Discount opportunities abound in the investment trusts universe, where 31% of portfolios with at least a five-year track record are now trading at double-digit discounts.

But that doesn’t mean that all of them make a great investment opportunity and discerning between the good and the bad can be complicated.

For investors that need a steer, Trustnet asked QuotedData analyst David Johnson to highlight one cheap trust in each developed market that he believes would make a good addition to investors’ portfolios today.

UK

In the UK, Johnson opted for the £216m Montanaro UK Smaller Companies, which mainly invests in companies with a market capitalisation of between £250m and £500m (making up 27% of the portfolio) and £2bn or more (24%), particularly in the industrial and technology sectors.

Historically, its 4% annual dividend policy and the strength of its past performance granted a much narrower discount than the current 16%, which is one of the widest among the trusts that focus on conventional listed-equity small-caps.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Johnson thinks that this small-cap growth strategy may offer “the best rebound potential within UK-focused sectors”.

“The large-cap sector is a mix of haves and have nots, and has been driven by the largest companies. The small-cap space has fared less well, but offers more interesting companies that trade on attractive valuations,” he said.

“A turnaround in the UK (be it due to rate cuts or politics) may favour battered growth stocks.”

However, even if that doesn’t happen, Johnson found the “strong current earnings and potential future earnings” of the trust’s holdings attractive.

“Even if we don’t see a rebound, these companies will likely remain the targets of corporate takeovers, given how cheap the region is. Montanaro UK Smaller Companies’ dual focus on quality and growth means that it should also do well in a recession, as these companies are likely better positioned to survive hardship.”

US

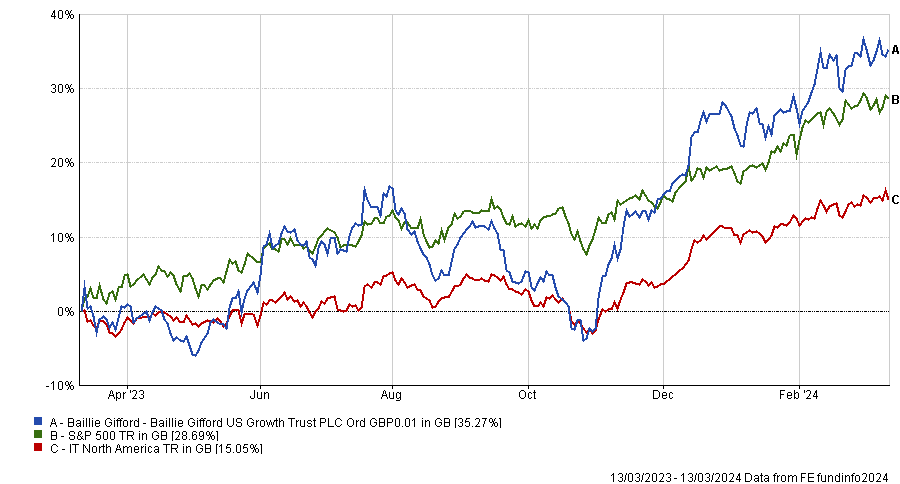

For US exposure, Baillie Gifford US Growth is “a natural choice”. The trust beat the S&P 500 index by seven percentage points over the past year, as shown below.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Thanks to the Magnificent Seven stocks, the US market has delivered for investors above and beyond expectations, so much so that many now question its ability to continue on the same track.

But Johnson believes US leadership will continue for at least one more year, for two reasons: one, it is ahead of the inflation management curve; and two, 2024 is an election year and “no president wants a period of difficult financial markets in the run up to an election,” he said.

“Given where we are in the economic cycle, that leadership will continue to come from growth strategies, as an interest rate cut will overwhelmingly favour growth stocks.”

Baillie Gifford US Growth offers the benefits of a 15% discount (which is amongst the widest of any US strategy) and has exposure to unlisted assets, which “would amplify its rebound in the event of interest rate cuts, as that reduces the valuation risk associated with them”.

