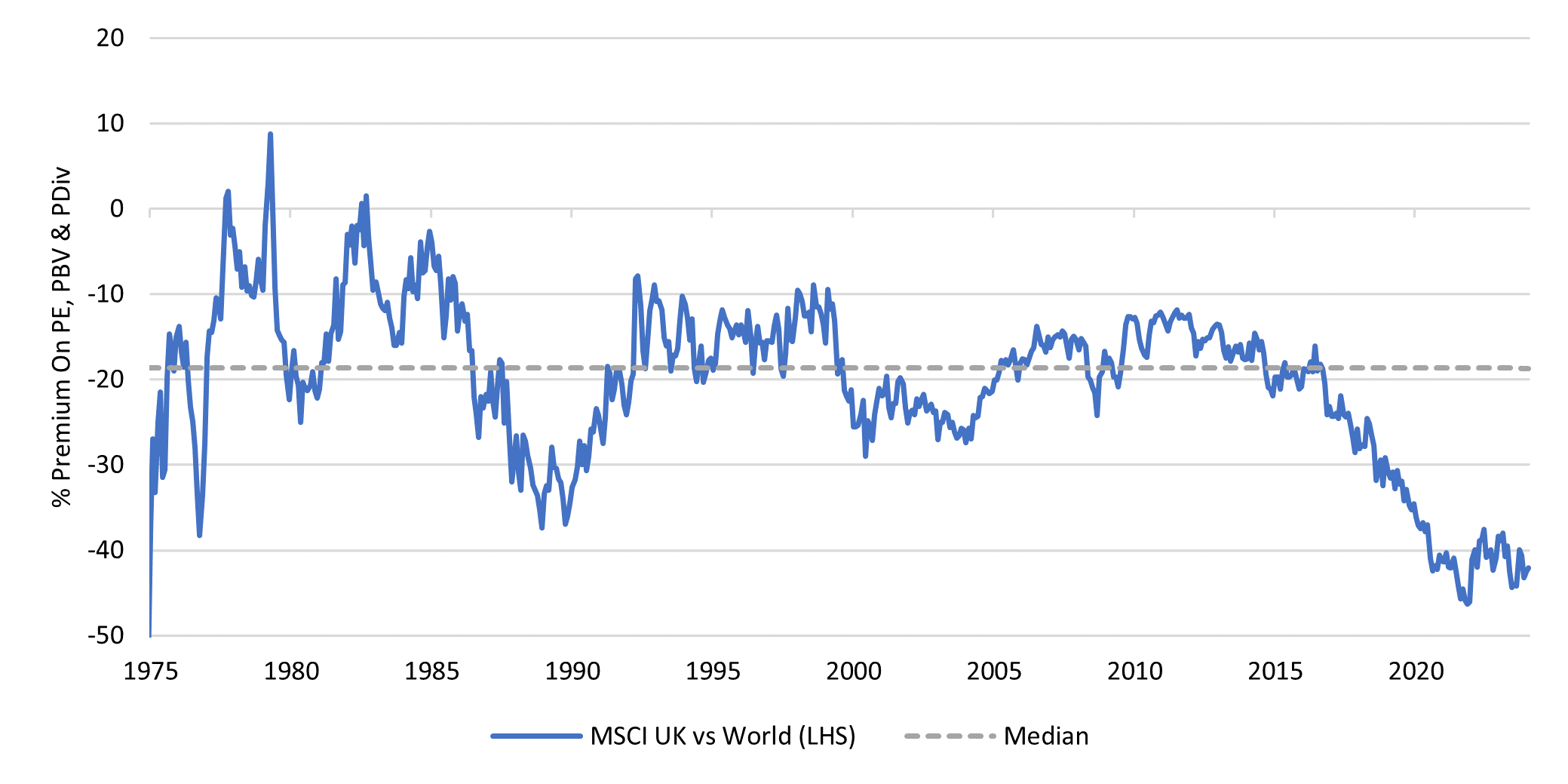

We have spent the past few years trying to demonstrate how cheap the UK equity market is, both in absolute terms but particularly when compared to the US equity market.

