‘It was the best of times, it was the worst of times.’ The opening lines of ‘A Tale of Two Cities’ by Charles Dickens is an apt description of the fixed income markets for the past couple of years, although the bad times in 2022 and early 2023 preceded the good.

For bonds, it currently looks like the best of times. Yields across the board are attractive and the income is back in fixed income – even though spreads are below long-term averages.

The high starting yields mean that strategic bond portfolios should be capable of delivering returns in the mid-to-high teens, said Jon Mawby, co-head of total and absolute return credit at Pictet Asset Management.

“That sort of return would be expected over an 18-24 month horizon if rates stay elevated. It would be possible over 12 months only if yields fall (e.g. due to a rate cutting cycle) and then bonds could benefit from significant capital gains,” he explained.

Further rate hikes would be detrimental for fixed income but returns should still be flat to slightly positive because yields are so high that they provide an element of protection, he continued.

“You’re being paid for the risk. If you’ve got the ability to be nimble, dynamic and strategic with no cognitive bias, it’s actually a great environment for the asset class.”

Maximum confusion amongst investors and central bankers

Yet despite the potential for high returns, many investors remain uncertain and are sheltering in cash and money market funds. Mawby described the current environment as one of “maximum confusion” because the dynamics of a normal economic cycle have been disrupted by massive fiscal stimulus after the pandemic.

Government spending cushioned consumers and businesses from feeling the full impact of rate hikes, throwing the “long and variable lag playbook” out of the window, he said. “These lags are going to be longer and they’ll probably be more variable. That is really what’s causing maximum confusion among central banks and the market.”

Mawby thinks the US Federal Reserve needs to cut rates soon or risk losing its window of opportunity because it would be politically unviable to introduce the first cut just before the November presidential election, lest the Fed be accused of trying to bail out the Democrats. “You know what the politics are going to be. I’d hate to be a central banker,” he confessed.

Mawby thinks the Fed needs to see “a shaft of light” to have the impetus to change course and believes that the yield curve needs to steepen, especially at the front end, before substantial cuts are implemented.

All that said, macroeconomic signals are divided with a cost-of-living crisis on one hand and better than expected economic data on the other. “I’m probably more confused than I’ve ever been about whether people are greedy or fearful,” Mawby said.

On the greedy side, equity market valuations look stretched, but on the fearful side, there is lingering distrust of fixed income following ‘the worst of times’ in 2022.

Investors in fixed income want three things, Mawby said: income; capital protection during times of stress; and diversification from risk assets. Fixed income failed to deliver on these criteria in 2022 and instead “super-charged risk”, which is why there is “maximum fear” surrounding bonds. That explains some savers’ preference for cash.

Where to invest in the bond market

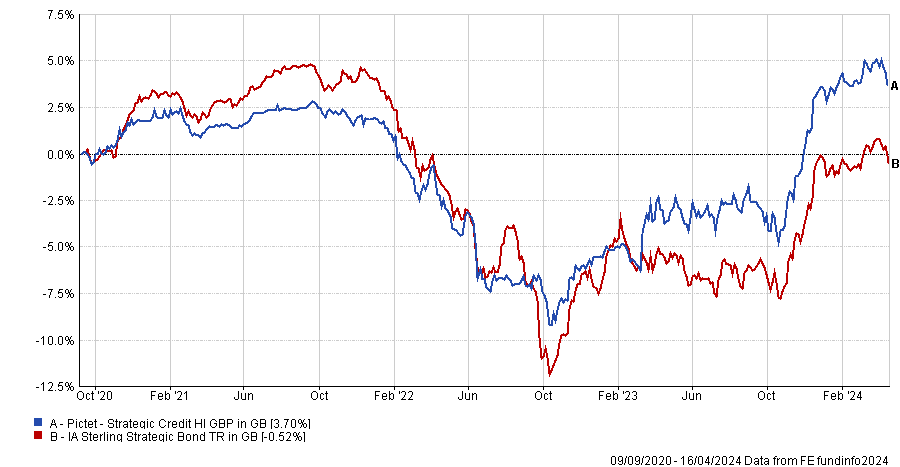

Fortune favours the brave and Mawby is looking for contrarian, undervalued opportunities for his Pictet Strategic Credit fund, which has an FE fundinfo Crown Rating of five (indicating that it is within the top 10% of funds in its sector for alpha, volatility and consistent outperformance).

Performance of Pictet Strategic Credit vs sector since inception

Source: FE Analytics

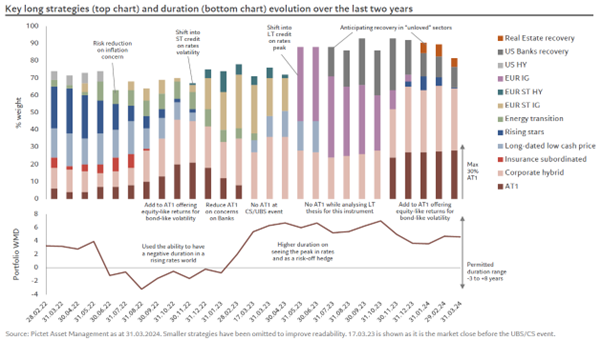

At the end of last year, he began building a position in additional tier 1 debt (AT1s), which were offering equity-like returns for bond-like volatility due to the elevated coupons on offer. “Everyone hated AT1s”, Mawby said, because investors were still spooked after Credit Suisse’s AT1 bondholders were wiped out as part of the forced merger with UBS in March 2023.

Although Mawby believes that AT1 instruments were designed to absorb losses, the Credit Suisse situation was unique; AT1s would not be written down to zero in the same way elsewhere in Europe or in the US, he said.

With the US regional banking crisis over, the outlook for the banking sector now appears more certain and AT1s look attractively-valued. They account for almost 30% of the Pictet Strategic Credit fund and he expects them to outperform as the yield curve steepens.

The Pictet Strategic Credit fund’s AT1 exposure

Another high conviction allocation is to short call hybrids with calls in 2024 to 2027 and yields from 4% to 6.5-7%.

“The carry or income is among the highest in the credit space thanks to the inverted yield curves and additional spread on offer in these subordinated bonds,” Mawby explained. “The issuers we hold are typically well-known or ‘national champion’ investment-grade-rated companies, where we are comfortable to harvest the additional carry through their subordinated debt.”