BlackRock regained its position as the UK’s top-selling fund management group during the second quarter of 2023, a closely watched report shows.

Volatility eased in the second quarter when compared with 2023’s opening three months but continued uncertainty, persistently high inflation and falling house prices worried investors and gross fund sales remained muted compared to pre-2022 levels.

As a result, equity funds suffered a sixth consecutive quarter of outflows and investors moved towards fixed income strategies, according to the Investment Association.

Anna Pridham, editor of The Pridham Report, which tracks fund managers' quarterly fund flows, said: “There were mixed results in the second quarter.

“Among the top 10 leading fund groups, roughly half saw their sales decline, while of those that reported a rise in new business, two experienced their highest quarterly gross sales on record.”

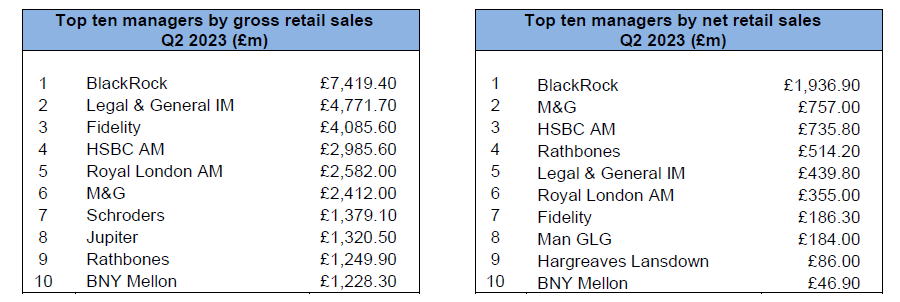

The report shows BlackRock had the highest gross and net retail sales in the second quarter of 2023 for the first time since the third quarter of 2021.

Source: The Pridham Report

BlackRock – the biggest fund management company in the world – had flat gross retail sales when compared with the previous quarter (£7.4bn). However, this was offset by lower redemptions, which boosted its net retail sales to just under £2bn (up from £984m in the first quarter).

The firm has benefited from continued trends in favour of index investing, such as cost and regulatory pressures, although sales of actively managed funds remain a core component of its business, accounting for 24% of gross flows in the second quarter.

Legal & General Investment Management, another heavyweight in index investing, posted its highest ever quarterly gross inflow.

The firm’s ‘core replacement’ products such as L&G International Index and L&G All Stocks Gilt Index generated its highest sales in the second quarter, but there was also growing demand for thematic strategies such as L&G Global Technology Index.

L&G Strategic Bond captured good inflows from Legal & General Investment Management’s actively managed offering.

M&G had its best quarter for net inflows in more than a decade, with an intake of £757m putting it in second place (up from £439m in the first quarter). Although M&G’s sales have historically been dominated by its fixed income funds, its equity funds have been attracting investors recently and gross flows were split evenly between the two ranges last quarter.

Rathbones was a newcomer to the top 10 for gross sales following record inflows in the second quarter. Rathbone Ethical Bond and Rathbone Global Opportunities tend to experience consistent demand but the group’s biggest seller in the second quarter was Rathbone Strategic Growth.

Hargreaves Lansdown also entered the leaderboard by moving into ninth position for net sales.