Equity markets have exceeded expectations this year, proving the doomsayers wrong and causing ‘recession fatigue’ to creep in, according to Shamik Dhar, chief economist at BNY Mellon Investment Management, who warned investors against complacency.

Fears that the global economy could enter into recession have persisted since towards the end of 2021, when central banks started raising interest rates, as investors weighed the risk – and likelihood – of policy error.

Those concerns have been particularly strong over the past 12 months as inflation has remained high and central banks have kept upping rates – at least until recently.

Dhar said: “Whilst ‘recession fatigue’ from a downturn that never seems to arrive is understandable, this fatigue is not an excuse to abandon the data and adopt an investment strategy of hope. The data continues to provide strong evidence that near-term recession risks are well above average.”

Dhar expects growth to be disappointing, inflation to surprise on the upside and monetary policy to be tighter than the market’s expectations.

He predicts that Germany will experience three consecutive quarters of falling output and that the UK will fare even worse, constrained by a double whammy of energy price hikes and a large reduction in effective labour supply as baby boomers retire and immigration fails to fill the gap.

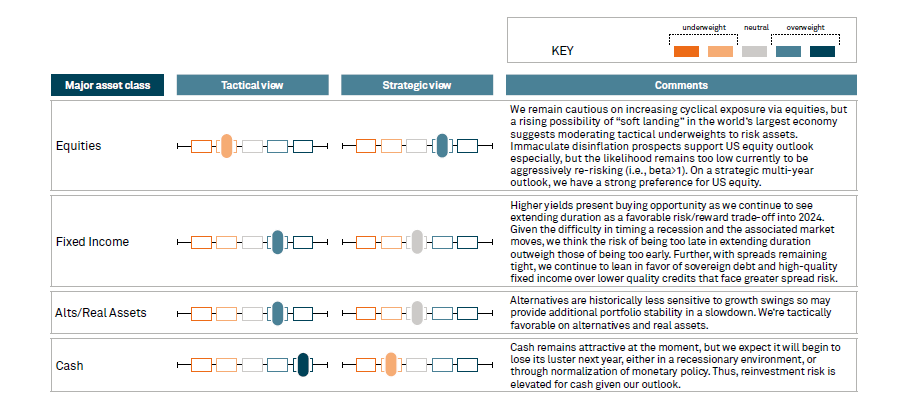

To combat this, he recommends a sizeable overweight to cash for safety and flexibility, as well as going overweight fixed income.

“Given the difficulty in timing a recession and the associated market moves, we think the risk of being too late in extending duration outweigh those of being too early,” he said.

“Further, with spreads remaining tight, we continue to lean in favour of sovereign debt and high-quality fixed income over lower quality credits that face greater spread risk.” Alternatives and real assets could also provide some useful diversification.

Although BNY Mellon Investment Management is underweight equities on a tactical basis, the US is the one bright spot where the possibility of a soft landing is rising.

Artificial intelligence provides a glimmer of hope and, whilst the benefits of AI adoption will be felt by US companies first, they should eventually spill over into international markets, which is why BNY Mellon’s multi-year outlook is much brighter, as shown in the chart below.

BNY Mellon's overweights and underweights

Source: BNY Mellon Investment Management

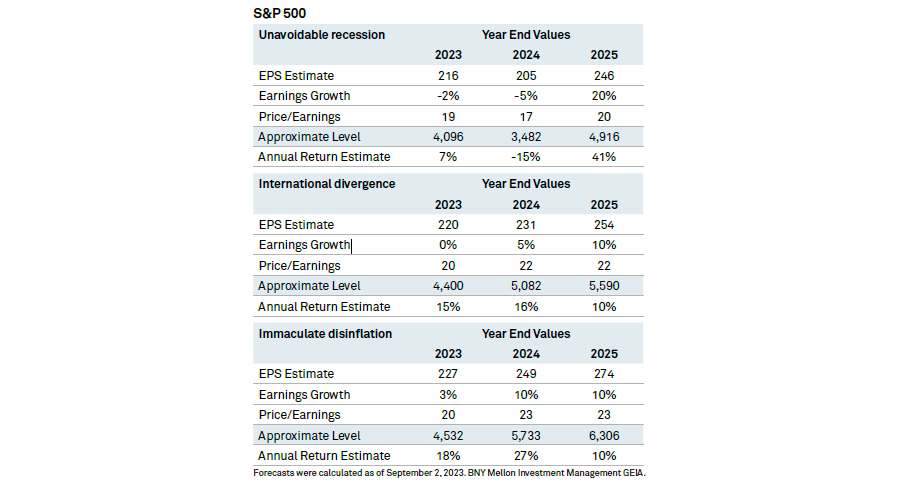

But predicting the future is an inexact science, so Dhar painted three possible scenarios for the global economy. ‘Unavoidable recession’ in the UK and euro area is the base case, with a 50% chance of happening.

An alternative forecast is ‘immaculate disinflation’, whereby interest rates level out, inflation stabilises at 2%, productivity growth strengthens and China’s downturn turns out to be a blip. This goldilocks scenario where “all the chips fall into place” tallies with what the markets have priced in.

Although this could happen, Dhar gives immaculate disinflation a 20% probability. In this unlikely scenario, markets could rally well above consensus expectations, providing a spark to equities.

What could happen to the S&P 500 in each scenario

Source: BNY Mellon Investment Management

A more plausible narrative, in Dhar’s view, is ‘international divergence’, whereby the US economy proves resilient, but stagflation risks materialise in the euro area and Chinese growth is stymied. Dhar gave this idea a 30% likelihood.

This means that either a sizable sell-off from a recession or a strong rally in 2024 have a higher likelihood than investors expect.