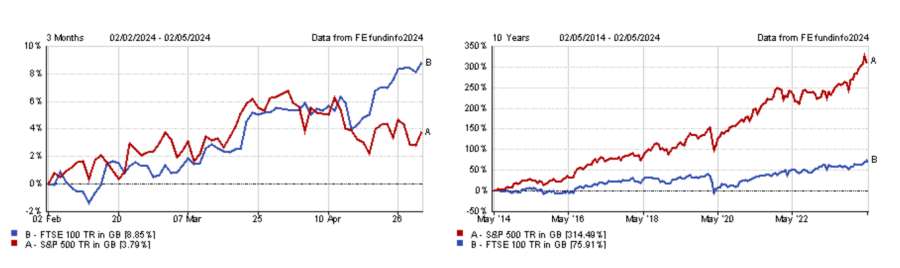

UK equities are having their moment in the sun, with the FTSE 100 recently reaching an all-time high and even outperforming the mighty S&P 500 over the past three months.

Although the UK stock market continues to grapple with a range of structural issues, the recent strong performance may herald brighter days for London-listed equities.

Danni Hewson, head of financial analysis at AJ Bell, said: “Can the FTSE 100’s run of form continue? Can the current momentum tempt more companies and more investors to look again at London?

“It seems churlish to speak of the woes the index has struggled with when there’s such optimism in the air, but there’s no better time to fix the roof than when the sun is shining.”

Performance of indices over 3 months and 10yrs

Source: FE Analytics

Signs of improvements in the UK economy may explain this recent exuberance, but the FTSE 100’s sectoral makeup – rich in energy, resources, pharmaceuticals and banking stocks – also played a role. This mix offers investors support during economic downturns, periods of uncertainty and times of risk aversion.

Jason Hollands, managing director of Bestinvest, said: “Other factors driving the FTSE 100 bounce are perhaps less cheery in nature. Heightened tensions in the Middle East with the risk of a regional war between Iran and Israel breaking out imminently, have propelled both oil and precious metal prices higher.”

The FTSE 100 also exhibits less sensitivity to the ‘higher for longer’ narrative that has recently resurfaced regarding interest rates.

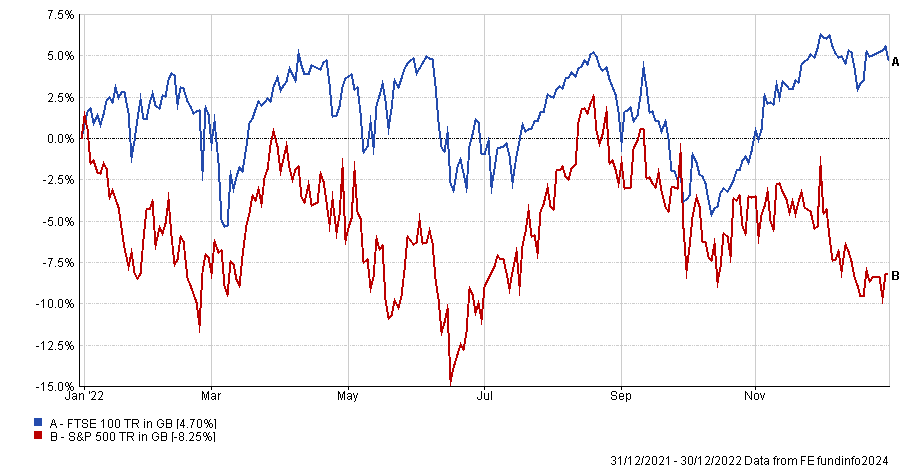

The UK blue-chip index already showed its ability to cope with higher interest rates in 2022 when it held its ground as inflation surged dramatically, forcing central banks to hike rates several times. In contrast, the US market, rich in long-duration stocks (such as the tech names), experienced a significant downturn.

Although rate hikes are still seemingly off the table, rate cut expectations have been tempered dramatically since the start of the year.

Dan Coatsworth, investment analyst at AJ Bell, explained: “Higher rates are negative when calculating the present value of future cash flows – put simply, investors suddenly lost their appetite for ‘jam tomorrow’ stocks and instead became hungry for ‘jam today’ stocks where the equity story is about making profits in the here and now, not about the sharp increase in profits expected in the future.

“The FTSE 100 has lots of ‘jam today’ style names such as tobacco producers and consumer staple businesses, hence why the UK market in this situation suddenly became more attractive than the US.”

Performance of indices in 2022

Source: FE Analytics

However, Rob Morgan, chief investment analyst at Charles Stanley, noted that this lack of ‘jam tomorrow’ in structural growth areas as well as the overrepresentation of economically sensitive sectors in the index could become a headwind if interest rates fall “in a more rapid and synchronised fashion than anticipated”.

As approximately three quarters of the index constituents earn revenue outside the UK, he also noted that a strong pound would negatively impact FTSE 100 companies with international operations. However, he stressed that a strong currency would also have positive implications for the domestic economy.

Bargain opportunity or value-trap?

