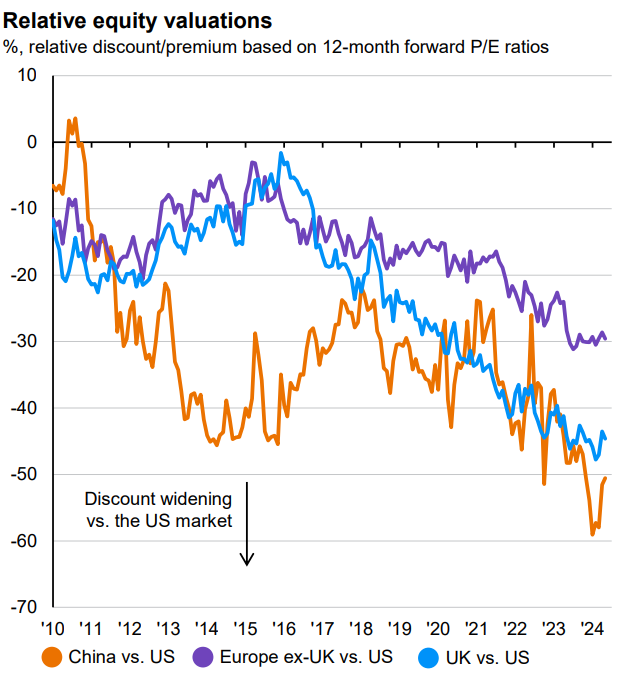

European equities have been unloved for some time, making almost a third of the returns of their US counterparts over the past decade. As a result, Eurozone stocks are trading at a 20-30% discount to the US.

This is despite recent strong performance. Over the past six months the Euro Stoxx index has been the best major equity market, up some 19.2%, pipping the S&P 500 by 2.5 percentage points.

It raises the question of whether investors should dive into the resurgent market while they can still take advantage of the relatively attractive valuations on offer.

Sources: JP Morgan Asset Management, FTSE, IBES, LSEG Datastream, MSCI, S&P Global, data to 6 May 2024

Some, but not all, of the valuation gap can be explained by the American economy’s greater productivity and the US market’s larger weighting to tech stocks, said Niall Gallagher, manager of GAM Star European Equity. US companies spend twice as much as their European peers on capital expenditure and research and development (as a percentage of cash flow), he added.

Meanwhile, war in Ukraine has weighed upon the European market and China’s slowdown (European stocks rely heavily on exporting to Asia) has impacted some companies heavily.

However, with inflation coming down, energy prices cooling, rate cuts on the horizon and China starting to recover, the stage may be set for a European resurgence.

Trustnet asked some of the best-performing European equity managers, all of whom have been nominated for the FE fundinfo Alpha Manager of the Year awards, whether this a good time for investors to shift focus from the new world back to the old.

Europe is well placed to benefit from a near-term cyclical upswing

Frederic Jeanmaire, manager of the CT Pan European Focus fund, thinks many of the tailwinds holding Europe back for the past couple of years are dissipating.

“Interest rate rises that followed the inflationary impact of the Ukraine war are petering out, energy prices have fallen from their peaks and inflation is coming under control faster than in the US,” he said.

John Bennett, who manages Janus Henderson Investors’ Pan European and Continental European strategies, agreed. “In the near term, Europe as an export-oriented group of economies is coming back in favour, as the interest rate cycle is about to turn and macroeconomic lead indicators are improving,” he said.

