The UK is currently synonymous with low growth and high volatility. While this might not sound like an ideal investing ground, Franck Dixmier and Virginie Maisonneuve, global chief investment officers (CIOs) at Allianz Global Investors for fixed income and equities respectively, are backing the market – something that domestic investors don’t seem prepared to do.

UK funds suffered a 28th consecutive month of outflows in September, with redemptions to the tune of £448m, as highlighted by the latest Calastone report.

But Allianz could be another example of a trend identified by Gervais Williams, manager of the Miton MicroCap Trust, in a recent interview with Trustnet, where he said that foreign investors have been driving the UK market and the FTSE 100 for the past three years.

Last-month estimates by the British Chamber of Commerce (BCC) have predicted a GDP growth of 0.4% in 2023, dropping then to 0.3% in 2024 and nudging up only slightly to 0.7% in 2025.

This low economic growth, the report explained, “is a reflection of the negative impact of inflation and interest rates on disposable income and household spending and their dampening effect on overall business investment”.

“Consistently low economic growth of this nature is comparable to previous periods of economic shocks and recessions such as the oil crises of the 1970s and financial crash of 2008,” it read.

This, paired with increased volatility, can give active investors a good hunting ground.

“I see opportunities in the UK in the environmental, sustainability and governance (ESG) sector as well as the small-cap space,” said Maisonneuve. “We really like the UK in general, but it’s especially interesting in the quality, value and income side. It also has the chance for rates to come down faster than in Europe.”

Maisonneuve’s optimistic stance on the domestic economy and UK equities was matched by a positive fixed-income perspective from Dixmier.

“We like an environment where there’s no growth and high inflation,” he said. “We also like what the central bank has done. The Bank of England is doing its job and also might have overdone it.”

Dixmier also favoured the UK as a high yielder, together with the US, Australia, New Zealand and Canada.

When it comes to gilts specifically, Allianz keeps a neutral bias with momentum supportive of higher yields while inflation dynamics are expected to ease.

In a very different context, Allianz Global investors also sees selective opportunities in China, where growth expectations are higher than in the UK, but slowing down.

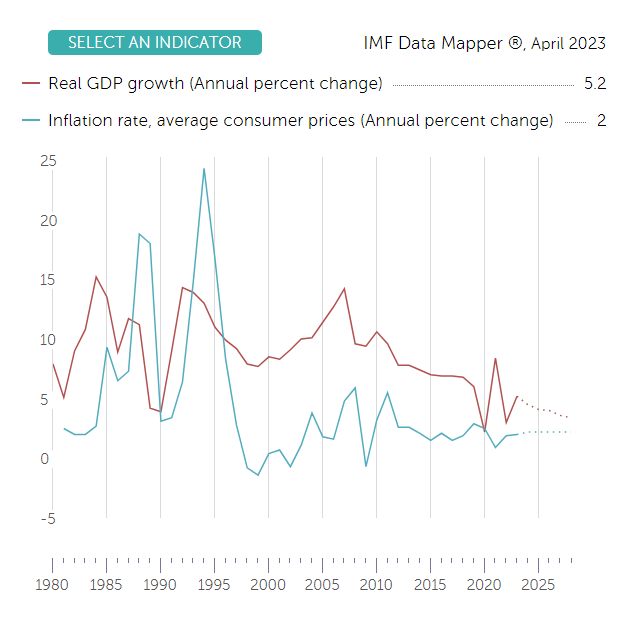

Here, the International Monetary Fund forecasts a 5% GDP growth for 2023 and 4.2% in 2024, with a cut of 0.1 and 0.2 percentage points from a previous forecast in July.

In this other lower-growth environment that’s emerging in China, Maisonneuve also saw pockets of that should improve over the rest of the year.

Chinese GDP growth forecast

Source: IMF

“Clearly, China is in a very slow patch right now, but it’s also in the process of stabilising. The latest PMI [Purchasing Managers' Index] numbers indicate that the economy is on an interesting path of structural change,” said Maisonneuve.

Recently, China has been particularly snubbed by investors for its low internal demand and, above all, its real estate crisis, recently covered by Trustnet. But there’s a whole other side to the equation.

“Yes, real estate, which accounts for about 20% of the country’s GDP, is not going to do well. But about 18% of GDP in China is represented by the new economy, which includes financial services, the real economy and tech, and very few are seriously looking at that at the moment.

“Chinese companies operate in different sectors and you don't have to have more deflationary trends. In China we look for innovation, pricing power and growth in a lower-growth environment,” she concluded.

Here, Allianz is in line with other UK managers such as Artemis, with chief investment officer Paras Anand recently writing on Trustnet that “when all markets can see are the negatives, it is usually a signal to buy”, while Waverton Strategic Equity’s manager Alena Isakova said she was convinced that Chinese equity valuations are discounting significant uncertainty in the near term.