Luck and consistency is one of the main balancing acts fund managers have to navigate, and something the great ones have mastered, according to FundCalibre managing director Darius McDermott.

“Finding the best fund managers is both a science and an art form,” McDermott explained. “You need experience and gut feel when you interview a manager about their process and philosophy, and you need the data to tell you whether they have been consistent or merely lucky.

“It’s not easy, but when you find those managers, they can make a huge difference to your finances.”

Below, McDermott highlights 10 managers who have bested all their peers since their tenure began.

LF Miton European Opportunities

First up is the £1.2bn LF Miton European Opportunities fund, managed by Carlos Moreno and Thomas Brown since late-2015.

Making a total return of 136.30 per cent during the managers’ tenure, the fund has beat the 105-strong IA Europe Excluding UK peer group, which has made an average return of 47.90 per cent .

Performance of fund vs sector & benchmark under managers

Source: FE Analytics

The five FE fundinfo Crown rated-fund aims to achieve a combination of both income and growth by investing across the market-cap space, but with a bias towards mid-cap companies.

“The managers look for quality companies, with strong clear brands or clear competitive advantages,” McDermott said.

LF Miton European Opportunities has ongoing charges figure (OCF) of 0.84 per cent.

Schroder Asian Alpha Plus

Next up is the £1.1bn Schroder Asian Alpha Plus fund whose manager – Matthew Dobbs – McDermott praises as: “highly experienced and able to utilise Schroder's vast analyst resource in the region”.

Having worked and managed Asian equity portfolios since 1985, for this fund Dobbs runs a ‘flexible mandate’ investing in 50-70 companies with a bias towards large-caps.

Under Dobb’s management the fund has made a total return of 233.37 per cent, besting its IA Asia Pacific Excluding Japan peer group (113.39 per cent) and the MSCI AC Asia ex Japan index (123.98 per cent).

The four FE fundinfo Crown rated-fund has an OCF of 0.94 per cent.

Guinness Global Equity Income

Made up of 35 stocks valued at over $1bn, Guinness Global Equity Income has been managed by both Matthew Page and Ian Mortimer since end-2010.

During that time, the fund has made a total return of 158.29 per cent, outperforming the IA Global Equity Income sector average return (100.46 per cent). However, both fund and sector average have underperformed the MSCI World benchmark, which is up by 163.64 per cent.

Performance of fund vs sector & benchmark under manager

Source: FE Analytics

The $1.2bn fund holds stocks on a three-to-five year view with the pair having “substantial freedom to entirely avoid countries and sectors they don't like,” according to McDermott.

It has an OCF of 0.85 per cent.

First State Greater China Growth

Martin Lau is next up with the £507.8m First State Greater China Growth fund which he has run since end of 2003.

An FE fundinfo Alpha Manager, under Lau’s tenure the fund has made a total return of 960.35 per cent, outperforming both the IA China/Greater China sector (480.93 per cent) and the MSCI Golden Dragon benchmark (428.34 per cent).

Performance of fund vs sector & benchmark under manager

Source: FE Analytics

“Martin has consistently delivered positive performance and demand for the fund was so fierce that it was closed to new investments for four years,” McDermott said.

The five FE fundinfo Crown rated-fund has an OCF of 1.07 per cent.

Baillie Gifford Japanese Smaller Companies

The next manager is Praveen Kumar whose £877.1m Baillie Gifford Japanese Smaller Companies fund, which has beaten its seven peers to generate the best returns since the manager’s start date in late-2015, a total return of 105.69 per cent.

The IA Japanese Smaller Companies peer group made (73.19 per cent) and the MSCI Japan Small Cap index (52.00 per cent).

It has an OCF of 0.62 per cent.

Jupiter Strategic Bond

McDermott’s next manager is Ariel Bezalel who manages the £4.2bn Jupiter Strategic Bond fund, a “flexible ‘go-anywhere’ fund” invesing across global bond markets.

“Ariel is quite cautious in his approach and tries to limit potential losses in tough markets ,” McDermott said.