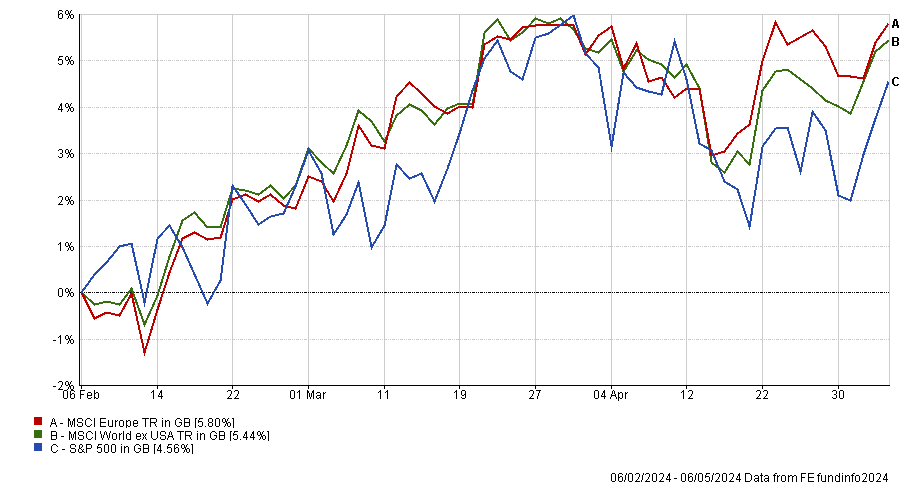

“Europe is an early cycle trade. It shows in stock performance. European equities versus the S&P 500 are on fresh three-month relative highs. Europe is making multi-year highs versus the MSCI World ex-US index. After almost two years of steady outflows from Europe, the region is beginning to see inflows again.”

Indeed, UK investors ploughed £471m into European equity funds in April 2024 alone, Calastone’s Fund Flow Index found.

Europe vs S&P 500 and MSCI World ex-US over 3 months

Source: FE Analytics

Giles Rothbarth, who manages the BlackRock European Dynamic and BlackRock Continental European funds, also believes Europe could be about to experience a “near-term cyclical upturn”.

“The European equity market today provides the broadest opportunity set we’ve seen in decades – benefitting from a diverse range of themes, such as innovations in health care, energy efficiency and the growing need for higher compute power,” he noted.

“We believe European companies are well positioned to benefit from improving capital expenditure and investment. We can observe this in growth forecasts, with earnings expected to accelerate – a trend happening in end markets that have been depressed due to market shocks in recent years.”

Deglobalisation could play to Europe’s strengths

Two related factors driving that growth are onshoring and fiscal spending. Deglobalisation has already sparked a record amount of fiscal spending in the US and this is likely to continue as geopolitical tensions persist.

Bennett thinks this trend will create opportunities for stock pickers. “Enablers of deglobalisation (think industrial automation, digitalisation, electrification and construction materials firms) could thrive,” he said.

“We could also see a political shift in favour of populist/pro-labour policies, from both traditional 'left' and 'right' ends of the political spectrum. This could mean stronger wage inflation and greater labour market friction.”

These forces, as well as higher borrowing costs, are creating an environment where the strong are likely to get stronger. “Large incumbents across many industries (such as brewing, food catering and enterprise software) could see their already dominant positions enhanced as the end of virtually 'free' money tempers the threat of disruption by unprofitable start-ups,” Bennett said.

Old world stocks possess unrivalled heritage

Franz Weis, manager of the Comgest Growth Europe Compounders fund, thinks that focusing on Europe’s relatively cheap valuations is missing the point – the quality and long-term heritage of Europe’s companies are what makes them so attractive.

“The beauty of Europe is the heritage of its companies and the quality which often comes with it. The companies we’ve assembled in Comgest Growth Europe Compounders fund are on average 130 years old,” he explained.

“It is very difficult to find such companies in the much younger emerging markets and even in the bigger US market, which is dominated by the comparatively young tech industry. Even Microsoft, one of the oldest tech companies, is only 49 years old.”

Some of the world’s strongest consumer and luxury brands are based in Europe, including Hermès (founded in 1837) and Ferrari (founded in 1939). Both of these companies are unique, he said. “They keep supply tight, have a strong new business pipeline and continuously develop their brands with a long-term view.”

Another example is the high tech and precision engineering industry. “You can find a lot of gems in Europe built on a strong heritage and protected by strong moats. Carl Zeiss is a company which is 208 years old and has developed unique precision optical technology for centuries,” Weis said.

“Carl Zeiss also delivers high precision optics to ASML, the Dutch giant supplying the lasers crucial for global semiconductor manufacture, allowing it to do EUV lithography.”

Jeanmaire concurred. Within industrials and aerospace, Airbus is an example of “European know-how leading to long-term enduring competitive advantage,” he said.

“Europe also contains several outstanding consumer goods brands distributing their product globally. Inditex, the owner of Zara, boasts strong brand and supply chain advantages over its competitors,” he added.

Three reasons to buy Europe

Gallagher also said there are plenty of reasons to invest in Europe other than attractive valuations.

First, “there is a greater sectoral diversity across European stock markets in contrast to the US where technology is so dominant,” he said. Second, “Europe could be said to have a more value bias, such that if the markets shift towards a less benign global growth outlook, value could come back into favour.”

And finally, European companies offer greater geographical diversity. They earn half their revenues from outside of Europe on average and have more exposure to Asia than US companies.