Investors concerned by anaemic growth forecasts across the developed world should consider looking to areas poised to surge, according to John Moore, senior investment manager at RBC Brewin Dolphin.

He said expectations are that UK GDP growth is expected to be just 1% in 2024 and 1.5% in 2025, while US growth is projected to be 0.1% and 1.1% over the next two years. Over the same period, the Eurozone is predicted to grow 0.3% and 0.4%.

But much higher growth will come from frontier markets, a loose definition of those economies that are surging from the least developed areas, but aren’t yet considered emerging.

Vietnam, for example, is expected to grow 6.5% in 2024 alone, according to the World Bank, and others including Indonesia and Sri Lanka in Asia, Argentina in South America, Africa’s Nigeria, Kenya and Morocco as well as Lithuania and Slovenia in Europe, offer a greater opportunity for investors than they did five years ago.

“Globally, the distribution of wealth and the drivers of growth are changing. There is capital in frontier markets looking for returns,” he said.

“Investing in these areas often means exposure to sectors such as financials, industrials, and resources. But if their economies are growing, these are the types of companies that benefit by providing the fuel that drives growth. You need only to look at the best-performing listed bank in Europe – the Bank of Georgia – for evidence that, as economies expand, banks tend to act as a toll on that process.”

Investors who want exposure to this growth have different options, including some country-specific trusts and funds listed in the UK, but Moore recommended taking a more regional approach to offset what can be very volatile individual economies.

The funds he recommends below are “reasonably sized, scalable, and they have experienced management teams who know how to make money in bad times as well as good”.

His first pick was BlackRock Frontiers Investment Trust, which mainly invests in Indonesia, Saudi Arabia, Thailand and Vietnam.

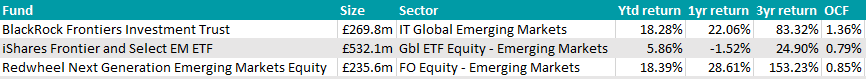

Performance of trust over 5yrs against sector

Source: FE Analytics

Financials make up 37% of its holdings, with further significant exposure to materials and energy, both at 15%.

“It was launched in 2010 and made a steady climb up to a peak in 2018, before attitudes towards frontier markets began to change. It offers a good spread of investments across a variety of countries and, although there has been some volatility in the share price, has the fallback of a relatively attractive 4% dividend,” Moore said.

Another option, this time on the open-ended spectrum, is Redwheel Next Generation Emerging Markets. Led by James Johnstone, this $300m strategy has a five FE fundinfo Crown rating.

Despite the name, the fund invests in frontier countries such as Indonesia, the Philippines and Saudi Arabia.

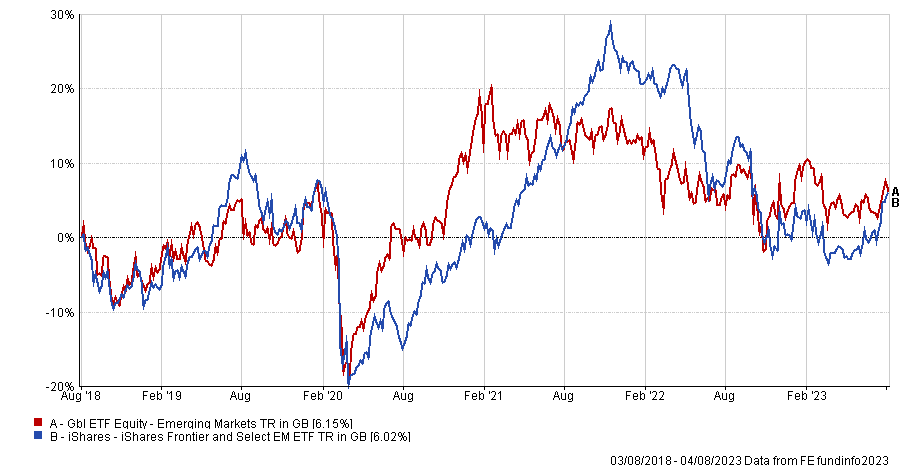

Performance of trust since launch against sector and index

Source: FE Analytics

“Redwheel Next Generation is an open-ended investment fund in a type of area that normally better lends itself to closed-ended vehicles,” said Moore. “But, the fund has performed very well since its launch in 2019, just missing the initial sell-off of the sector a year or two before.”

Finally, for exchange-traded fund (ETF) fans, Moore highlighted the iShares Frontier and Select EM ETF. Investing in around 160 companies across a range of markets, this vehicle has nearly one-third of its holdings in Vietnam, with Romania, Kazakhstan and the Philippines as the next-largest geographies, but all with single-digit exposures.

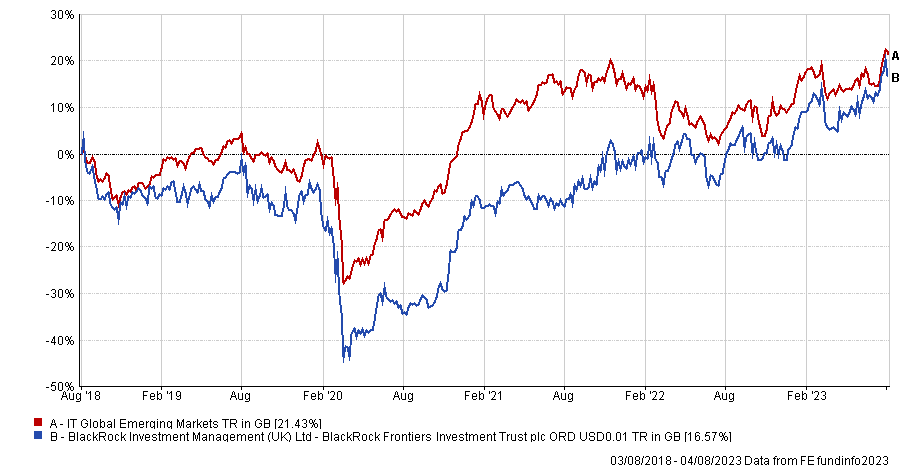

Performance of fund over 5yrs against sector

Source: FE Analytics

Financials account for more than 30% of the ETF, followed by materials and real estate at around 13% each.

“This iShares ETF offers cheap exposure to what is typically quite a pricey area to get exposure to,” said Moore.

“Unlike most of iShares’ ETFs, it is also actively managed – something that is very important in fast-moving markets such as those that fall under the banner of frontiers.”

Finally, the investment manager noted that these are volatile markets and can be uncertain, particularly from a political intervention perspective. For this reason, they have to be seen as long-term investments, he said before “strongly recommending” investors take financial advice to check they align with personal objectives.