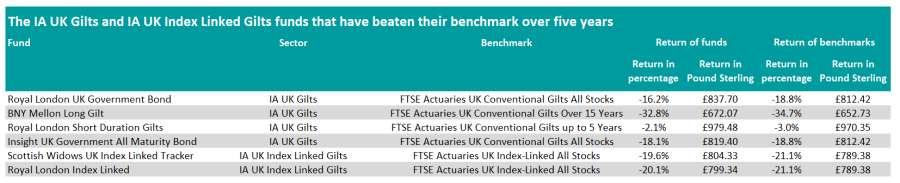

The past five years have been difficult for bond investors. Perhaps nothing illustrates this better than the fact that no fund in the IA UK Gilts sector, whether active or passive, made positive returns over that period (and neither did their benchmarks).

Moreover, only four funds in the sector were able to beat their benchmark between 30 September 2018 and 30 September 2023.

The situation is broadly similar in the IA UK Index Linked Gilts sector, with no fund making positive returns and only two beating their benchmark.

The IA UK Gilts and IA UK Index Linked Gilts funds that have beaten their benchmark over five years

Source: FE Analytics

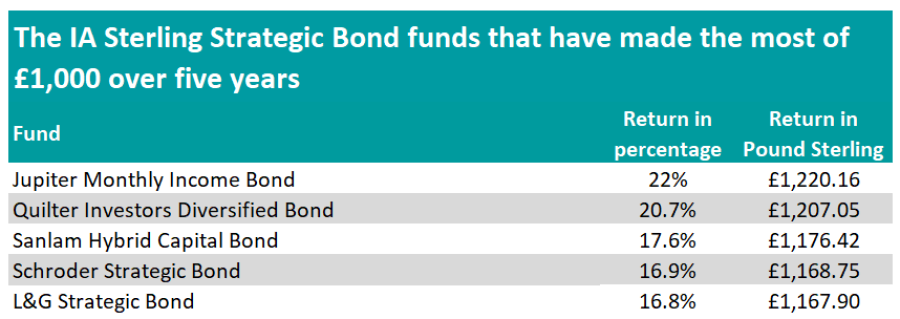

To see returns, investors should have favoured taking on more risk in sectors such as the IA Sterling Strategic Bond and the IA Sterling High Yield.

The top funds in the strategic sector produced the best returns overall. Jupiter Monthly Income Bond would have made a good use of £1,000 by returning £1,220.16 after five years. The FE fundinfo five crowns fund, managed by Hilary Blandy since September 2020, sits in the top quartile of the sector over 10 years, five years and three years among others.

The fund typically has half of its allocation in sub-investment grade bonds and may have a maximum of 20% in contingent convertible bonds, which are bonds that can be converted into shares or written off in certain pre-specified conditions.

The IA Sterling Strategic Bond funds that have made the most of £1,000 over five years

Source: FE Analytics

Other funds that would also have served investors well in the IA Sterling Strategic Bond sector include Quilter Investors Diversified Bond, Sanlam Hybrid Capital Bond and Schroder Strategic Bond.

The former Merian Global Strategic Bond would have made the most of £1,000 of any funds having returned £1,256.52 over five years, but was moved last month to the IA Targeted Absolute Return sector following its merger with Jupiter Flexible Macro. The portfolio, still run by Mark Nash, is now called Jupiter Global Macro Bond.

