Few seasoned fund managers are able to stay ahead of the competition for extended periods of time. They might live off their previous track records or fall behind newer managers with fresher ideas.

Yet Artemis’ Adrian Frost, who has been managing Artemis Income since 2002, has achieved that rare feat of beating his peers during the tumultuous market conditions of the past three years, bringing to bear his experience garnered during a 22-year track record.

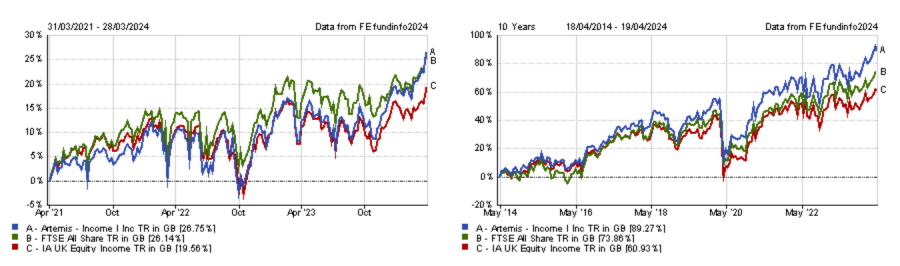

Trustnet researched which funds have been managed by the same person for 20 years or more and have produced top-quartile returns over the past three years. Artemis Income is the only strategy in the IA Equity Income sector to tick both boxes.FE fundinfo Alpha Manager Frost was joined by Nick Shenton in 2012 and Andy Marsh in 2018. Over the three years to 31 March 2024, the trio made 26.8%, with Artemis Income ranking 13th out of 73 in its sector in terms of performance.

Frost, Shenton and Marsh look to grow both income and capital over five-year periods by focusing on free cash flow, as they believe this metric determines a company’s ability to grow its dividend.

Analysts at Square Mile said: “In general, this approach guides the managers towards robust companies and can help highlight the potential risks in their business models.

“The fund has been designed to generate a yield in excess of the market, but the managers will not unnecessarily place capital at risk in order to achieve this, which is in keeping with the managers' total return aspirations.”

The fund has also done well over longer timeframes and sits in the top-quartile of its sector over 10 years and 15 years.

Moreover, Artemis Income’s Sharpe ratio over those periods has been among the best in the sector, suggesting that the amount of risk taken was worthwhile.

In terms of volatility, the fund has been less turbulent than many of its competitors over the long term, but fell into the third quartile on that metric over three years.

Performance of fund over 3 years and 10 years vs sector and benchmark

Source: FE Analytics

One concern highlighted by Square Mile analysts is the size of the fund, which may be a consequence of the successful longer-term track record.

Yet, the £4.5bn of assets under management might not be too much of an impediment, as Frost and his colleagues tend to focus on large-cap stocks. For instance, the fund’s top 10 holdings include FTSE 100 constituents such as 3i Group, London Stock Exchange Group and GSK as well as some overseas large-caps such as Amsterdam-listed information services company Wolters Kluwer.

Due to Artemis Income’s ‘conservative’ approach to investment, analysts at RSMR suggested using the fund as a core holding.

Previously we looked for funds with veteran managers at the helm that have outperformed for the past three years in the IA UK All Companies and IA UK Smaller Companies sectors.