Emerging market equities – especially China – generated the highest returns in the fund world during January, as 2021 got off to a sluggish start after two straights months of market rallies.

While some individual stocks experienced dizzying jumps thanks to the Reddit ‘short squeeze’, January brought relatively muted gains in the Investment Association universe as the UK and other countries tighter restrictions in response to new coronavirus variants.

The average fund made a loss in 28 of the 39 Investment Association peer groups in January, after many developed market stock markets trended downwards. Emerging markets, however, had a stronger month.

Ben Yearsley, investment consultant at Fairview Investing, said: “After the euphoria of ‘Vaccine November’ and ‘Brexit Deal December’, January has turned into a damp squib.

“Despite the frankly astonishing pace of vaccinations in the UK, worries have resurfaced around Covid variants and the impact of lockdowns on the economy. Markets have just been a bit lacklustre rather than having a full-on panic moment like last March. The only real excitement has been the day trading frenzy of the last week in the US, which will undoubtedly end in tears.”

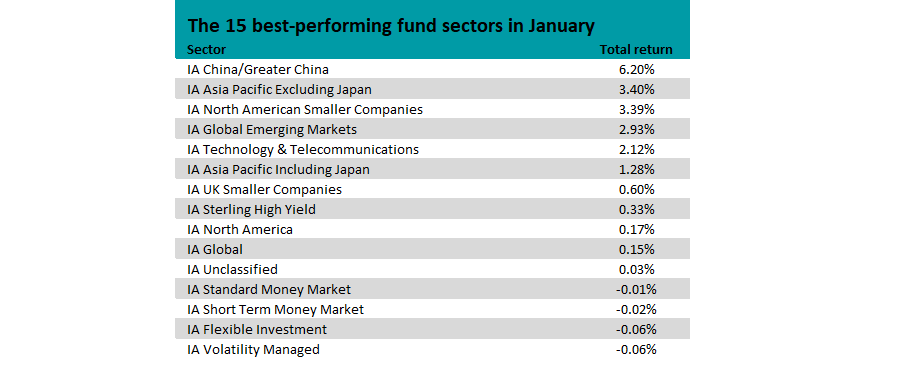

Source: FE Analytics

The table above shows how the month played out in the Investment Association sectors, with IA China/Greater China coming out on top with an average total return of 6.4 per cent.

Asian equity and global emerging markets sectors are also well represented on the list. While one month is a very short time frame, these areas have tended to lag behind the likes of the US for most of the past decade.

“The start of the year won’t necessarily set the market trend; however, I do think Asian markets are well set for a prolonged period of outperformance,” Yearsley said.

“Better handling of Covid, lower debt levels, good demographics and some world-leading companies make for an exciting combination. Obviously, the path won’t be smooth but after a long period of dominance by the US and their tech leaders, is it time for a market shift?”

The worst performing sector of January was IA UK Index Linked Gilts, where the average fund made a 2.81 per cent loss. The next worst performers were IA Global EM Bonds Local Currency (down 1.99 per cent), IA Europe Excluding UK (down 1.82 per cent), IA UK Gilts (down 1.75 per cent) and IA Japan (down 1.50 per cent).

