CFP SDL UK Buffettology, JOHCM UK Opportunities and L&G UK Index Trust are some of the UK funds that could suit investors with aggressive, balanced and cautious portfolio, according to the AFI panel of leading financial advisers.

Following the latest rebalance of the FE Adviser Fund Index (AFI), there have been some additions and removals to the FE three portfolio based on the recommendations of around 20 of the UK’s leading financial advisers.

Three indices with differing levels of risk form the AFI: AFI Aggressive is designed for someone in their late-20s, AFI Balanced is for someone in their mid-40s and AFI Cautious caters to those nearing and in retirement.

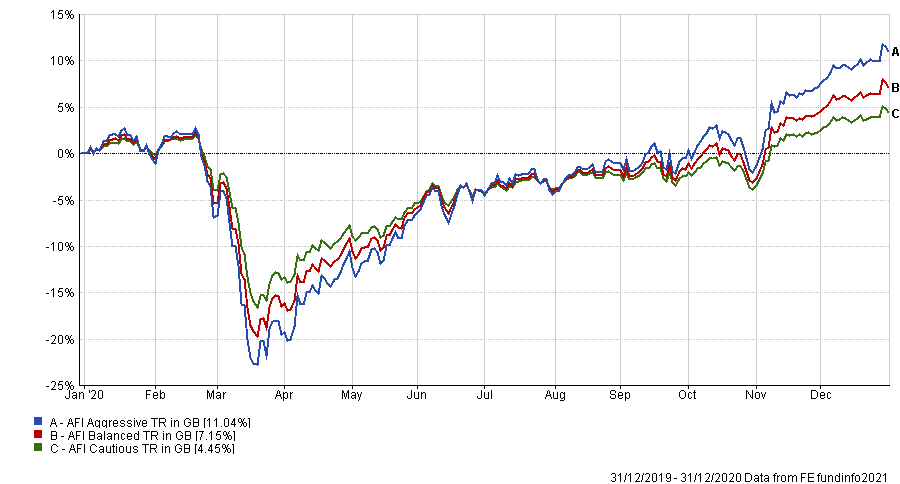

Performance of AFI portfolios in 2020

Source: FE Analytics

Despite a sharp fall of 22.73 per cent in March, the AFI Aggressive index made a total return of 11.04 per cent in 2020, while the Balanced and Cautious indices rose by 7.15 and 4.45 per cent respectively.

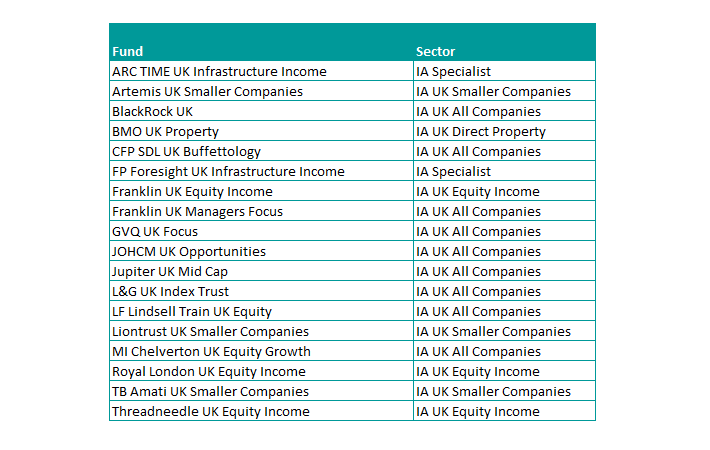

A number of funds appear in all three AFI portfolios, suggesting that advisers think they could be appropriate for investors of all risk tolerances. In this article, we look at the UK funds that are in all three, of which there are 18.

Considering that the UK is emerging from a four-year Brexit cloud and leading the way in vaccination programmes, many experts and advisers are expecting a strong UK resurgence this year.

In the latest rebalance, there were some notable UK funds that were removed from the AFI. Jupiter UK Growth, Ninety One UK Special Situations, Premier Miton UK Multi Cap Income and Unicorn UK Income were taken out of the portfolios to make way for a selection of global index strategies, amongst others.

In the remaining list of UK funds across all the indices, the only passive vehicle is the £6.2bn L&G UK Index Trust.

According to the team at FE Investments, its presence in all three portfolios can be attributed to its fairly straightforward replication process of the FTSE All Share.

L&G favours physical replication with strictly controlled stock lending (where a third-party borrows a limited amount of the passive fund’s holdings) and derivatives are only used in very small amounts. This means that counterparty risk is very low within its range of passive funds.

UK funds in all three AFI portfolios

Source: FE Analytics

Amongst the names within the IA UK All Companies sector, there were some familiar strategies – including Keith Ashworth-Lord’s £1.5bn CFP SDL UK Buffettology and Nick Train’s £6.4bn LF Lindsell Train UK Equity funds

Both are some of the best-known UK funds in the business and have track records of strong outperformance thanks to a preference for quality-growth stocks.

The £329.3m Franklin UK Managers Focus fund might be less familiar than the above, but is managed by a team of experienced individuals who all look after certain elements of the investment process.

Mark Hall works as coordinator for the portfolio, which is designed to be a shop window for the UK team’s best ideas at Franklin.

Colin Morton manages the blue-chip and equity income stocks of the fund, focussing on the best large-cap names, while FE fundinfo Alpha Manager, Paul Spencer and Ben Russon provide the best mid-cap ideas. Richard Bullas brings forward the best small-cap ideas.

The influence of Spencer, Russon and Bullas does lend to a slight structural bias to mid-and-small-caps.

Another Franklin strategy managed by some of those individuals also made the list, the £849.8m Franklin UK Equity Income fund is managed by Morton, Hall and Russon.

The bottom-up stock selection process is aimed at identifying high quality, income generating companies that can provide the portfolio with the prospect of a rising yield and long-term capital growth.

The fund has a yield requirement of 110 per cent of the FTSE All Share and will hold a minimum of 70 per cent in FTSE 100 stocks. The majority of the holdings will be in FTSE 350 companies.

JOHCM UK Opportunities is also found in all three portfolios. It made a total return of 26.15 per cent over the past five years, compared with 36.25 per cent from the average fund in the IA UK All Companies sector.

The fund has a strong value tilt, which explains the recent underperformance as the growth style has led the market. That said, value appears to be having something of a resurgence and some expect it to head into a period of outperformance when economic recovery takes hold.

Finally, three IA UK Smaller Companies funds are present in all three AFI portfolios and could be considered by investors of differing risk appetites.

Smaller companies often operate in more niche markets and can achieve fast technological growth. This, combined with a favourable environment of low-interest rates, has allowed these businesses to outperform over the last two decades.

Since March 2001, the IA UK Smaller Companies sector has made 440.03 per cent, while the FTSE All Share posted a gain of 163.04 per cent.

Performance of sector vs FTSE All Share over 20yrs

Source: FE Analytics

The environment in 2021 has given two further tailwinds to UK smaller companies: the signing of the Brexit trade deal and the rapid roll-out of the coronavirus vaccine.

The £408.3m Artemis UK Smaller Companies, £1.4bn Liontrust UK Smaller Companies and £631m TB Amati UK Smaller Companies funds all feature in the AFI’s recommendations across all risk profiles.

With an FE fundinfo Crown Rating of five, the Liontrust fund is the highest rated, but it is the TB Amati fund which has outperformed both its benchmark and sector peers every calendar year since 2014.

TB Amati UK Smaller Companies fund has been run by Paul Jourdan since 2000 and is co-managed by David Stevenson and Anna Macdonald. The fund’s focus on quality-growth companies has helped it perform well when growth companies lead the market.