Despite the recent outperformance, the FTSE 100 remains cheap compared to indices from other developed markets, which may be of interest to bargain investors.

Hollands said: “Although the UK’s blue-chip index is near a record high in point terms, this is certainly not an indication that UK-listed shares are now expensive. Far from it.

“A better measure is where shares prices are in relation to expected earnings and in this respect the market is cheap both compared to global equities – with UK shares trading at a price-to-earnings ratio around 37% lower than global equities – and their long-term median valuations.

“At such giveaway valuations, expect to see continued bids for UK-listed companies by overseas buyers – the number of takeovers of UK public companies reached the highest level in a decade last year – but cheap valuations are also spurring many companies to launch share buybacks, which should boost shareholder returns.”

However, Morgan warned that the cheapness of UK equities is a “double-edged sword”. While it presents "exciting" valuation opportunities for contrarian investors in the short term, the long-term outlook is more concerning as UK companies continue to move their listings abroad in pursuit of better valuations, and investors are selling domestic equities en masse.

For instance, outflows from UK equities reached £8bn in 2023, according to figures from Calastone. In March of this year, British investors withdrew another £823m, marking the 34th consecutive month of net selling for UK equity funds.

Morgan said: “In the long run, a shrinking pool of listed companies that is potentially biased towards less appealing businesses, and those that are simply too big to be swallowed up, is an unhealthy picture for investors.

“A potential longer-term risk is the UK market simply failing to maintain its significance to global investors. Continuing to attract companies to list in the UK and encourage investors to allocate capital is vital, but it remains in doubt.”

How to pair a FTSE 100 tracker

For investors tempted to give domestic equities another chance, a FTSE 100 tracker is likely to be the first port of call. However, due to the concentration of the index and the overrepresentation of specific sectors, they might want to pair it with an active fund to get greater diversification and potentially better long-term returns.

For that purpose, Alex Watts, investment data analyst at interactive investor, suggested Fidelity Special Values, managed by FE fundinfo Alpha Manager Alex Wright.

Watts explained: “The flexible mandate permits bottom-up stock selection across the FTSE All-Share, allowing a 20% overseas allocation. Manager Alex Wright looks for undervalued companies and is willing to take contrarian positions where a company is out of favour. Accordingly, the aggregate valuation across the portfolio of 11.5x earnings is lesser than valuations of the broader market.”

While the manager holds well-known FTSE 100 names such as Aviva, Imperial Brands and Reckitt Benckiser, the portfolio has a small- and mid-cap bias, as this is the part of the UK market where Wright perceives the greatest degree of mispricing.

Performance of investment trust over 10yrs vs sector and benchmark

Source: FE Analytics

For similar reasons, Rob Morgan picked Man GLG Undervalued Assets, managed by FE fundinfo Alpha Managers Henry Dixon and Jack Barrat.

The fund also follows a value-oriented approach, buying undervalued stocks with the anticipation that their merits will be recognised over time, resulting in a positive re-rating of their share prices.

Morgan said: “The fund has an established, disciplined process with an emphasis on financial strength, good cash generation and operational momentum to avoid potential ‘value traps’. As well as diversification from a tracker it could provide a good-quality standalone fund for UK exposure.”

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

Finally, Ben Yearsley, director of Fairview Investing, explained there are two possible paths to explore when looking to pair a FTSE 100 tracker.

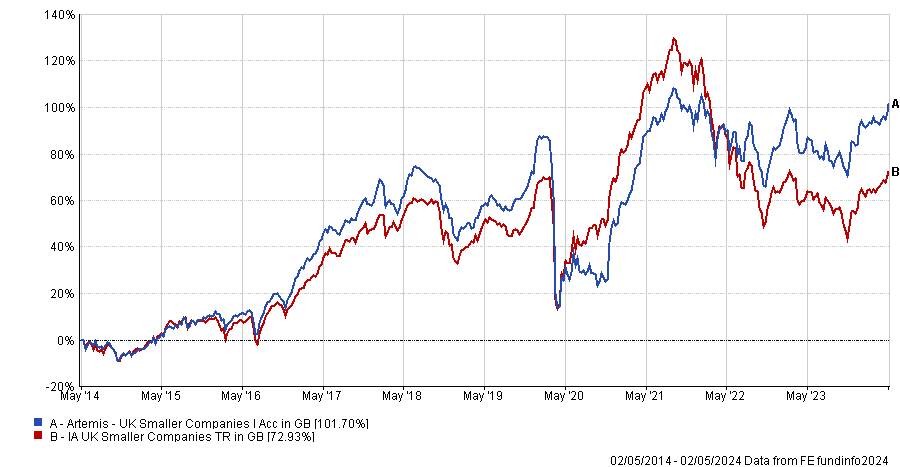

One is to take the plunge and look at opportunities in the small-cap space. In which case, he recommended Artemis UK Smaller Companies, a top quartile fund over 10, five and three years.

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

The other way is to go global with either a global tracker or an active fund such as Blue Whale Growth to counterbalance the “value” bias of the FTSE 100.