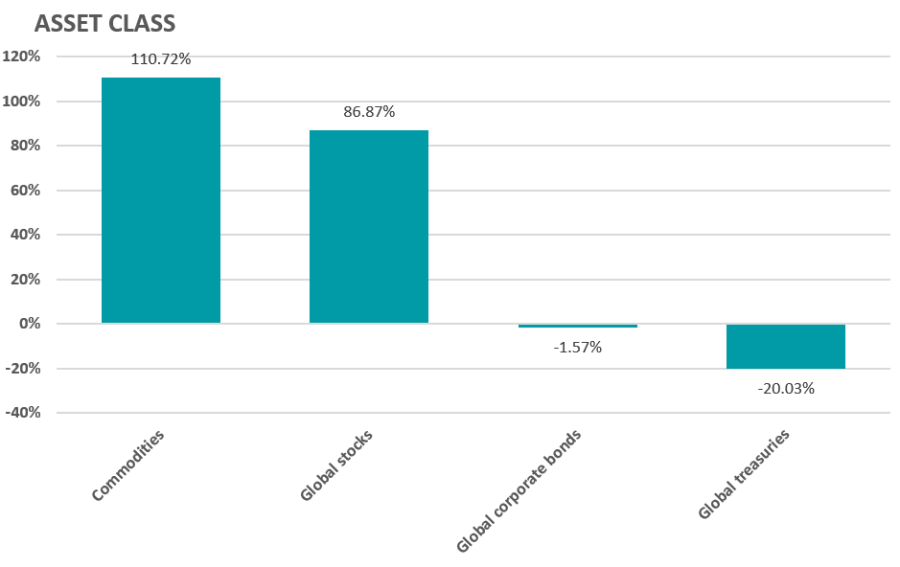

Commodities have been the best performing asset class since the Covid lows in mid-March 2020, outperforming global stocks, corporate bonds and government bonds – even beating returns from the tech sector.

Commodities have been propelled by surging inflation, interest rates hikes following the post-Covid reopening, supply chain issues and the war in Ukraine.

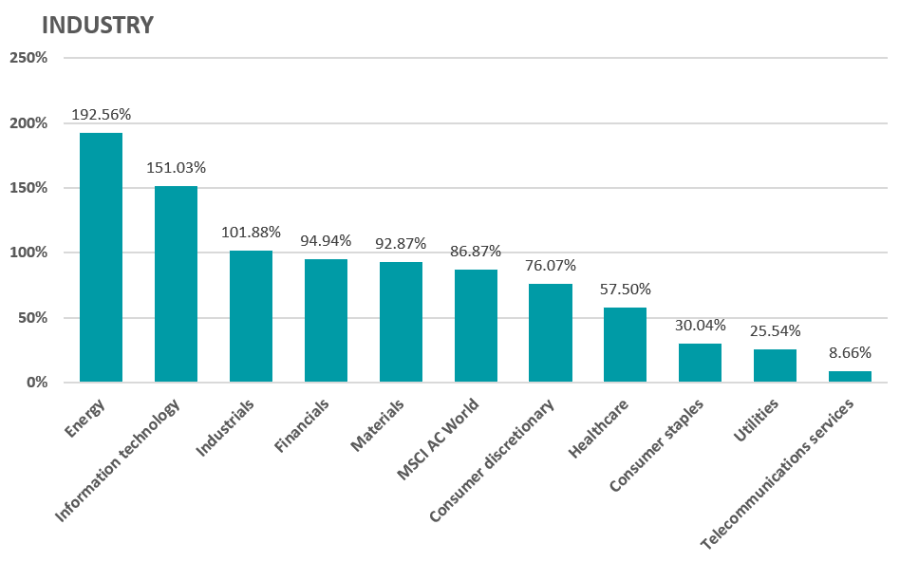

The strength of the commodities has been visible through the performance of different industries, with energy topping the list, ahead of technology, industrials and financials.

Source: FE Analytics

At a granular level, unleaded gasoline has been the strongest commodity since March 2020, followed by gas oil, heating oil and brent crude. Meanwhile, natural gas and Chicago wheat have been the only types of commodities to fall in value in that period.

