The latest rebalance of the FE fundinfo Crown Ratings have seen 16 new funds wine the highest rating at their first time of asking while strategies using environmental, social and governance (ESG) investing have come out well.

The FE fundinfo Crown Ratings are designed to help investors to distinguish between funds that have strongly outperformed their benchmark over the past three years and those that have not. Rebalanced in January and July, they take into account three key measurements of a fund’s performance: alpha, volatility and consistently strong performance.

The top 10 per cent of funds are awarded five FE fundinfo Crowns, the next 15 per cent receive four Crowns and each of the remaining three quartiles are given three, two and one Crown(s) respectively.

FE fundinfo’s analysts have just rebalanced the rating to include the second half of 2020, when markets continued their rally from the coronavirus pandemic.

During this time, some 85 funds hit their three-year anniversary and became eligible for an FE fundinfo Crown Ratings. Of these, 16 were handed the top rating of five – which can be seen below.

Source: FE fundinfo

Charles Younes, research manager at FE Investments, highlighted LF Blue Whale Growth as a fund that is “definitely one to keep an eye on”. Since launch in September 2017, the fund has made a top-decile 78.79 per cent total return, compared with 42.65 per cent from its average IA Global peer.

Younes added: “The manager, Stephen Yiu, along with his deputy Daniel Allcock, have adopted a similar successful approach to Terry Smith and performed admirably, returning more than 17 per cent over the past year in very challenging conditions."

Terry Smith, one of the best-known investors in the business, also has a fund receiving five crowns in its first rating: Fundsmith Sustainable Equity. This joins his flagship Fundsmith Equity fund in holding the top rating.

The inclusion of this fund highlights another trend seen in this rebalance of the ratings – the strong performance of ESG strategies.

While the coronavirus crisis of 2020 put some sectors under intense pressure, especially the likes of energy, travel and hospitality, others prospered.

ESG investing hit the mainstream in 2020 and ethical/sustainable funds were some of the best performers in the Investment Association universe and this was reflected in the crown rebalance.

Almost one-fifth of all the ethical and sustainable funds that were eligible for a rating were awarded five crowns. They now account for 8.44 per cent of all five-crown rated funds, despite ethical and sustainable funds comprising just 5.04 per cent of the total 3,255 funds that were considered.

Oliver Clarke Williams, portfolio manager at FE Investments, said: “There is no doubt that ESG investing has really taken off in the past year. While global lockdowns have had a huge impact on markets and traditional stocks have suffered, ESG funds have seen record inflows and increasing investor attention.

“Their success is reflected in our latest crowns rebalance, where they now make up a significant proportion of the best performing funds. We expect this trend to continue in 2021 with new regulations coming into play, meaning funds will have to be more transparent with their ESG disclosures. Fund groups will increasingly direct their efforts and resources into making their investments more sustainable in the long term.”

Across the entire rebalance, 72.6 per cent of funds saw no change in their FE fundinfo Crown rating, while 23.6 per cent were promoted or demoted by just one crown.

There were few extreme moves – only two funds jumped from one crown to five (Aberdeen Standard SICAV I Global Innovation Equity and NB Corporate Hybrid Bond) and nine funds dropped from five crowns to one.

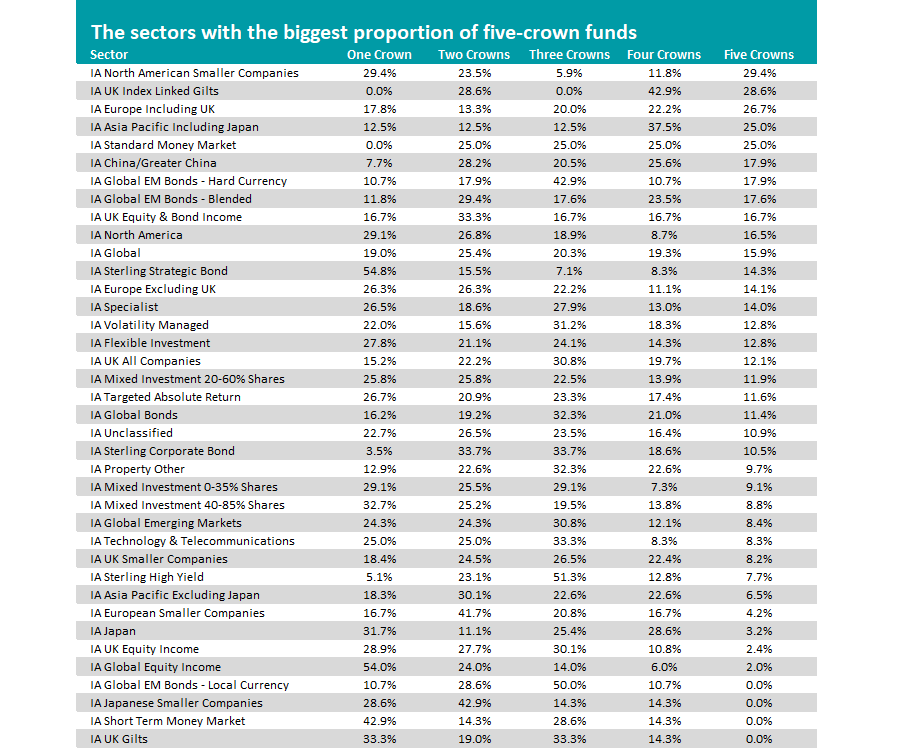

When it comes to the individual peer groups, the strong performance of US equities throughout 2020 means the IA North American Smaller Companies sector has the highest concentration of five-crown funds. Some 29.4 per cent of its members won a top rating, followed by IA UK Index Linked Gilts (28.6 per cent) and IA Europe Including UK (26.7 per cent).

Source: FE fundinfo

As the chart above shows, the heavy dividend cuts of 2020 meant income-focused funds suffered with just 2 per cent of IA Global Equity Income and 2.4 per cent of IA UK Equity Income funds holding five crowns.

But as can be seen, there are four sectors were not a single member was awarded the top rating.

FE Investments’ Younes said: “2020 was for many a year of home-working, which brought about rapid change within the markets and clearly defined the winners and losers in the new Covid-19 environment. Funds invested in technology stocks reaped the benefits, while those in traditional sectors such as energy and financial services not only suffered from the great sell-off in March last year, but also failed to capture the upside.

“Looking forward and with the prospect of huge stimulus packages being delivered at policy level, we can expect to see those funds with positions in infrastructure and technology to continue to perform well, while the recovery for traditional stocks will continue to lag.”