Investors should refrain from making any snap decisions about funds managed by Schroders’ Matthew Dobbs, experts say, after the asset manager announced the veteran investor would be retiring next year.

This week Schroders announced that Dobbs would be retiring from next year, after almost 40 years at the firm, with the transition of his funds to new management starting early in 2021.

Dobbs (pictured) is the manager of several Asian equity strategies – including the £1.3bn Schroder Asian Alpha Plus fund and £951.5m Schroder Asia Pacific investment trust – and small-cap strategies – the £136.2m Schroder ISF Global Smaller Companies and £172.1m Schroder Small Cap Discovery funds.

His Asian mandates – which also includes £717.4m Schroder Oriental Income investment trust – will be handed to colleague and collaborator Richard Sennitt, who will be supported by Abbas Barkordar.

Dobbs’ global and international small-cap strategies – which further includes the $103.2m Schroder ISF Global Emerging Markets Smaller Companies fund – will be taken on by Bob Kaynor, Luke Biermann and Alex Deane.

Such a carefully-managed transition, said Schroders, will ensure continuity for clients and demonstrate its commitment to promoting and supporting in-house investment talent, as well as showing the depths of its expertise.

Performance of Matthew Dobbs vs peer group composite since January 200

Source: FE Analytics

However, when the departure of a long-term and well-known manager is announced it can sometimes unsettle investors and pose the question of whether to stick with the new management or consider alternatives.

Andy Merricks, independent fund strategist and manager of the 8am Global fund, said that it would take something extraordinary for him to sell out of a fund just because of a manager change.

“As a rule of thumb, when a fund manager moves on for any reason other than fraud or malpractice I wouldn’t rush to sell out of the fund just because of a name change,” he explained.

“Much like in a football team, you’d expect any substitute to know how to fit in with the way the team plays, be fit and well-drilled and, who knows, may turn out to be better in time than the player that they’ve replaced.”

Refraining from making rash decisions when a manager leaves or, in this case, retires is something that FundCalibre managing director Darius McDermott believe is good advice.

He said: “Dobbs has obviously been instrumental in building an extremely successful Asian equity franchise for Schroders over more than three decades and his expertise will be a loss to the company and investors.

“However, his departure has been well sign-posted and there is a long handover period, so we don’t feel there is a need for a snap decision at this time.”

McDermott added: “Overall, we are neutral to positive on the plans Schroders has put in place and would encourage investors to take their time deciding too.”

Taking time to make a decision before redeeming from a fund is something that Tracy Zhao, investment research analyst at the Share Centre, agrees with, particularly given the notice given by the asset manager in making the transition to new management.

She said: “Investors should not be overly concerned or rush to leave the strategies, given the lengthy transition period provided, strong investment team in Schroder and carefully chosen successors.”

Zhao said Sennitt – Dobbs’ successor on the Asian equity mandates – has a “tremendous knowledge” about the Asia-Pacific region, which will be supportive of the strategies.

Indeed, FundCalibre’s McDermott said that given the close relationship between Dobbs and Sennitt – to the point where they have been acting as alternates on each other’s funds – demonstrates an understanding of the funds’ style and support continuity.

McDermott said when you compare the performance of Sennitt’s £1.2bn Schroder Asian Income fund with Dobbs’ Schroder Oriental Income trust. Over the length of Dobbs’ tenure Schroder Asian Income fund has actually outperformed, making a total return of 353.85 per cent versus the latter’s 311.77 per cent.

Performance of funds during Dobbs’ tenure

Source: FE Analytics

“So, investors in the trust may well want to stay put and see how it goes,” McDermott said.

Nevertheless, Dobbs has served his investors well over time, said independent fund consultant Merricks, with fairly consistent outperformance of the benchmark “without shooting the lights out”.

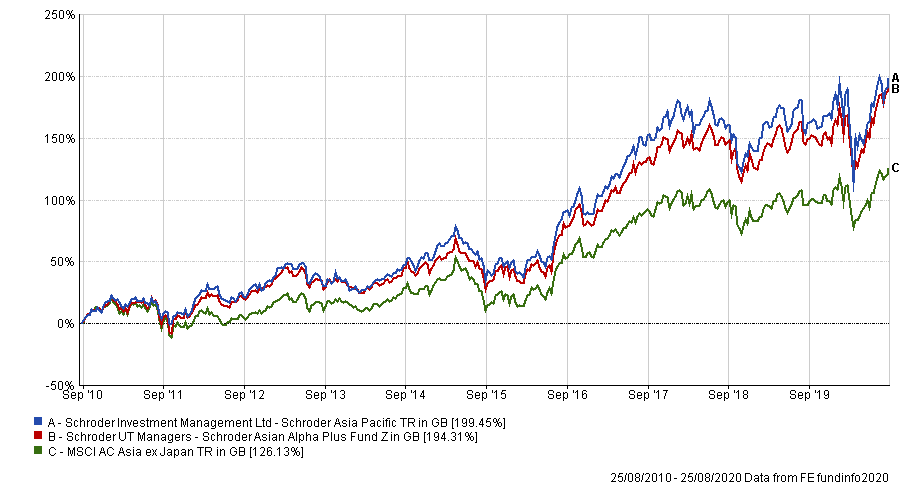

Looking at Schroder Asian Alpha Plus and Schroder Asia Pacific, both have outperformed over the long term.

Performance of funds vs index over 10yrs

Source: FE Analytics

The open-ended Schroder Asian Alpha Plus has made a total return of 194.31 per cent, while the Schroder Asia Pacific investment trust is up by 199.45 per cent compared with a gain of 126.12 per cent for the MSCI AC Asia ex Japan benchmark.