MSCI UK Index vs MSCI World Index

Source: Morgan Stanley, 31 Dec 2023

When we highlight the very low valuations on offer in the UK equity market, however, the first question we are asked is ‘what is going to change this?’ and that is a very fair question since I personally find it hard to see a scenario where all the money that has departed the UK suddenly comes back in this direction.

We can see two mechanisms that could potentially realise this value in UK equities without the need for large money flows into the market: corporate takeovers and share buybacks.

Corporate takeovers

The relentless selling of UK equities has driven valuations to such low levels that overseas corporates have spotted an opportunity to acquire UK assets at prices that offer serious potential to achieve an attractive return.

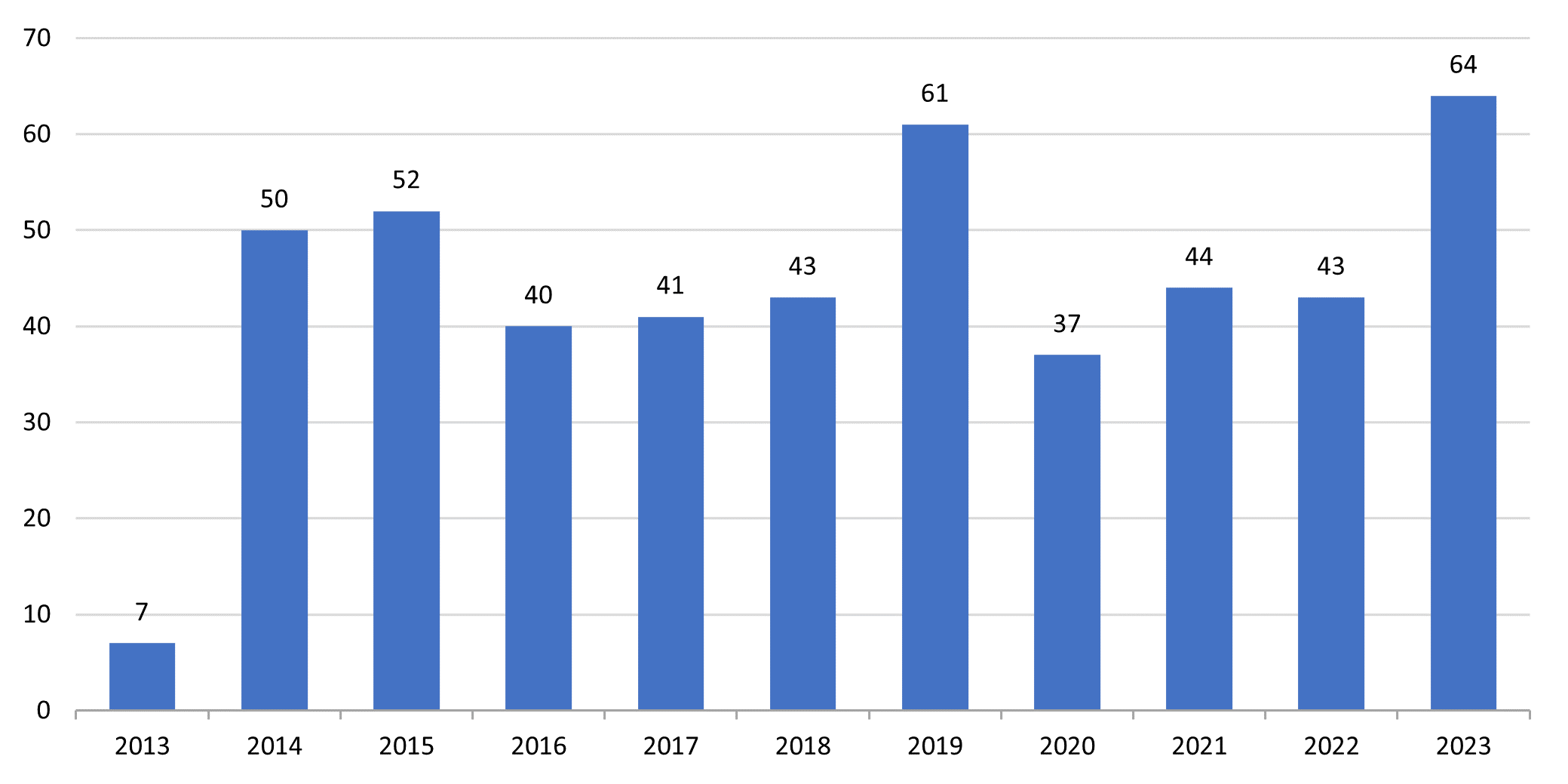

The chart below shows the numbers of takeovers in the UK market and the fact that this picked up significantly in 2023.

This momentum has accelerated in 2024. By the end of February, we had already seen offers for Currys, Direct Line, Wincanton, Redrow, LXI REIT and Spirent.

Number of takeovers in the UK market

Sources: Redwheel, Factset, 31 Dec 2023

Share buybacks

Meeting the chief executive officers of the companies we invest in has been quite a depressing experience in recent years since many feel that they are doing a very good job of running their companies and yet continue to watch their share prices fall.

