There’s a growing interest in income investing as high inflation and rising interest rates put pressure on growth stocks and create the need for money to work harder, as analysis of investor research trends on Trustnet recently found.

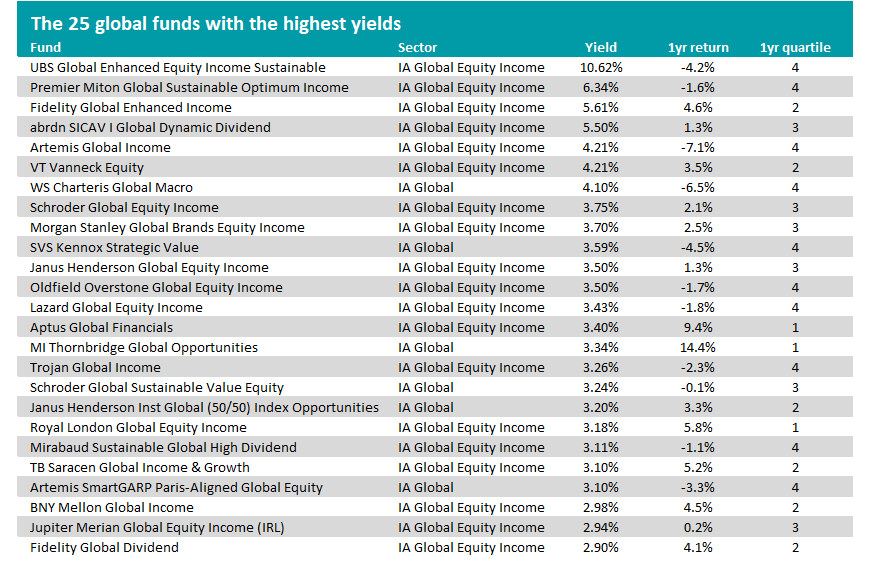

Last week, we looked at the UK funds with the highest yields so in this article we turn our attention to the IA Global Equity Income and IA Global sectors.

While the UK is a traditional hunting ground for income investors, yield is harder to come by on the global stage. The yield on the MSCI World index, for example, currently stands at just 2.11% - compared with 3.74% for the FTSE All Share (the yield on the average IA Global Equity Income fund is 3.08%).

However, within the two global peer groups, there are 54 funds yielding more than the index and the one with the highest yield is UBS Global Enhanced Equity Income Sustainable.

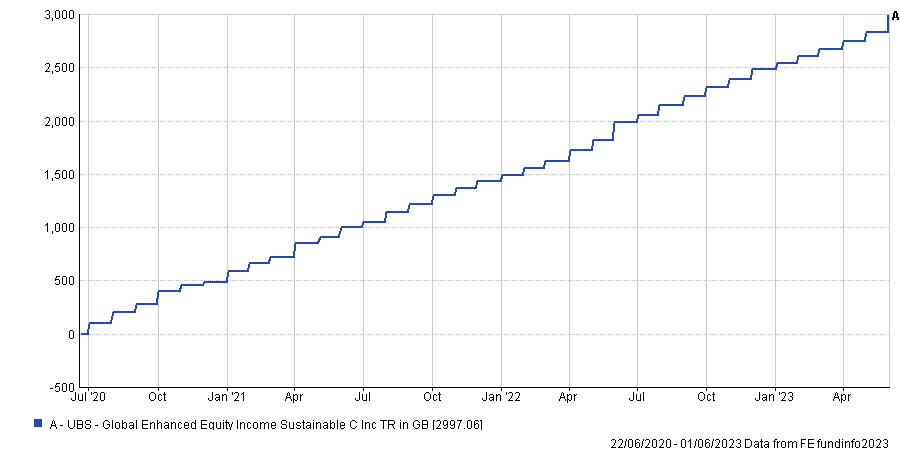

Income paid by UBS Global Enhanced Equity Income Sustainable over 3yrs

Source: FE Analytics

According to FE Analytics, this fund is yielding 10.62% - the highest in the IA Global Equity Income sector by a wide margin. Over the past three years, it has paid out almost £3,000 on an initial investment of £10,000.

Like with the IA UK Equity Income sector, the highest yields have come from ‘enhanced income’ funds, or those that invest predominantly in dividend-paying stocks and use strategies such as covered call options to boost income.

Covered calls involve selling call options on stocks that the fund owns to essentially exchange some capital upside for higher income; the premium received from selling these options can significantly boost the fund's income.

UBS Global Enhanced Equity Income Sustainable uses this approach, as well as the integration of environmental, social and governance (ESG) factors into its stock-selection. This is similar to the fund in second place, Premier Miton Global Sustainable Optimum Income yielding 6.34%, while third-placed Fidelity Global Enhanced Income also uses covered calls but is not a dedicated sustainable fund.

Source: FE Analytics

The first non-enhanced income fund on the list is abrdn SICAV I Global Dynamic Dividend, with a yield of 5.5%.

The majority of the fund’s assets are typically in long-term holdings intended to generate income and growth, although it will put “a small portion” in short-term positions to benefit from regular dividends as well as one-off or special dividends.

Artemis Global Income comes in fifth place with a yield of 4.21%. With assets under management of £1.1bn, this is a well-known member of the IA Global Equity Income sector.

Analysts at Square Mile said: “The strategy does not exclusively rely upon the typical higher yielding mega-cap names to meet the income objective; rather, the manager seeks a greater allocation to large and mid-cap stocks.

“To provide a balance the manager populates the portfolio with a variety of yield plays that includes a core of reliable quality names and an outer layer of companies with cyclical characteristics and more risky special situations.”

One important point on the above list is how many funds have underperformed from a total return point of view over the past 12 months: 10 are in the bottom quartile with another six in the third quartile.

Yield is calculated by dividing the value of income payouts over the past year by the current share or unit price of an asset. This means that a high yield can be the result of high dividends or weaker capital growth.

Just three of the 25 funds above are in the first quartile for total returns: Aptus Global Financials, MI Thornbridge Global Opportunities and Royal London Global Equity Income.