Liontrust Sustainable Future UK Growth and JOHCM Regnan Global Equity Impact Solutions are some of the ESG funds that investment firm 7IM has put at the core of its new range.

7IM has extended its ESG (environment, social and governance) offering with a new risk adjusted multi-asset range. Called Responsible Choice Model Portfolios, it comprises five portfolios with different risk categories ranging from cautious to adventurous.

The firm said that the range aims to provide a multi-asset option that also fully incorporates responsible, ethical and sustainable investment principles.

“Designed to help advisers provide the end solutions clients really want as the world moves towards a more sustainable future, the portfolios are focused on investments that score well on ESG factors and minimise exposure to controversial activities like armaments, tobacco and thermal coal,” it said.

“Managed by 7IM’s investment team, they also look beyond these factors, with a focus on investing in companies that can have long-term positive impacts on society and the environment.”

The new Responsible Choice Model Portfolios will follow the same strategic asset allocation (SAA) and risk management process as 7IM’s existing portfolios.

Manager Jack Turner explained that with the new multi-asset range the firm wanted to “invest in each part of responsible investment spectrum.”

Turner argued that investing in the different areas of responsible investing avoids the risk of the portfolios becoming too concentrated in just one part of the market.

Taking impacting investing as an example, he explained: “One problem with investing all of your portfolio in impact investments is your portfolio can become quite concentrated and you may get kind of some unintended consequences of that such as illiquidity, etc. That doesn't mean all impact stocks are illiquid or don’t have their issues, but it's something you have to keep in mind.

“We want to have flexibility about how much we invest to impact stocks and how much we invest in themes that we that we think are really important.”

He added that it was a minimum requirement for all the holdings and managers in the range to carry out some level of ESG integration.

With that in mind below Turner details some of the core funds in the new Responsible Choice Model Portfolios range.

Liontrust Sustainable Future UK Growth

First is Peter Michaelis and Martyn Jones’ Liontrust Sustainable Future UK Growth fund. Turner said that this was a “really good fund” and provides the range with UK exposure.

He added that it was also a “really good thematic fund and we thought was a really good way of getting access to kind of healthcare themes and financial resilience is another thing that they play”.

The £851.3m fund follows Liontrust’s ESG process, which looks for companies that have three characteristics: excellent management and core products or services that are making a positive contribution to society, strong growth prospects, and a business model that enables them to grow profitably from these trends.

Over the past five years it has made a total return of 83.26 per cent, beating the IA UK All Companies sector (42.38 per cent) and the MSCI United Kingdom benchmark (33.99 per cent).

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

The FE fundinfo Five Crown rated fund has an ongoing charges figure (OCF) of 0.87 per cent.

JOHCM Regnan Global Equity Impact Solutions

The next fund is a very recently launched option, but which Turner said was important for the range’s impact investing exposure.

JOHCM Regnan Global Equity Impact Solutions is a thematic portfolio aligned with the United Nations Sustainable Development Goals (UN SDGs). It aims to outperform by investing in companies that provide solutions to the ongoing and currently unmet needs of society and the environment.

Turner explained that the managers approach investing by asking questions like what are the issues in the world, have we got a solve for issues like clean agriculture, global warming and education across the world, and what companies are on the forefront of that?

“It's not a case of investing in, say, Google because they've got a small part of their businesses in some sort of education online. That doesn't qualify – it has to be the lion's share of the business profile and focused towards that solution.”

JOHCM Regnan Global Equity Impact Solutions is managed by Tim Crockford, who is head of equity impact solutions at Regnan, and Mohsin Ahmad.

Since launch it has underperformed both its sector and index, making a total return of 8.50 per cent.

Performance of fund vs sector and index since launch

Source: FE Analytics

It has an OCF of 1.11 per cent.

