UK equity income funds with a preference for large value stocks have led the way in recent years, outperforming their peers holding smaller companies by a significant margin, Trustnet research shows.

This annual series looks at the major Investment Association sectors through a variety of lenses to see which funds have consistently delivered for investors. This time around, we’re shining a light on the IA UK Equity Income sector.

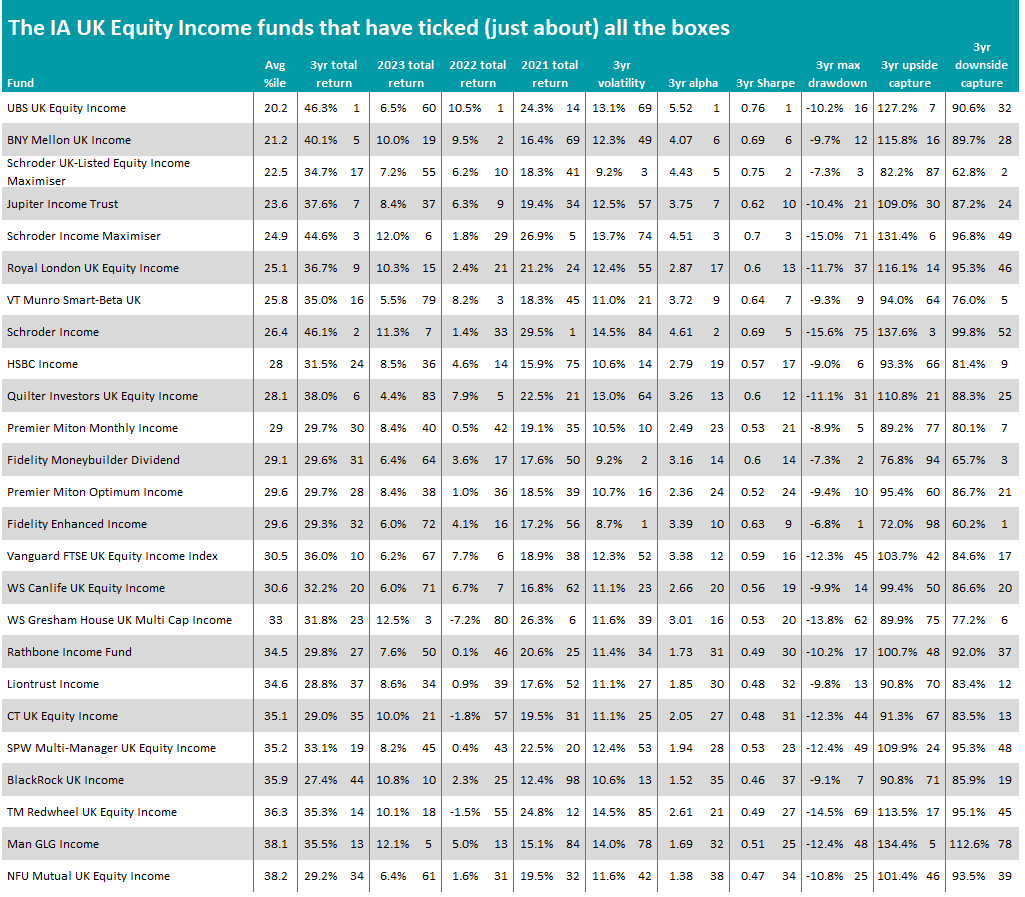

To do this, we have worked out the percentile rankings of each fund for cumulative three-year returns to the end of 2023 as well as the individual returns of 2021, 2022 and 2023 (to ensure performance isn’t down to one standout year), annualised volatility, alpha generation, Sharpe ratio, maximum drawdown, and upside and downside capture relative to the sector average.

The 10 percentile rankings for these metrics are then collated into an average percentile score for each fund; the lower the score, the stronger a fund has been across the board over the past three years.

