Dan Nickols, head of Jupiter Asset Management’s small and mid-cap UK equities team, will retire on 30 June 2024. He is lead manager of the £426m Jupiter UK Smaller Companies fund and the £120m Rights and Issues Investment Trust and is an FE fundinfo Alpha Manager.

Matt Cable will replace him at the helm of both strategies. He has co-managed the Rights and Issues trust with Nickols since Jupiter won the mandate in October 2022. Cable joined Jupiter in 2019 and has more than 15 years of investment experience, garnered at M&G Investments and Schroders.

Tim Service, who has worked with Nickols for almost 20 years, will replace him as head of Jupiter’s ‘smid’-cap team and will be a supporting manager on the fund and trust. Service has been at Jupiter since 2007 and was previously a UK equity fund manager at Merian Global Investors. Earlier in his career, he was an analyst at JPMorgan and ABN Amro.

Nickols joined Jupiter in 2020 when it acquired Merian, where he led the UK small and mid-cap team. Before that, he worked at Albert E Sharp, Morgan Stanley and Deloitte and Touche.

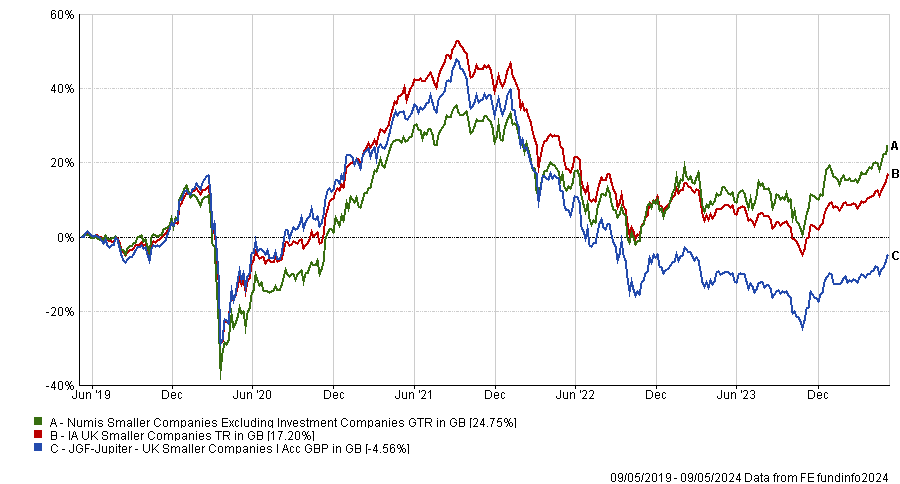

Jupiter UK Smaller Companies has a strong long-term track record but has struggled during the past five years, trailing the IA UK Smaller Companies sector and the Numis Smaller Companies index. It peaked at £1.5bn in assets under management in September 2021 when it was the most popular fund in its sector but has been in outflow mode since then, shrinking to one third of its former size.

Fund vs sector and benchmark over 5yrs

Source: FE Analytics

The fund suffered in 2022 as central banks rapidly hiked rates, putting the small and mid-sized growth-oriented companies in its portfolio under pressure.

As Bestinvest managing director Jason Hollands explained: “This was down to the strong growth style bias being hit hard during a period of rising interest rates and borrowing costs. It is also a relatively concentrated portfolio for a small-cap fund, with circa 56 holdings, which does leave it more vulnerable to stock-specific risk than more diversified products.”