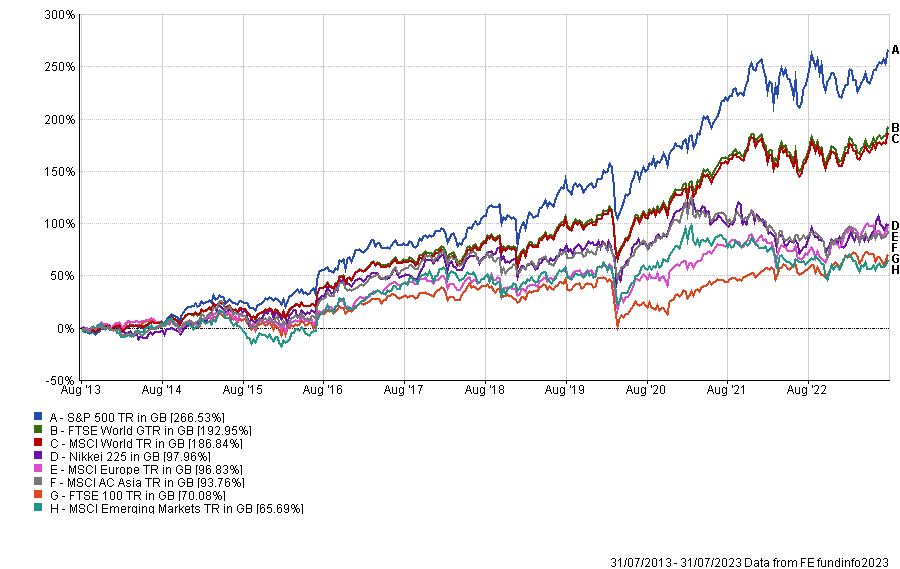

Over the past 10 years, investors did not need to be particularly creative to get outstanding returns. Simply putting money in a passive fund tracking the S&P 500 would have done the trick and there wasn’t much you could have done to do better.

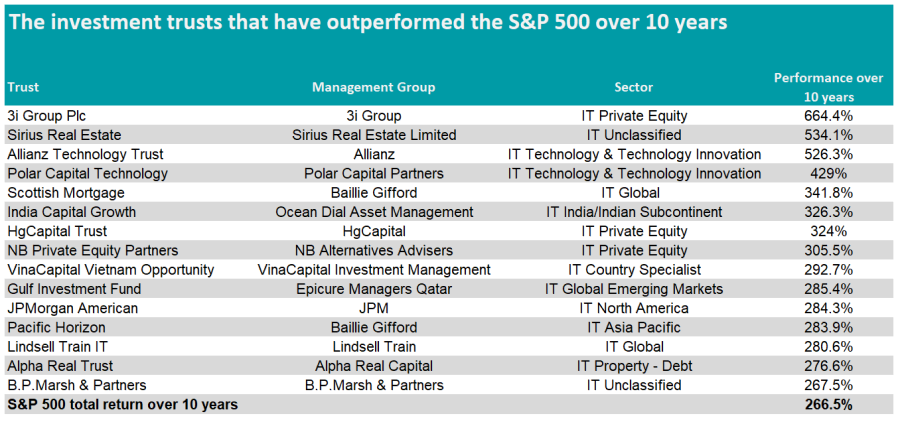

Only 7% of investment trusts (excluding venture capital trusts) and 6% of open-ended funds have been able to outperform the US index during that period.

Those figures show that investment trusts have proportionally fared slightly better than their open-ended rivals against the US index.

As a result, we have looked at those few investment trusts that have delivered even more than the S&P 500 in the past 10 years.

Performance of major indices over 10yrs

Source: FE Analytics

Starting with the IT North America sector, JPMorgan American has beaten the S&P 500 a feat worth noting as US equities fund managers have historically struggled to beat their benchmark.

The trust was run by Gareth Fish between 2002 and 2019 when Jonathan Simon and Timothy Parton took over the management, with Simon focusing on value stocks and Parton on growth.

In the global sector, Scottish Mortgage and Lindsell Train IT are among the handful of trusts that have prevailed over the S&P 500 over 10 years.