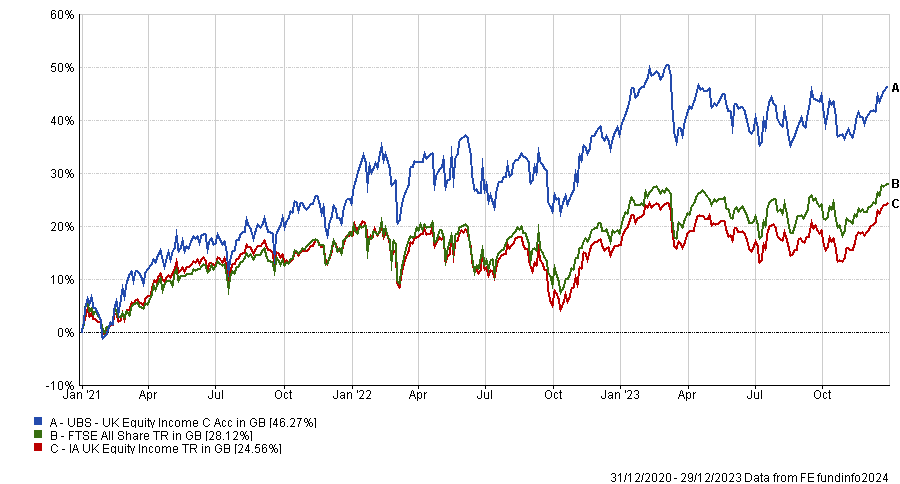

Performance of UBS UK Equity Income vs sector and index over 3yrs to end of 2023

Source: FE Analytics

With an average percentile score of 20.2, first place was taken by the £331m UBS UK Equity Income fund. It’s 46.3% total return is the peer group’s highest for the three years to the end of 2023 while it also the sector’s highest alpha and Sharpe ratio.

Managed by Steven Magill, Kevin Barker and Philip Haigh, the fund aims to generate income and outperform the FTSE All Share over the medium to long term (three to five years). Like many income funds, it has a value approach – a strategy which has paid off in recent years after a significant period of underperformance.

In last year’s interim report, the managers said: “While investors have become more sanguine about the outlook for interest rates and the global economy, we do believe that interest rates and inflation will remain elevated compared to the last five years for example. As such, we believe value should continue to outperform.”

As well as value approach, UBS UK Equity Income has a large-cap bias with its top holdings including FTSE 100 names such as Shell, AstraZeneca, BP, HSBC and Glencore. All five of these stocks – which are the fund’s largest positions – outperformed the FTSE All Share by a wide margin over period examined in this research; Glencore, for example, is up 147% compared with a 28.1% gain from the index.

The 25 funds in the IA UK Equity Income sector with the best average percentile scores can be seen the table below.

Source: FE Analytics

UBS UK Equity Income is not alone in using a strategy of investing in large-cap value stocks and achieving a strong average percentile score for the past three years.

Many of the funds in the table above have a similar preference, with well-known funds following this approach include BNY Mellon UK Income, Jupiter Income Trust, Schroder Income Maximiser, Royal London UK Equity Income, Schroder Income, HSBC Income, Fidelity Moneybuilder Dividend, Rathbone Income and, taking a passive approach, Vanguard FTSE UK Equity Income Index.

The outperformance of value has been a persistent theme in other sectors we’ve examined in this research this year. Growth investing had dominated the market for much of the post-financial crisis bull run but the surge in inflation and subsequent interest rate hikes after the Covid pandemic brought value to the fore; which style leads the next phase of the market is yet to be seen.

The effect of this has been compounded for equity income funds as many of the stocks with high yields – i.e. those that are most attractive to income investors – tend to fall into the value bucket.

Meanwhile, large-caps naturally pay out more dividends than their smaller peers thanks to their more stable businesses and need to satisfy bigger investors. Large-caps have outperformed in recent years thanks to worries over the health of the economy, which has benefitted funds holding larger companies.

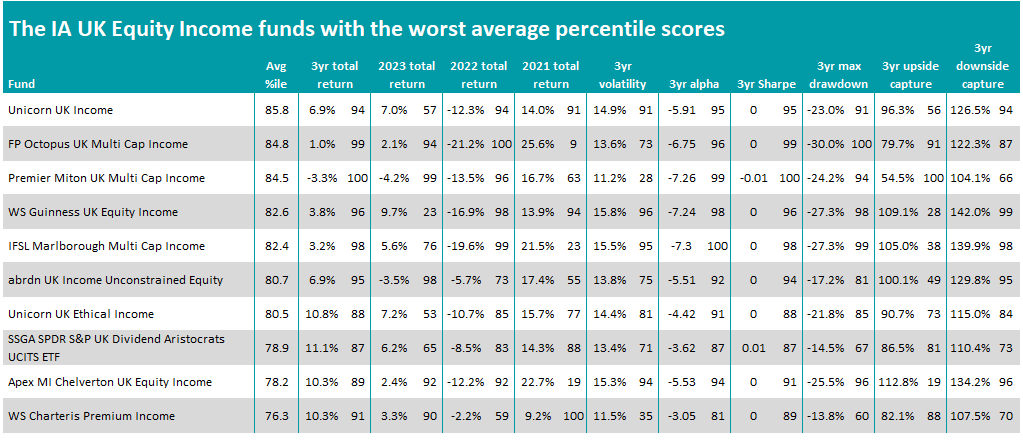

Source: FE Analytics

This is apparent when we look at the table of IA UK Equity Income funds with the lowest average percentile scores.

While many have a value bias, owing to this being the natural hunting ground for income investors, the likes of Unicorn UK Income, FP Octopus UK Multi Cap Income, Premier Miton UK Multi Cap Income and IFSL Marlborough Multi Cap Income focus on smaller companies.

This has led to periods of strong outperformance in the past, when investors were more confident on the economy and had stronger risk appetites, but has been a headwind in more recent times.

To see the previous articles in this series, please click here.