Since Bezalel took over the fund in mid-2008 it has made a total return of 132.53 per cent, almost doubling the IA Sterling Strategic Bond peer group’s 76.97 per cent gain. Jupiter Strategic Bond fund has an OCF of 0.73 per cent.

MI Chelverton UK Equity Growth

The £601.8m MI Chelverton UK Equity Growth fund has been managed by James Baker since 2014 with what McDermott called “a comprehensive and disciplined process”.

Having joined Chelverton Asset Management in June 2014 to manage this fund Baker has over 30-years’ experience investing in UK small- and mid-cap companies, which this fund has a bias towards.

Performance of fund vs sector & benchmark under manager

Source: FE Analytics

Under Baker the fund has made a total return of 140.48 per cent, significantly outperforming the 222-strong IA UK All Companies peer group average (31.82 per cent). The fund has an OCF of 0.9 per cent.

LF Gresham House UK Multi Cap Income

Next on the list is £64.7m Ken Wotton’s LF Gresham House UK Multi Cap Income fund, the only fund McDermott highlights with less than £100m in assets under management (AUM).

A concentrated, multi-cap income portfolio Wotton focuses the fund on small caps, an area both he and co-manager Brendan Gulston believe there is both strong income growth and sustainable earnings to be found.

Having managed the fund since launch in summer 2017 it has made a total return of 20.58 per cent, outperforming the IA UK Equity Income sector which has made a loss of 11.17 per cent. LF Gresham House UK Multi Cap Income has an OCF of 0.89 per cent

Marlborough Special Situations

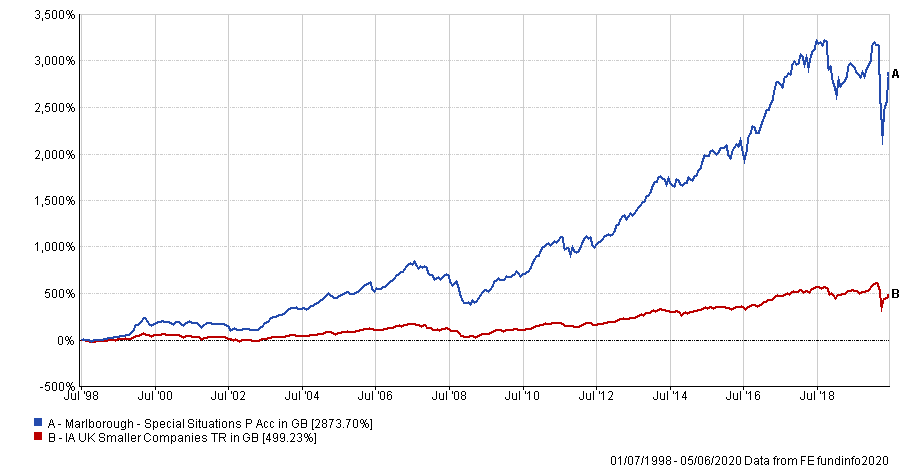

Penultimately is Giles Hargreave’s £1.2bn Marlborough Special Situations fund, who McDermott calls both an “astute and [a] pragmatic stockpicker”.

Focusing on the small- and mid-cap space, the FundCalibre managing director said the FE fundinfo Alpha Manager’s process “has held up well across a wide range of market conditions and the long-term track record of this fund is exemplary”.

Performance of fund vs sector & benchmark under manager

Source: FE Analytics

Under Hargreaves’ 22-year tenure Marlborough Special Situations has made a total return of 2,873.70 per cent, outperforming the IA UK Smaller Companies sector average (499.23 per cent). It has an OCF of 0.78 per cent

European Opportunities Trust

Last on the list is European Opportunities Trust, which has been run by former Jupiter manager Alexander Darwall of Devon Equity Management since the turn of the century.

With total assets of £1.1bn the four FE fundinfo Crown-rated investment trust has made a total return of 755.91 per cent. In comparison, its IT Europe peer group has made an average return of 332.31 per cent, while the MSCI Europe index was up by 130.70 per cent.

The trust is currently trading at a 5.6 per cent discount to net asset value (NAV), is 8 per cent geared, has a dividend yield of 0.7 per cent, and ongoing charges of 0.90 per cent as at 8 June.