5% after providing an update on its shareholder consultation and announcing the potential sale of Verne Global. It had been the worst performer in September, down more than a third.

Source: FE Analytics

At the foot of the table, Secure Property Development & Investment and Grit Real Income Group both made losses of more than 30%.

Overall, Yearsley said: “Markets are skittish even though third quarter results from a raft of US and UK juggernauts such as Google owner Alphabet and Visa have been good.”

“Markets look decent value – bonds look good, gilts look good, equities look good (in pockets), even commercial property looks to have bottomed. Be patient in times of volatility.”