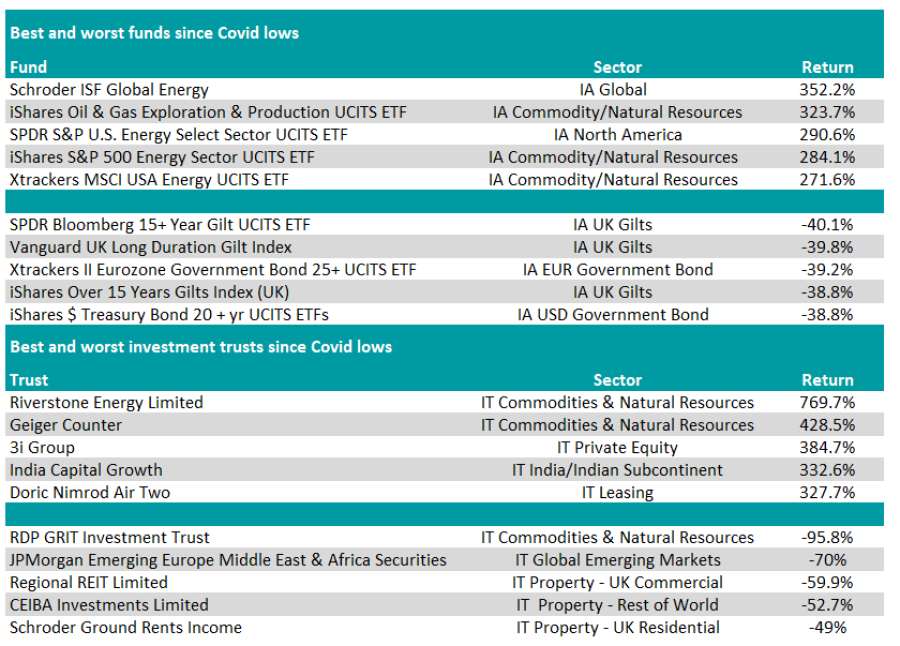

Commodities’ dominance is also noticeable via the performance of the different Investment Association (IA) sectors, with IA Commodity/Natural Resources leading the pack since March 2020.

Yet, the asset class has been much slower since 2023, after demand stabilised and production adjusted itself. Moreover, the Chinese economy – which has historically been an important consumer of commodities – has been slowing down, hampering the idea of a new supercycle.

Source: FE Analytics

Meanwhile, IA Technology and Technology Innovations has been the next best performing sector. It benefited from the ultra-low interest rates in 2020, but de-rated significantly when central banks hiked interest rates in 2022, before experiencing a rebound underpinned by the artificial intelligence frenzy in 2023.

Conversely, it’s been a dreadful period for fixed income, with IA UK Gilts and IA UK Index Linked Gilts falling more than 19%. IA EUR Mixed Bond, IA USD Government Bond, IA Global Government Bond and IA EUR Government Bond also shrank more than 12%.

Bond yields and bond prices are negatively correlated, which means that bond prices tend to fall in value when central banks hike interest rates. However, fixed income could take centre stage going forward if the consensus view that interest rates have already peaked is proved right.

Looking at investment trusts specifically, IT India has been the best performing Association of Investment Companies’ sector since March 2020.

In a similar vein, MSCI India has risen more than any other index since the Covid lows, ahead of the Nasdaq 100, the S&P 500 and Euro STOXX.

Yet, some experts fear that Indian equities might now be overvalued and on the cusp of a correction.

At the other end of the spectrum, IT Property - Rest of the World and IT Farmland & Forestry and IT Growth Capital de-rated more than 20%.

Source: FE Analytics

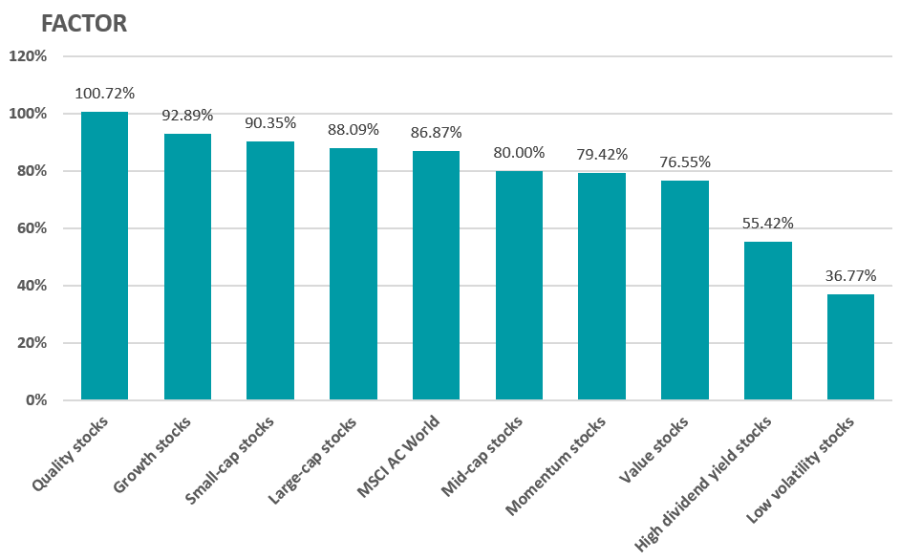

In terms of factors, quality stocks have delivered the best returns ahead of growth and small-caps.

Quality stocks may have benefited from characteristics such as strong balance sheets, low leverage and pricing power. In theory, it means they are more resilient in environments where interest rates and inflation are higher.

Growth stocks and small-caps outperformed at the start of this decade when interest rates were still low but have suffered since the style rotation and rate hiking cycle of 2022.

Jonathan Boyar, director of Boyar Value Group and advisor to the MAPFRE AM US Forgotten Value Fund, explained: “When interest rates are higher, the capital that many growing companies rely upon (including those that are not yet profitable) to fund their expansion becomes more costly.

“Furthermore, the price investors are willing to pay for growth stocks tends to be sensitive to expectations of cash flows well into the future, which become more significantly discounted in higher interest-rate backdrops.”

Source: FE Analytics

This is also true for small-cap stocks, which are more sensitive to monetary policy, as the increased cost of capital makes it more difficult for them to finance their activities.

Yet, a number of fund managers have been moving into small-caps to take advantage of their depressed valuations, which have already priced in much of the bad news. Furthermore, small-caps are expected to perform better once the global economy improves and sentiment turns.