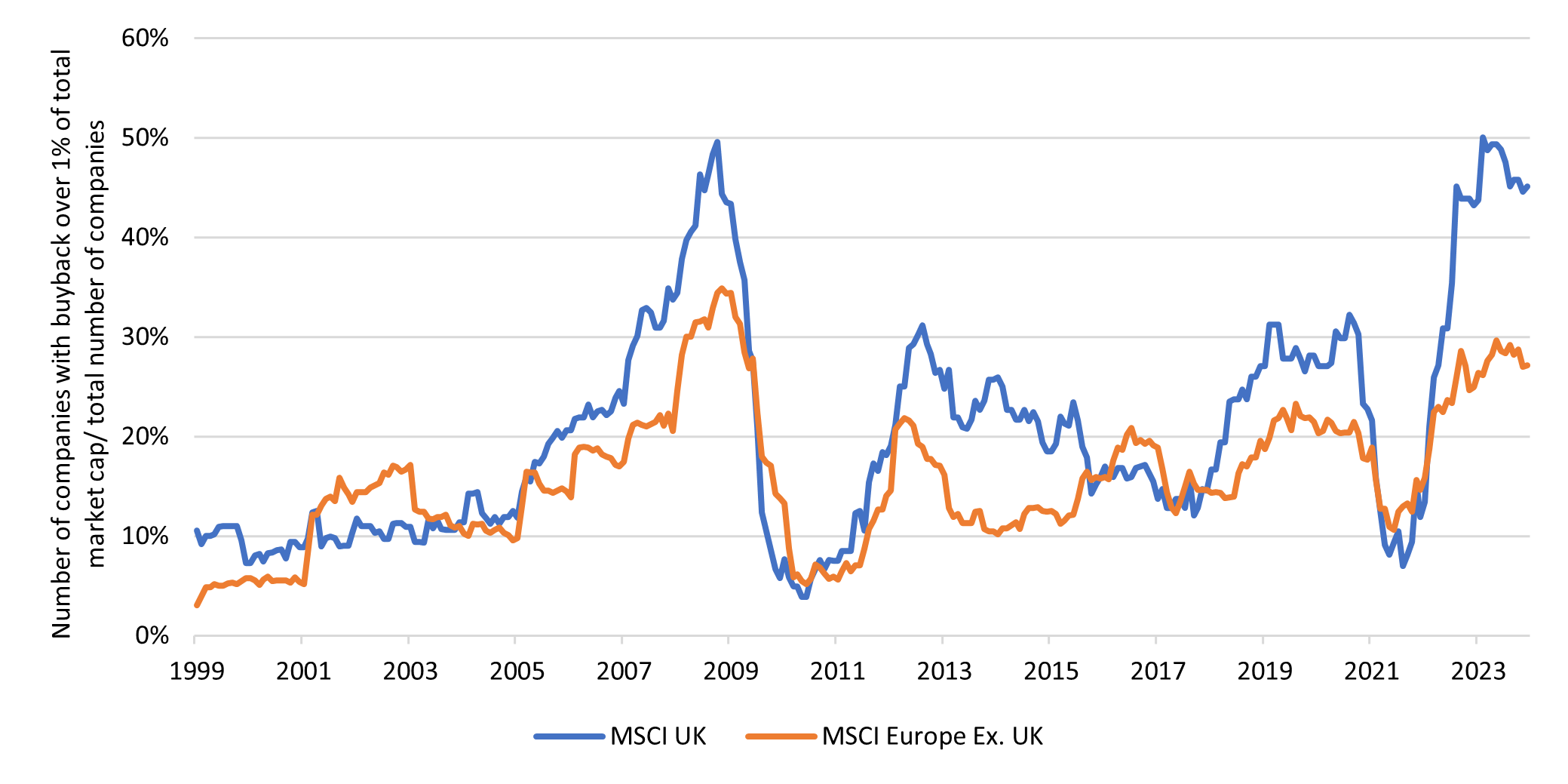

Our advice has been to not take the low share price personally but rather to use it to the advantage of the company’s shareholders by buying shares back at lower valuations as this will be value accretive in most cases.

The chart below suggests that this message is finally starting to hit home as 50% of UK companies within the MSCI UK index have bought back shares in the past 12 months, the highest percentage of any market in the world.

Number of companies with buyback over 1% of total market cap/total number of companies

Source: Morgan Stanley, ‘The Land of Equity Yield’, 31 Dec 2023

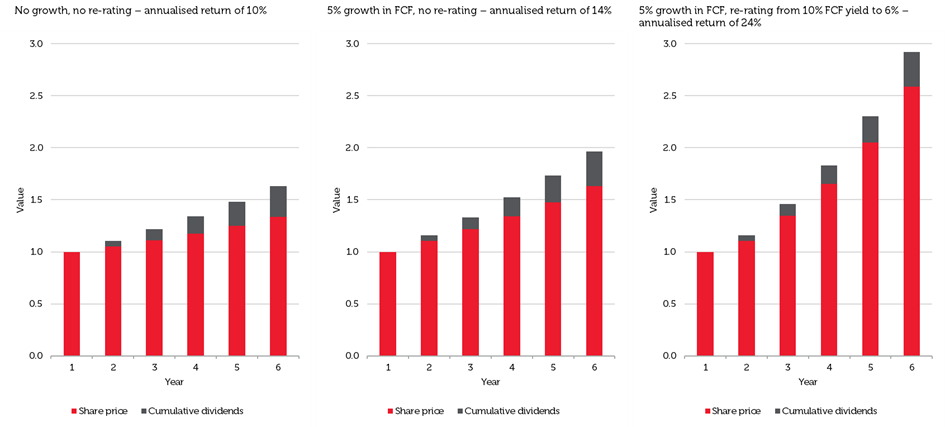

How share buybacks add value: The theory

To show how share buybacks can add value, we have created three scenarios below. To keep the maths simple, in all cases we are using a fictional company with a market capitalisation of £1bn that is generating £100m of free cash flow per annum, i.e. cash generated after interest, tax and capital expenditure that is free to return to shareholders. This company would be valued on a 10% free cash flow yield (£100m/£1000m).

Company one pays a £50m dividend (5%) and buys back £50m of shares. The share buyback will reduce the share count by 5% meaning that for a constant level of earnings and dividends, the earnings per share and dividends per share will rise by 5%. This 5% dividend and 5% buyback will thus produce a total return of 10% per annum and will continue to do so even if the free cash flow remains unchanged.

Company two is identical with the exception that the free cash flow grows at 5% per annum and this produces a total return of 14% a year.

Company three is the same as company two but in this case, we have assumed that investors warm to the company over the five-year period and place a higher valuation on the business. In this case we assume the shares re-rate from a 10% free cash flow yield to a 6% free cash flow yield. This produces a total return of 24% per annum which I believe would be more than acceptable for most investors.

