The UK is not the first market that springs to mind when it comes to investing for growth, as the FTSE 100 index has a dearth of companies that fit this characteristic.

In fact, Richard Penny, manager of the TM Crux UK Core and TM CRUX UK Special Situations funds, said it is structurally difficult for growth businesses to thrive in the UK, which has led to investors looking mainly overseas and, in particular, the US.

“Americans are much more comfortable with allowing companies to take shareholder capital and invest for the future, while the UK is a lot more conservative,” he said.

“As they have paid high dividends and not invested in themselves for a number of years, it unfortunately means a lot of large companies in the UK are not likely to grow.”

Yet, it does not mean that the UK has nothing to offer for growth investors, provided they are comfortable with looking in the lower echelons of the market.

While they have a lower profile than their US counterparts, UK growth companies trade on lower multiples than their North American counterparts.

For instance, Penny is enthusiastic about the prospects of animal genetics group and FTSE 250 constituent Genus.

The company is a leader in its market but profits have been depressed in recent times as the business has been spending higher amounts on research and development, while also being penalised by higher interest rates, the spread of African swine fever and weaker demand for pork in key markets.

Penny said: “Its profits are depressed, but it is doing it to leverage the distribution, so at some point next year there will be good upside.

“A lot of the hedge funds are going to say ‘well, cash generation isn't good’. Of course, it is not good, if you want to create something of value, you must invest in it. It costs cash.”

FD Technologies, which trades on AIM, is another growth businesses that Penny likes.

He said: “It is investing in a database product which lends itself to the internet of things, but it is also very highly implicated in vector databases for artificial intelligence.

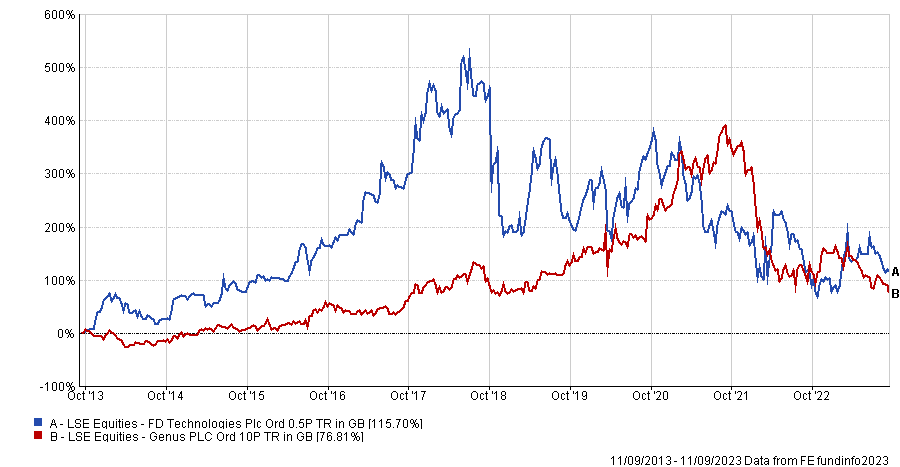

Performance of shares over 10yrs

Source: FE Analytics

The share price of this UK tech company has risen from 40p to £15 over the past 30 years, but it has had a bumpy ride since 2018.

Penny added: “Buying businesses that have long-term growth when they were in downturns has really driven some of the biggest increases during my career.”

Finally, Penny was also optimistic about the future of Kooth, a company providing digital mental health care, which is also quoted on AIM.

The company has recently won a $188m contract with the California Department of Health Care Services to provide its services to the 13-25 years olds residing in the Golden State.

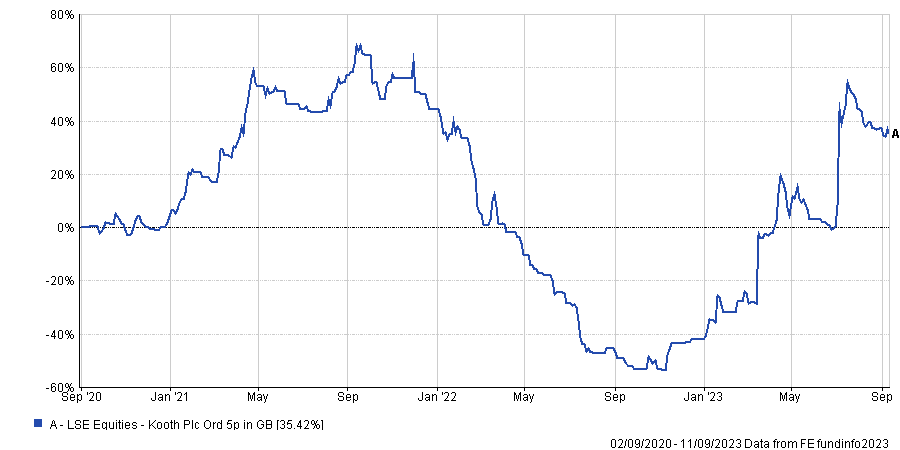

Performance of share since listing

Source: FE Analytics

Penny said: “It won this contract against 450 other businesses, many of whom are American, and much highly valued. It opens up growth for a number of years, potentially throughout other US states beyond California.”