June appeared to be a turnaround month for some fund sectors, as what had flourished in May now languishes at the bottom of the returns table and vice versa.

Last month saw investors continue to put risk back on the table as many parts of the world continued to ease their lockdowns amid falling infection rates. Given this, June saw global equities and commodities make higher returns that defensive assets like government bonds and gold.

When it comes to how the Investment Association peer groups performed last month, the IA China/Greater China sector had the best performance for June with an average total return of 10.62 per cent.

Source: FE Analytics

The Chinese government launched a $500bn fiscal stimulus package last month and the country may now be feeling the positive effects of that, combined with its economy reopening from a prolonged lockdown period ahead of others.

This is despite China not announcing a target for its annual GDP growth for the first time in almost 20 years. This follow a contraction in the Chinese economy in the first quarter of 2020, the first time this has occurred since the country started reporting quarterly GDP in 1992.

Ben Yearsley, co-founder of Fairview Investing, said: “June was another risk on month with Asia and emerging markets firmly in the spotlight. China was the best performing fund sector, closely followed by Asia, emerging markets and more Asia.

“A multitude of factors is at play but having the virus early (and many countries handling it better) combined with much better debt and demographic numbers are all relevant to investment markets.”

Source: FE Analytics

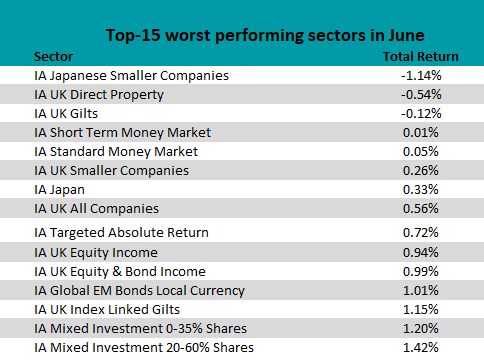

At the other end of the table, the IA Japanese Smaller Companies sector was the worst performer in June as its average member made a loss of 1.14 per cent. It was the only equity sector to post a negative return in June and is a reversal from May, when it was the best-performing sector.

The IA Japan sector also featured low down the table with an average return of just 0.33 per cent.

Another poorly performing sector was IA UK Smaller Companies, which had a total return of 0.26 per cent. Although a large number of non-essential UK businesses were allowed to reopen in June the country remains under lockdown – with some easing – and remains persistently unpopular with investors.

Yearsley said: “It’s difficult to know whether to be optimistic or pessimistic about markets, however despite some new lockdowns and partial closures of UK, Germany and the US, developed world markets seem to have moved out of the coronavirus funk recording some of the best quarterly returns on record.”

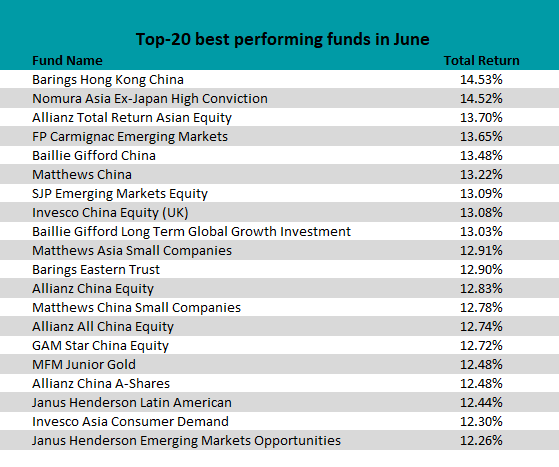

Moving onto the individual funds and the sector story is very much reflected as China focused portfolios dominated the top of the table.

Source: FE Analytics

The best performing strategy overall was the $1.5bn Barings Hong Kong China fund, which is co-managed by Nicola Lai, William Fong and Titus Wu. It made a total return of 14.53 per cent in June.

Its manager use an all-cap process to invest in what call a ‘flexible investment universe’, which covers domestic Hong Kong listed, onshore Chinese (A-shares), Taiwanese and multinational companies with significant exposure to China.

