Even the best fund managers go through periods of underperformance, and occasionally entire sectors do as well.

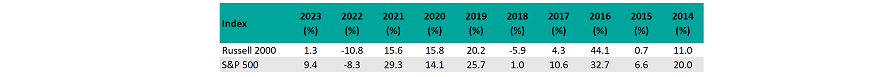

One example is US smaller companies. While small-caps typically outperform their larger counterparts over the long term, data from FE Analytics shows the Russell 2000 index has underperformed the S&P 500 for seven of the past nine calendar years and is behind in 2023 as well.

Performance of indices in calendar years

Source: FE Analytics

Even within this underperforming area of the market, Jon Brachle has found his JPMorgan US Smaller Companies IT lagging both its sector peers and benchmark over the past year.

In such situations, he said it is important to remember the trust’s quality style of investing has been proven to work over the long term – which can’t be said for the factors currently driving the market.

“The most difficult market environments for us are ones that are very macro driven, or where investor risk-taking is just very high,” he said, pointing to the ‘Vaccine Monday’ rally in November 2020 and the meme stock phase the following year as examples.

The manager added that after some of the most speculative areas of the market were punished in 2022, he noticed signs of excessive risk-taking returning last month on the back of optimism over artificial intelligence.

“If you look back at May, small-caps were down 1%, which at face value doesn't seem very risk on,” he continued.

“But if you look beneath the surface, the factors that did well were high beta, low return on equity and non-earners.

“Technology was up 11% in that month and the unprofitable names within that were up 15%. Healthcare was the second-best sector, led by a 5% gain in biotech stocks, most of which are unprofitable. Given that backdrop, we did have a very difficult May.”

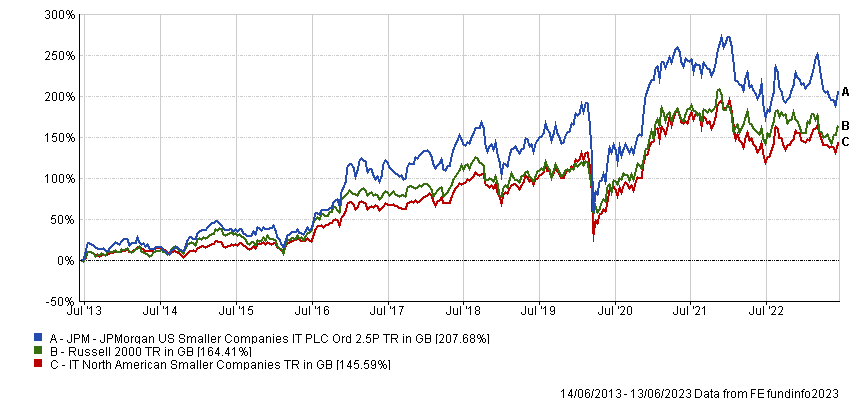

Performance of trust vs sector and index over 1yr

Source: FE Analytics

Brachle said one “silver lining” to periods in which his trust tends to underperform is that the quality companies he favours also fall out of favour, presenting buying opportunities for anyone with a long-term perspective.

Among the quality traits the manager looks for are wide profit margins, strong cashflows, high levels of recurring revenue and dependable management teams.

This has led the manager away from many companies in the small-cap area that hope to benefit from the AI trend which has “stoked animal spirits”, although he has increased his exposure to data centres within his semiconductor holdings.

“Last year, we added a company called Macom which generates 20% of its revenue through chips that enable optical connectivity within data centres,” he said. “But it's also a company that generates 35% EBITDA, so it’s very high quality.”

Brachle said there are more fruitful opportunities in unfashionable areas, with industrials one sector where he tends to find “high-quality names that are dominant in niche markets, with solid and stable free cashflow generation”.

As an example, he pointed to Toro, a provider of commercial lawn-care equipment and irrigation products used by golf courses and landscape contractors.

“The company has a strong competitive position with resilient demand because grass grows whether we are in a recession or not, and therefore needs to be mowed,” he said.

“This means the equipment wears out and needs to be replaced. If you follow golf, it's obviously seen a huge resurgence in the past few years after the pandemic. And if you think about the service that a golf course provides to consumers, it's basically nice grass.

“Toro’s products directly impact the life of golf courses, so they are very mission critical.”

A recent note from Numis said JPMorgan US Smaller Companies represents an interesting option for investors who want exposure to the US but are wary of valuations in the mega-cap tech stocks that dominate the S&P 500.

The analysts at the group noted US small-caps have derated due to the uncertain economic outlook, leaving the Russell 2000 trading on an historic P/E (price-to-earnings) ratio of just 13.5x. This compares with its 10-year average of 19.3x and represents a discount of about 38% to the S&P 500, the widest in about 20 years.

“The trust also offers relative value, trading on a forward P/E of 15.7x, compared with 17.2x for the Russell 2000,” they added.

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

“There is clearly a threat of earnings falling, however the trust should be relatively well insulated through its focus on high-quality businesses with durable franchises and strong market positions in niche industries that have the potential to deliver resilient earnings streams.

“As a result, we believe that JPMorgan US Smaller Companies is an interesting portfolio diversifier, particularly after the discount widened to about 10%.”