How share buybacks can add value

Source: Redwheel, 29 Feb 2024

Share buybacks in practice

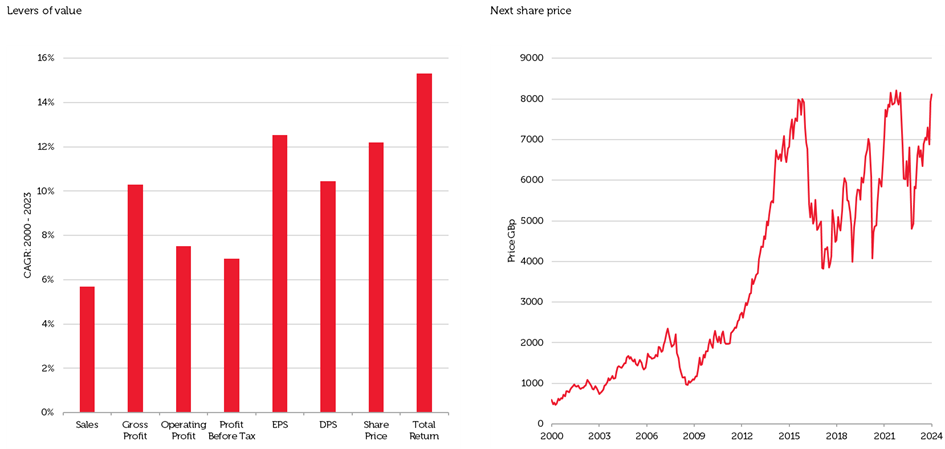

The poster child for a successful capital allocation policy that uses share buybacks is Next plc. It has bought back two-thirds of its shares in issue since 2000 and hence produced a total return for investors of 16% per annum and seen its share price rise from £5 to £80 over that time, despite only growing sales at 5% a year.

Share buybacks in practice: Next

Sources: Bloomberg, Redwheel, data from 1 Jan 2000 to 31 Dec 2023

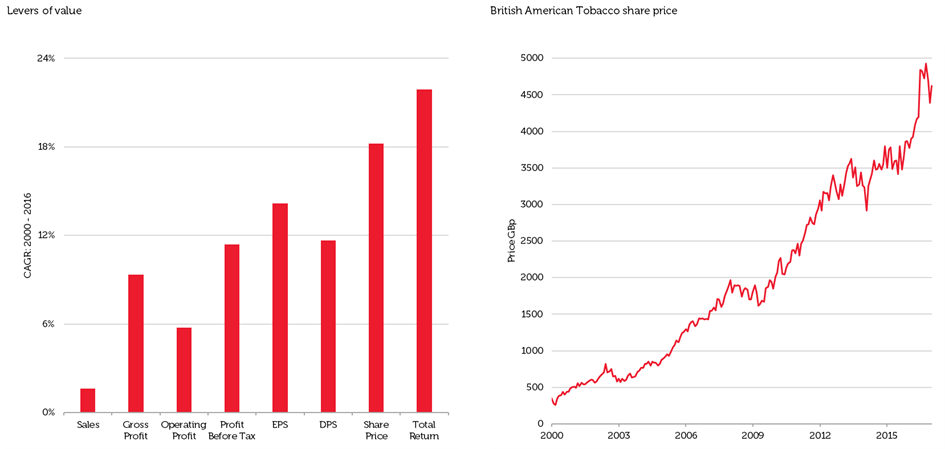

Perhaps an even more spectacular example of the power of share buybacks has been British American Tobacco. Investors were right to identify in 2000 that it had poor growth prospects due to declining numbers of people smoking. Between 2000 and 2016, its sales only grew by 2% a year and yet it gave its shareholders a 22% per annum total return and saw its share price rise from £3 to £50.

Share buybacks in practice: British American Tobacco

Sources: Bloomberg, Redwheel, data from 1 Jan 2000 to 31 Dec 2023

The return of the total return kings?

