A new company has entered the list of the UK’s 10 most shorted stocks: Keywords Studios, which provides creative services to the video games industry, including art and audio recording.

GLG Partners, Gladstone Capital Management, Marble Bar Asset Management and SFM UK Management are all betting against the stock, according to the Financial Conduct Authority.

Keywords Studios’ share price fell off a cliff last year. Although it started to recover in late December and January 2024, it subsequently resumed its downward trajectory, as the chart below shows.

Share price performance over 5yrs

Source: FE Analytics

The Hollywood actors’ strikes dealt a $20m or 2.6% blow to Keywords Studios’ revenues last year.

Currency fluctuations also had a negative impact on revenues. Keywords Studios was established in 1998 in Leopardstown, a suburb of Dublin, but it has grown by acquisition and now operates in 26 countries. It completed five acquisitions in 2023 alone.

Fears that artificial intelligence might disrupt Keywords Studios’ business also weighed on the share price.

Despite all of these factors, the company’s annual results, announced in March 2024, were upbeat. Chief executive officer Bertrand Bodson said: “In what was a difficult year for the industry, we delivered resilient performance in 2023 and we continued to grow our market share and industry leadership position.”

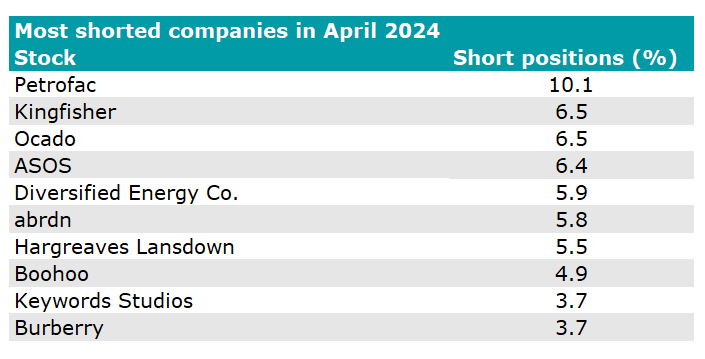

It joins long-time targets abrdn and ASOS among the 10 most shorted UK-listed companies, while Petrofac remains the most shorted stock, as the below table shows.

Source: Financial Conduct Authority