While the Lindsell Train investment trust has been managed by Nick Train since 2001, Scottish Mortgage has experienced a managerial change in the past 10 years. The bulk of the returns came under James Anderson who resigned in 2022 and has since moved to Lingotto Investment Management after 20 years at the helm of the Baillie Gifford’s flagship trust. He had, however co-run the trust with current manager Tom Slater since 2015.

Source: FE Analytics

Pacific Horizon is another trust from Baillie Gifford that has beaten the S&P 500 in the same period. Unlike Scottish Mortgage, Pacific Horizon is part of the IT Asia Pacific sector and invests in markets such as China, India or South Korea. The management of the trust has regularly changed hands in the past 10 years, with three different managers in that period.

Two other Asian funds have achieved the same feat as Pacific Horizon, but with single-country focuses, namely India and Vietnam.

India Capital Growth invests in Indian mid-cap equities and has regularly been the best performer in the IT India/Indian Subcontinent sector. With £137.5m in assets under management, it is also the smallest trust in the sector.

VinaCapital Vietnam Opportunity is part of the IT Country Specialist and invests in the Vietnamese market. Unlike its rivals Vietnam Enterprises Investment and Vietnam Holding which focus on Vietnamese public equities, VinaCapital also holds private equities and public equities with private terms.

Another emerging market fund that has outperformed the S&P 500 is Gulf Investment Fund. The trust gives exposure to markets of the Gulf Cooperation Council such as Saudi Arabia, the UAE and Qatar. According to the AIC, the trust predominantly invests in the industrials and financial services sectors.

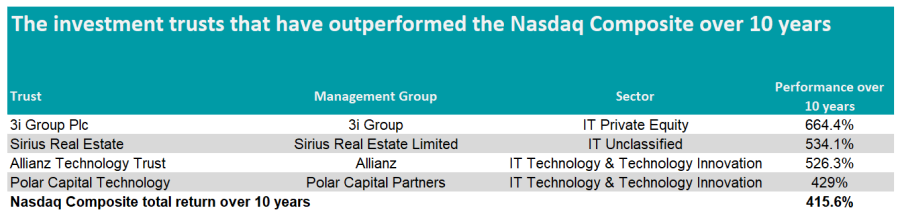

Moving on to industry-specific sectors, Allianz Technology Trust and Polar Capital Technology Trust invest in tech businesses across the world. They have not only beaten the S&P 500 over 10 years, but also the Nasdaq Composite index – an even higher benchmark.

Beating the Nasdaq Composite was an even harder feat to achieve as it has a pronounced emphasis on technology stocks, which have driven the US market in the past decade. For instance, information technology represents 28% of the S&P 500, while it accounts for 55% of the Nasdaq Composite.

Performance of indices over 10yrs

Source: FE Analytics

Another trust that has outperformed both the S&P 500 and the Nasdaq Composite is private equity trust 3i Group Plc.

It invests in private equities around the world but stands apart from its competitor with a very high concentration (over 50%) in a single business: Action, a Dutch discount retailer.

HgCapital Trust* and NB Private Equity Partners are two other trusts in the IT Private Equity sector that have beaten the S&P 500 over 10 years. Yet, unlike 3i Group, they did not outperform the Nasdaq Composite.

HgCapital Trust invests in unquoted software and service businesses, while NB Private Equity Partners holds unlisted businesses across different industries and geographies.

Among other alternative assets, Alpha Real Trust has also outperformed the S&P 500 over 10 years. The trust, which is part of the IT Property – Debt sector, focuses on asset-backed lending, debt investments and high-yielding property in Western Europe.

Source: FE Analytics

Sirius Real Estate, which is also related to property investing, has beaten the S&P 500 over 10 years as well as the Nasdaq Composite.

The investment company owns a portfolio of commercial real estate assets in Germany such as offices, business parks and industrial complexes. It seeks to generate returns for shareholders through capital appreciation and rental income. Despite its focus on property assets, Sirius Real Estate is part of the IT Unclassified sector.

B.P.Marsh & Partners is another constituent of the IT Unclassified sector to have outperformed the S&P 500 in the past decade. It invests in early-stage financial services intermediary businesses, such as financial advisers, wealth managers, consultancy firms, etc.

*HG Capital is the owner of FE fundinfo.