Investors who are bullish on Scottish Mortgage’s unlisted companies could broaden their horizons and consider the Schiehallion trust instead, which is “the purest version of Baillie Gifford’s private equity holdings”, according to Peel Hunt analysts.

When activist hedge fund Elliott Investment Management entered Scottish Mortgage’s shareholder register with a 5% position last month, Peel Hunt analysts suggested that Elliott’ interest might lie in the trust’s private equity holdings.

“It could be that the hedge fund investor sees value beyond [Scottish Mortgage’s] daily net asset value (NAV) and could be considering further valuation upside from the unlisted holdings,” they said.

The trust’s unquoted portfolio includes names such as Elon Musk’s SpaceX, fintech companies Wise and Affirm, TikTok parent ByteDance and software company Bending Spoons, as well as companies rumoured to be considering initial public offerings (IPOs), including satellite company Starlink, battery developer Northvolt and healthcare specialist Tempus.

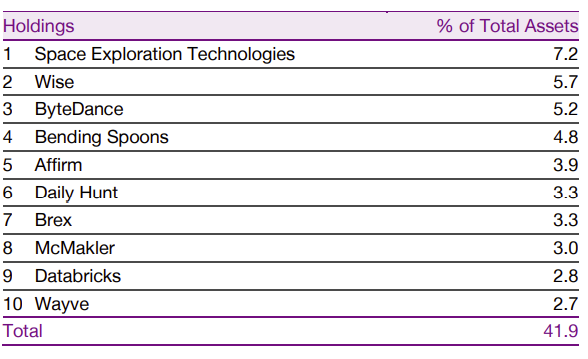

But while these companies make up 26% of Tom Slater’s and Lawrence Burn’s portfolio, they represent a whopping 42% of the Schiehallion trust’s assets under management, run by Baillie Gifford’s Peter Singlehurst and Robert Natzler, as shown in the table below.

Top-10 Schiehallion holdings

Source: Baillie Gifford

“We look across to Schiehallion for multiple reasons,” the analysts continued. “If the view held by outside parties is that the private company holdings are undervalued, then Schiehallion is the purest version of Baillie Gifford’s private equity holdings, and it’s on a 35% discount to end-February 2024 NAV.

“In the case of Scottish Mortgage, Elliott’s arrival has caught the market’s attention, but investors are left questioning what else there might be to target, given the recent commitment to a £1bn buyback programme and the narrowing of the discount to 5%.”

The hedge fund’s bullish stance on Scottish Mortgage didn’t move the needle either for Shavar Halberstadt, equity research analyst at Winterflood Securities. He remained positive on the trust but said that “the presence of an activist is not necessarily a catalyst we would classify as a reason for investment, although of course any accretive proposals could be helpful.”

Halberstadt also saw the appeal of the Schiehallion trust* for its “substantial exposure to high-quality private companies that are commonly considered prime IPO candidates once market conditions allow”.

“As we approach a probable rate cutting cycle, we expect markets to develop additional risk appetite. There have been some green shoots in the US IPO market recently, and we would not be surprised to see investor interest in Schiehallion ramp up as this widens out,” Halberstadt continued.

That interest won’t necessarily come from Elliott in particular, as “a certain level of scale is prerequisite”, but he expected other activist investors to pile into investment trusts to take advantage of the discounts.

Private equity investment trusts in general are trading at historically wide discounts due to investor skittishness in recent years.

Risk aversion increased due to the extraordinary disruption wrought by Russia’s invasion of Ukraine and other macro factors such as interest rate hikes. Furthermore, given the inherent reduction in visibility and time-lag of reporting compared with listed equities, some investors have been sceptical of private company valuations, Halberstadt said.

“That was understandable. However, private equity investment trusts continued to deliver over 2022 in terms of realisations at substantial uplifts to carrying value, and markets failed to adjust.

“While we saw mild rating improvement over 2023, the sector remains substantially too cheap, trading at a 30% discount to NAV at present versus 15% in January 2022.”

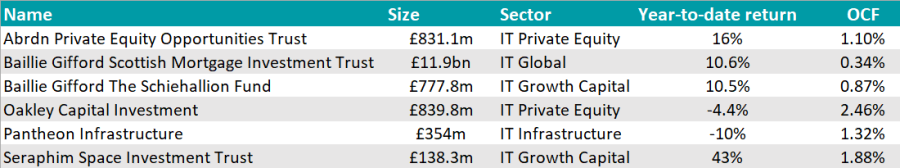

For investors looking to take advantage of those discounts, Winterflood’s 2024 recommendations included Seraphim Space and Pantheon International.

With a share price total return of 60%, Seraphim Space was the top performing investment trust over the year to date. Meanwhile, Pantheon was highlighted by Winterflood’s Elliott Hardy for its “continued a track record of realising assets at an uplift to their underlying value” and its unwarranted 32% discount.

“The fund’s strategic focus over the last decade on secondaries and co-investments should help to support distributions and liquidity amidst record low exit volumes,” he said.

Finally, Quoted Data’s head of investment company research James Carthew recently highlighted Oakley Capital Investments and abrdn Private Equity Opportunities in the private equity space.

The former strategy has been able to generate “robust earnings growth”, a 4% NAV growth and an 18% total shareholder return in 2023. Macroeconomic uncertainty is creating opportunities for Oakley Capital, which “has been busy deploying cash into new investments at what it feels are attractive valuations,” Carthew said.

In January, abrdn Private Equity Opportunities announced a net asset value total return of 5.4% and share price total return of 11.7% in its annual results for the year ending 30 September 2023. These performance disclosures helped to narrow the trust’s discount from 45% last October to the current 28.9%.

“This resilience came in spite of a slowdown in activity in European private equity markets in 2023, dampened by a residual fear of rising interest rates and geopolitical tensions,” Carthew said. “However, as interest rates come down, the market could bounce back quickly.”

Source: FE Analytics

* A corporate broking client of Winterflood Securities.