Other high performing funds that focus on this part of the world included GAM Star China Equity (12.71 per cent), Allianz China Equity (12.83 per cent) and Invesco China Equity (UK) (13.08 per cent), to name a few.

Breaking up the top performing China funds are numerous emerging market funds, namely driven by a strong performance from Brazil.

Brazil is the largest and most liquid market in Latin America, making up more than 60 per cent of the MSCI Emerging Markets Latin America index, which outperformed the MSCI World index in June. But MSCI Brazil beat both of these broader indices in June with a 7.45 per cent return.

Coming into the crisis, Brazil had strict statutory limitations on fiscal spending had to be overcome. But the country announced a $30bn fiscal stimulus package in March while last month Congress granted the Banco Central do Brasil (BCB) crisis powers which would allow it to buy a range of private and public assets to shore up on liquidity.

This strong performance in Brazil shown through funds like FP Carmignac Emerging Markets (13.65 per cent) and Janus Henderson Latin America (12.44 per cent) funds featuring amongst the top performers.

Source: FE Analytics

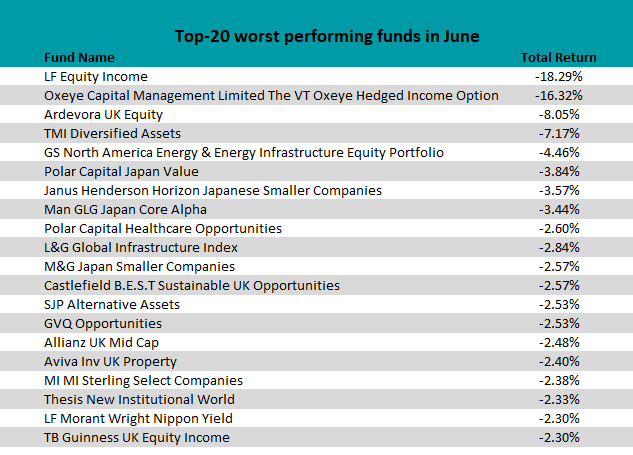

At the bottom of the funds table, however, is the stricken LF Equity Income fund - formerly LF Woodford Equity Income – which made a loss of 18.29 per cent in June.

Last year, the investment firm and fund that carried manager Neil Woodford’s name was closed following a period of disappointing performance, a flurry of redemption requests and concerns over illiquid holdings.

It was handed over to BlackRock and brokerage Park Hill by administrator Link Fund Solutions. Park Hill wrote to investors last week after an agreement to sell a significant portion of the remaining assets in the LF Equity Income fund was reached.

Adrian Lowcock, head of personal investing at Willis Owen, said: “The sum is below the $300m that was speculated, and only accounts for about 50 per cent of the market value of the fund as of 3 June.

“Rather disappointingly there is no detail on what was sold, for how much and what the losses were on those investments. Investors should be given an idea of what the costs incurred for this deal are and what they could expect to see back. It would also help to have an update on the progress with the remaining investments, but these are most likely the ones that the fund will find hardest to sell.

“Investors should find out by the end July how much they can expect to get paid in the third distribution and when that will be paid to them, possibly in August.”

Lowcock added: “It is frustrating for investors in Woodford, but unfortunately winding up funds is a messy business, especially when it involves illiquid assets at a time when the UK faces the deepest recession in history.”

Other funds at the bottom of the table reflected the sector pattern of Japan and UK underperformance, with funds such as Polar Capital Japan Value, M&G Japan Smaller Companies, Ardevora UK Equity and Aviva Inv UK Property all making a loss in June.

It’s worth noting that, on the fund side specifically, those with a value investment bias fared worse off as the gap between value and growth continues to widen with growth continuing its outperformance after another rally.

Indeed, comparing the two throughout 2020 so far and MSCI World Growth index has made a total return of 13.39 per cent, whereas the MSCI World Value index has made a loss of 12.03 per cent.