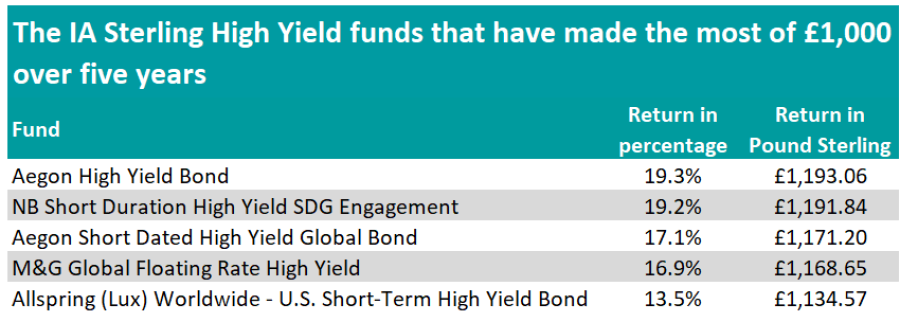

In the IA Sterling High Yield sector, Aegon High Yield Bond would have turned £1,000 into £1,193.06 over five years, the most an investor could have made in that period.

The fund is index agnostic and seeks to take advantage of inefficiencies in rates and credit markets. It is also a regular top performer in the high yield sector, having made top quartile returns over 10 years, five years and three years relative to its peers.

The managers Mark Benbow and Thomas Hanson also manage the Aegon Short Dated High Yield Global Bond which has returned £1,171.20 over five years. The strategy is more recent, having been launched in 2017 and invests primarily in high yield bonds with less than five and a half years to maturity.

The IA Sterling High Yield funds that have made the most of £1,000 over five years

Source: FE Analytics

The M&G Global Floating Rate High Yield fund grew £1,000 to £1,168.65 within five years by investing in floating rate notes, which are bonds paying coupons whose value is determined by a reference rate (e.g. Euribor). As the rate resets periodically, the payment received varies overtime.

In a note, Square Mile Investment Consulting and Research analysts said the fund should provide some protection against inflation in developed markets over the long term and is suitable for investors seeking to protect their income stream from the effects of rising interest rates and are prepared to hold the fund for at least five years.

They added: “This is an interesting strategy which should provide investors with protection against rising interest rates over the long term and that should offer a more defensive performance profile than that of the wider high yield bond market.

“However, at periods of severe market distress these defensive characteristics may not hold and the strategy can fall in line with the wider high yield market, as occurred in the first quarter of 2020.”

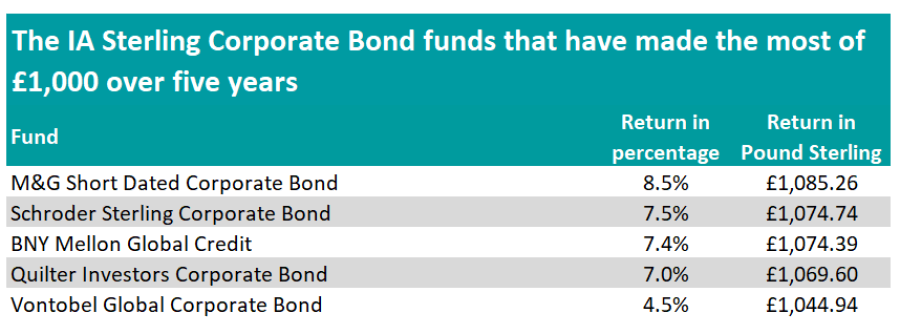

The IA Sterling Corporate Bond fund that would have made the most of £1,000 is also a strategy from M&G, M&G Short Dated Corporate Bond, which would have returned £1,085.26 after five years.

The portfolio is made of short duration global investment grade bonds, including emerging markets. The purpose is to try to minimise the effect of interest rate movements on the bonds’ value.

The IA Sterling Corporate Bond funds that have made the most of £1,000 over five years

Source: FE Analytics

Schroder Sterling Corporate Bond would have turned £1,000 into £1,074.74 over the same period. The fund aims to generate alpha by investing in investment grade bonds, without any strong focus on macro influences.

The fund has made top-quartile returns over 10 years and five years. It also beaten its peers and benchmark year-to-date.

In the fund’s latest interim report, the managers Daniel Pearson and Julien Houdain explained that performance were driven by the security selection in securitised credit, services and senior insurance provided positive active returns. Subordinated financial services and European services, also contributed to the fund’s performance.