Large funds are often the first to grab investors attention, but smaller portfolios can sometimes go unnoticed despite beating their bigger counterparts.

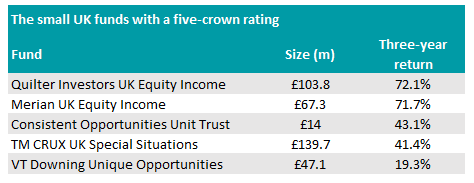

In the IA UK Equity Income and IA UK All Companies sectors alone, Trustnet found five funds with less than £300m in assets under management (AUM) that were among the highest ranking portfolios in the Investment Association (IA) universe.

While their small size may leave them overlooked, each of these funds garnered a five FE fundinfo Crown Rating – something only 10% of the thousands of funds on the market are awarded.

Funds with a full five-crown score must exemplify outstanding alpha, volatility and consistent performance over a three-year period to gain the rating.

Six UK funds also made it onto Trustnet’s previous article of five-crown rated smaller companies portfolios under £300m.

Source: FE Analytics

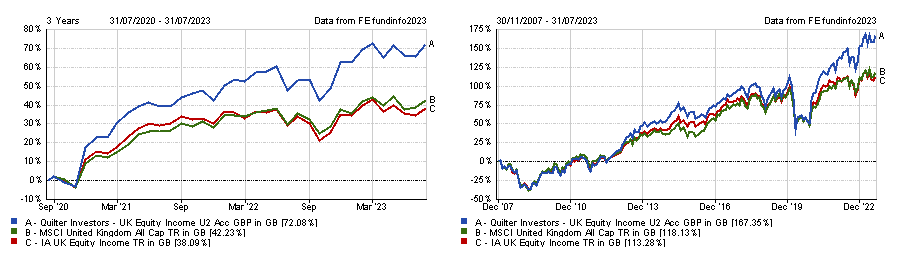

The best performing fund on the list was Quilter Investors UK Equity Income, which returned 72.1% over the past three years.

It beat every other fund in the IA UK Equity Income peer group over that period, outperforming the average return by 34 percentage points, but remains small with just £104m in AUM.

Running of the fund is outsourced to a team at Jupiter Asset Management (formerly the Merian Global Investors part of the business) headed up by Ed Meier, which has delivered a total return of 167.4% since it launched in 2018.

Total return of fund vs benchmark and sector over the past three years and since launch

Source: FE Analytics

Source: FE Analytics

The fund is not available to buy for retail investors, but an identical portfolio run by the same team – Merian UK Equity Income – is purchasable on most platforms.

It’s three-year return of 71.7% trailed narrowly behind, but the long-term track record goes further back than the Quilter portfolio.

Though it may be small, this £68m fund beat the IA UK Equity Income sector by 39.8 percentage points since launching in 2012 with a total return of 132.4%.

Total return of fund vs sector over the past three years and since launch

Source: FE Analytics

Source: FE Analytics

Meier has devoted the highest individual sectoral allocations towards financials (19.6%) and consumer discretionary (19.2%), but energy and utilities companies jointly make up a sizable chunk of the portfolio (24%).

Drax, Centrica, Shell, BP and Diversified Energy account for half of the fund’s top 10 holdings, collectively worth almost a fifth (19.9%) of all assets.

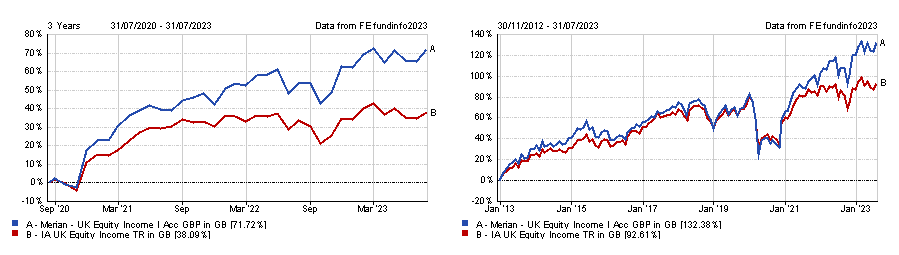

An even smaller UK fund to have bettered more than 90% of the IA universe is the Consistent Opportunities Unit Trust.

This £14m fund was up 43.1% over the past three years, climbing 13 percentage points above the IA UK All Companies sector.

However, its track record beyond the three-year sampling period FE fundinfo uses to judge crown ratings is not as impressive. Returns trailed 25.8 percentage points behind the peer group over the past decade, climbing 36.7%.

Total return of fund vs benchmark and sector over the past three and 10 years

Source: FE Analytics

Source: FE Analytics

Nevertheless, the Consistent Opportunities Unit Trust may stand out among its peers given its preference for mid-to-small-cap companies – more than half (57.5%) of its holdings have a market capitalisation below £250m.

The fund performed well over the past three years, but managers Jay Patel and Nicholas Pritchard said the additional interest rate hikes they forecast “will continue to dampen investor appetite for UK equities in the short term”.

Crown ratings are used to measure the performance of a fund, but FE fundinfo analysts also award FE fundinfo Alpha Manager status to individuals who have demonstrated an outstanding skill for stock-picking.

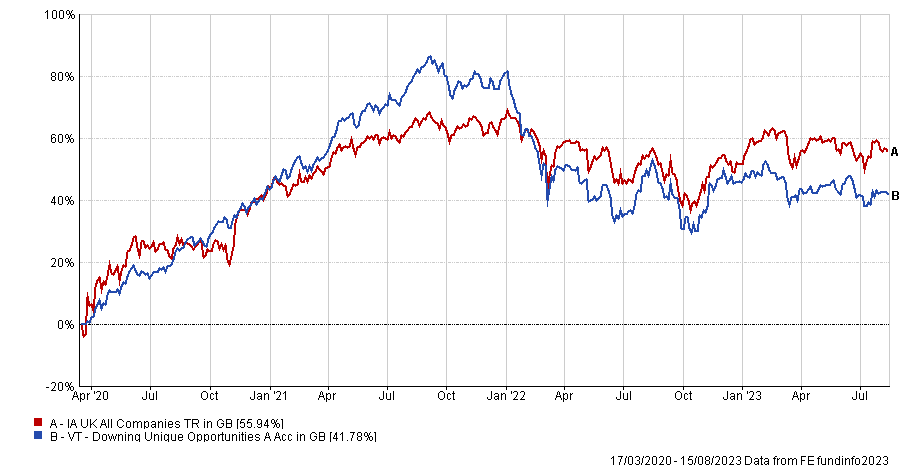

VT Downing Unique Opportunities was the only fund on the list not only to have a five-crown rating, but an Alpha Manager at the helm – Rosemary Banyard.

Total return of fund vs sector since launch

Source: FE Analytics

Source: FE Analytics

She launched the fund in March 2020, during which time it has delivered a total return of 41.8%. This is 14.2 percentage points behind the IA UK All Companies peer group, yet the fund’s strategy and Banyard’s track history have proven themselves to be ahead of the market.

Since 2000, she has delivered returns across her career of 707.8%, far above the 413.1% of her composite peer group during this time.