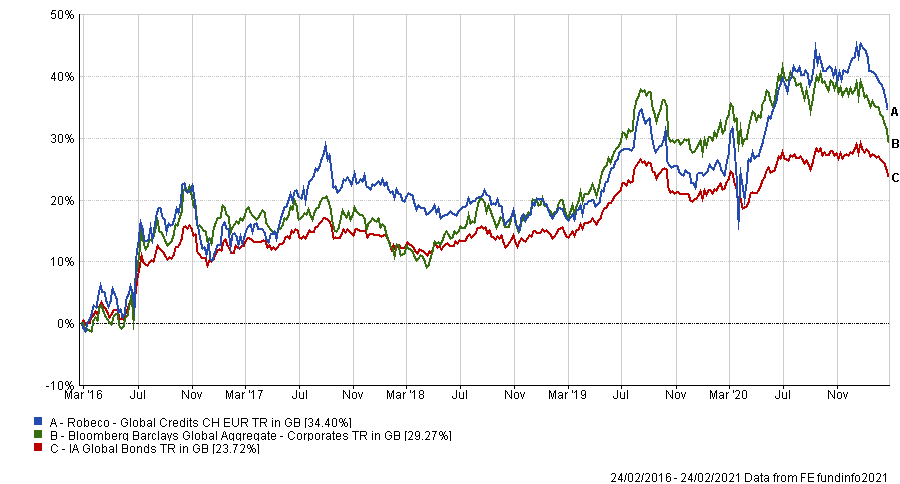

Robeco Global Credits

Next is the €2.4m Robeco Global Credits fund, run by FE fundinfo Alpha Manager Reinout Schapers and Victor Verberk.

“That's a good credit manager,” said Turner.

“We've got a relatively large global corporate allocation in the portfolios and Robeco is a very good manager in this space. There’s a long history of sustainable investing, really strong in engagement, scores very highly through organisations like the UN PRI and ShareAction.”

The fund aims to provide investors with higher yields than those offered by government bonds, but without the higher risk found in a pure, high-yield corporate bond fund. It creates some flexibility by also investing in the fixed income credit universe.

In a recent 2021 outlook, the managers said that while 2020 was one of many opportunities, “this year will be either boring or bearish”.

“There is hardly any room for aggressive tightening by central banks. At best, we will see some carry, roll down and certain sectors recovering from Covid-19. While there is something left on the table, it is not much,” they added

“We cannot afford to have policy errors, rising yields or inflation, nor any oil price, political or geopolitical shock. There is just not enough cushion left. We faced the same asymmetry this time last year. So, it will either be a boring year, with a small excess return, or a bearish one, should one of these events occur.”

The Luxembourg-domiciled fund has outperformed both the IA Global Bonds sector (23.72 per cent) and the Bloomberg Barclays Global Aggregate – Corporates index (29.27 per cent) over five years, with a total return of 34.40 per cent.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

It has an OCF of 0.61 per cent.

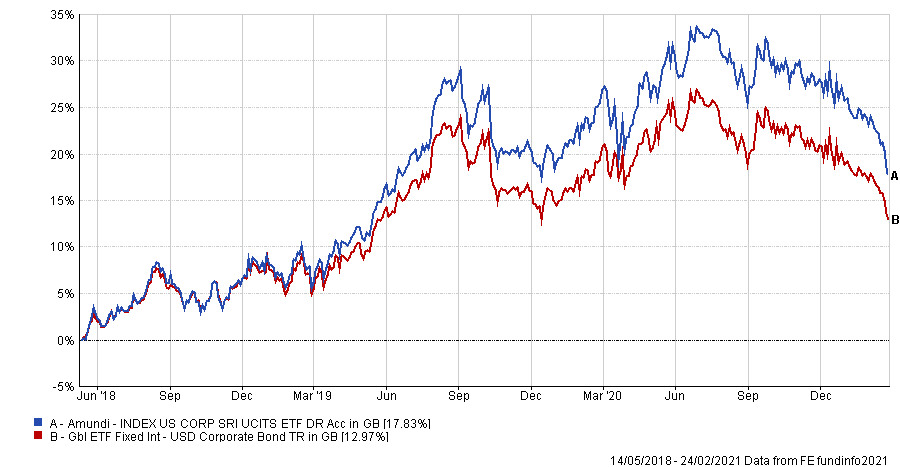

Amundi INDEX US CORP SRI

The final pick is a passive strategy. The Amundi INDEX US CORP SRI ETF looks to replicate the Bloomberg Barclays MSCI US Corporate ESG Sustainability SRI index’s performance.

Turner said: “The fund gives us good exposure to kind of some of the best companies within the US based on ESG ratings.”

The $471.7m ETF is overseen by Stéphanie Pless, head of fixed income index management, Laurent Caudamine and Fadil Hannane.

Performance of fund vs sector over 5yrs

Source: FE Analytics

It has an OCF of 0.16 per cent.