The share price of Google parent Alphabet jumped 10% in today’s pre-market trading, following the best set of overall results it has ever released and the announcement of a dividend program of $0.20 per share.

According to Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund, this development “proves the company’s stature as one of the quality leaders in the global digital revolution”.

“With its advancements in generative artificial intelligence (AI) already showing improved engagement and advertising performance, the business is firing on all of its many cylinders, resulting in constant currency revenue growth of 16%. It is also pleasing to see the 28% revenue growth in Google Cloud with a multiple increase in profitability,” he said.

“Within a rapidly changing digital environment, it has been able to increase group profitability with a 4% increase in operating margin. Our long-held view that Alphabet can later become a dividend stock also got validated.”

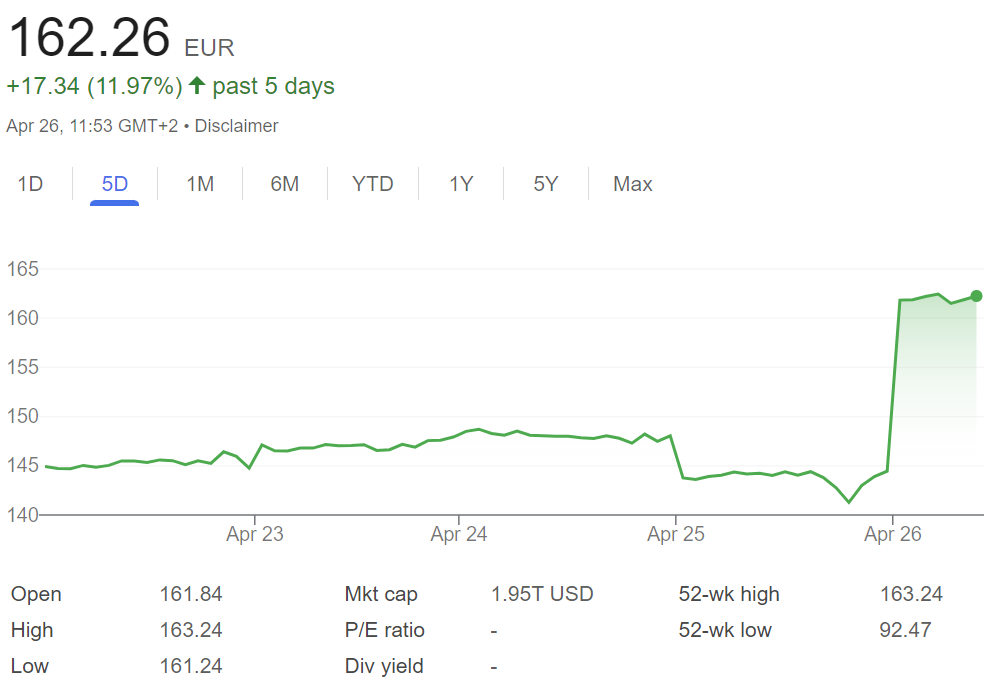

Alphabet’s share price

Source: Google Finance

Microsoft also filed strong earnings and shot up 4% in after-hours trading, reliably delivering well on both organic growth and profitability, as Smit noted.

“The main features are its AI demand resulting in Azure Cloud growth of 28% and a further 2% basis points increase in profitability,” he said. “We perceive Microsoft as the staple of the digital world.”

The tech giants' surge injected a much-needed boost after Meta's cautious forecast failed to inspire confidence, SPI Asset Management’s Stephen Innes noted.

“Tension was taut following a rough day for Meta, which unnerved investors with its cost outlook and capex plan, both of which underscored just how expensive building the future is likely to be,” he said.

Another disappointment had come from the US GPD reading for the first quarter but despite prevailing macroeconomic unease, Alphabet and Microsoft's earnings reports shone through.

"Alphabet, for instance, experienced its most robust top-line growth in two years, announcing not only its inaugural dividend, but also a $70bn stock buyback,” said Innes.

“This news exceeded the expectations of even the most discerning ears.”