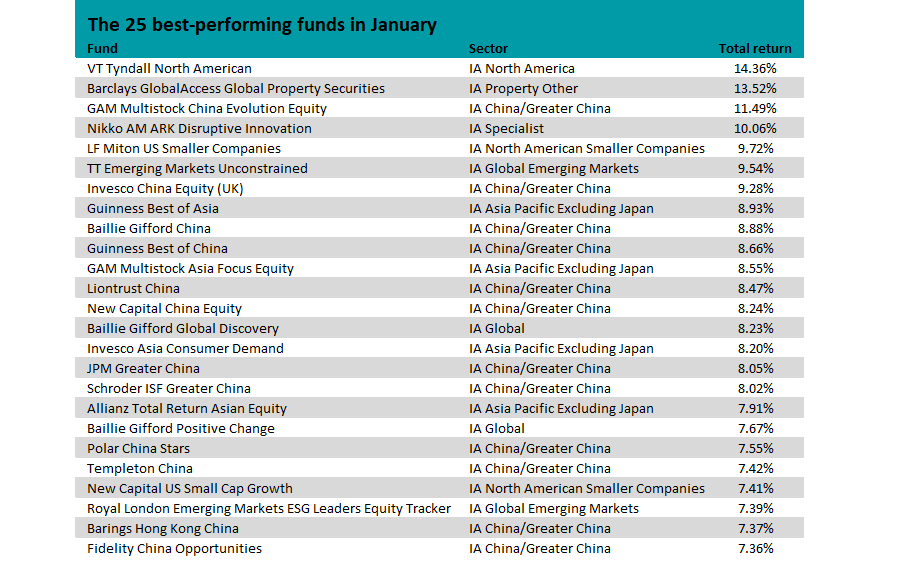

Source: FE Analytics

January’s highest-returning fund from the entire Investment Association universe was VT Tyndall North American, with its 14.36 per cent total return.

Headed up by Felix Wintle, the £35.7m fund was aided by owning GameSpot. This stock was the initial focus of the ‘short squeeze’ by retail investors on social media platform Reddit. The video games retailer’s shares have jumped 1,700 per cent since December after massive levels of buying by private investors.

“The extraordinary performance saw [VT Tyndall North American] beat the S&P by 15 per cent in a single month,” Yearsley said.

“Now luck, as well as judgment, often plays its part in fund management; the luck is often down to timing, which was definitely in Felix’s favour in January. He bought GameStop in December as a three-year turnaround story and sold it last week more than achieving his price target without any need for the business to turn around.”

Two other US funds are among the top 25 best performers in January (Premier Miton US Smaller Companies and New Capital US Small Cap Growth) but the list is dominated by Chinese equity funds.

Strong returns came from the likes of GAM Multistock China Evolution Equity, Invesco China Equity (UK), Baillie Gifford China, Guinness Best of China and Liontrust China, all of which made more than 8 per cent.

While it is one of the smaller sectors in the Investment Association universe, IA China/Greater China was one of the strongest performers last year.

Although the Covid-19 virus was first spotted in China, the country was the first to lock down and the first to open up its economy, while keeping the outbreak under control. This meant the country was one of the few to achieve positive economic growth in 2020 and is expected to expand by more than 8 per cent this year.

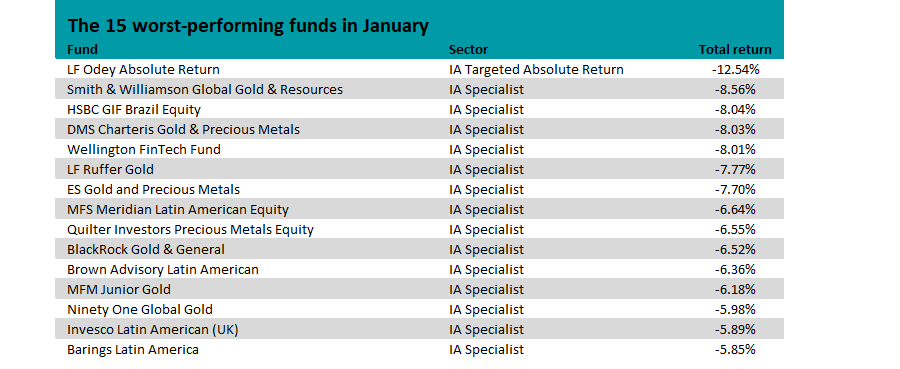

Turning to the bottom of the table and the biggest loss of January came from LF Odey Absolute Return, which was down more than 12 per cent.

Source: FE Analytics

The fund made close to 30 per cent in 2020 – the highest return of the IA Targeted Absolute Return sector – but some of its largest holdings like AO World, EasyJet and IAG suffered heavy falls in January.

The standout trend of last month’s worst performers, however, is that the list is dominated by gold and Latin American equity funds.

Gold opened the month just below the $1,900 level, rose briefly to hit $1,954 before ending January at $1,850, while a more infectious coronavirus variant was discovered in Brazil, prompting further restrictions and weakened investor sentiment.