We believe that the conditions today are reminiscent of those that existed in 2000; once more investors are focusing on the growth prospects of technology companies and are paying very high valuations for them in our view.

Conversely, they have seemingly little interest in investing in old economy sectors such as energy, financials and autos and have driven the valuations of these parts of the market to lower levels.

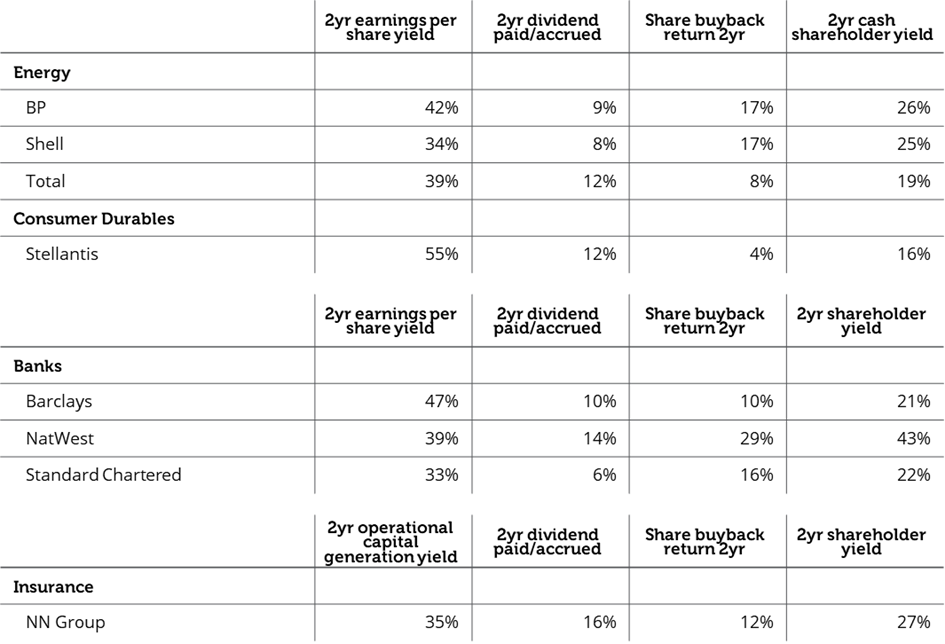

So which companies today are in a similar situation to Next and British American Tobacco and thus have the potential to reward their investors with attractive total returns in the future?

The table below contains some of the companies we hold in our portfolios which we think could produce attractive total returns for investors.

It’s important to note that share buybacks are more powerful when valuations are low, simply because for every £1 used, you are able to buyback more shares. We would argue that US technology companies who buy back highly valued shares are making a bad capital allocation decision.

Company earnings as a percentage of current market capitalisation

Sources: Redwheel, company report & accounts, 29 Feb 2024

We hope it should be fairly obvious that if these companies continue to buy back shares at the rate of the past two years, it seems likely that their share prices will eventually respond since their earnings per share and dividends per share could increase significantly. If the share price does not rise, then the price-to-earnings ratios and dividend yields will eventually reach ridiculous levels.

We believe that the market is currently offering up some incredible opportunities for investors not because there is anything fundamentally wrong with these businesses but rather because of neglect.

As US fund manager David Einhorn has said, valuation has become almost irrelevant for most market participants: “The market is still dominated by investors that either will not (index funds), cannot (untrained novice investors) or choose to not (valuation-indifferent professional investors) have valuation as a cornerstone of their investment process.”

What we have hopefully demonstrated, however, is that companies have the ability to use this low valuation to change the fundamentals of their business, i.e. increase their earnings per share and dividends per share and that eventually the market will take notice of this.

Just as in 2000, investors are so entranced with the potential growth being offered by US technology companies that they are ignoring some of the real bargains to be found in the new ‘total return kings’.

Ian Lance is co-head of Redwheel’s value and income team and co-portfolio managers of the Temple Bar Investment Trust. The views expressed above should not be taken as investment advice.