Europe

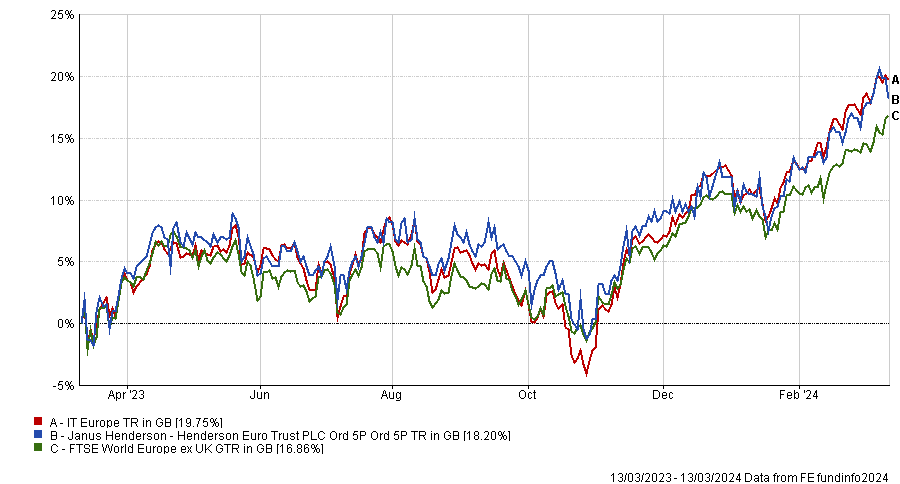

In Europe, Henderson Eurotrust’s 13% discount is “a compelling opportunity” when compared to the other trusts in the two European sectors.

Performance of fund against sector and index over 1yr

Source: FE Analytics

It is another quality-growth strategy and finds itself “in a stronger position than Europe’s value and core sectors, which lack the earnings potential of the US while still commanding a higher valuation than the UK”.

The trust is set to be merged with Henderson European Focus and investors will have a chance to cash in around 5% of the fund at a 2% discount.

"The investment approach will be much the same but with lower fees, greater liquidity and the benefit of combining the best of the two vehicles, it could get re-rated," said Johnson.

“Near-term fund flows are likely to prefer European large-cap companies rather than small-caps, with the stellar rise of Novo Nordisk being an example."

Japan

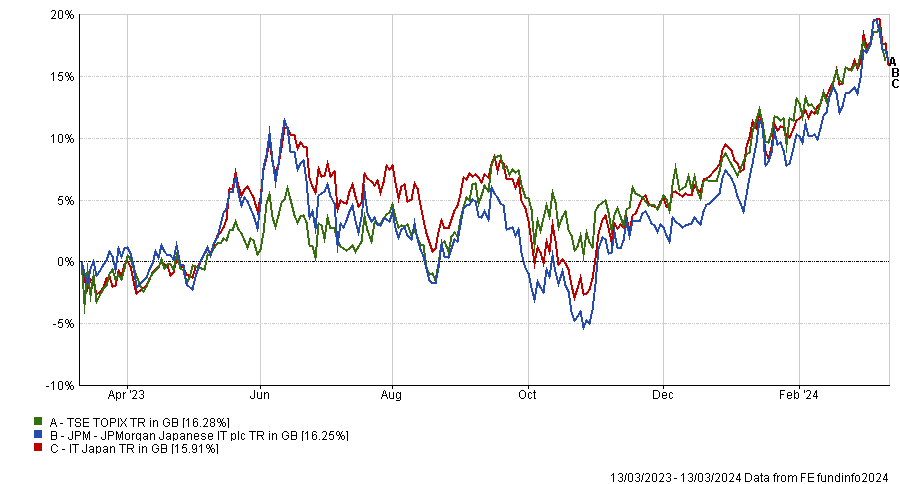

Finally, the Japanese equity sector is “a bit tricker to find discount opportunities in because of the consistently strong performances of many of its constituents”, which all trade on narrow discounts.

Here too, Johnson favourd large-caps strategies, as they have been most rewarded by foreign inflows (which will continue to be a major factor in Japan’s equity performance in the near term) and growth opportunities because value stocks “have myriad issues affecting them”.

So, when looking for sectors likely to benefit from near-term market tailwinds, Johnson is more bullish on technology automation and high-end industries, which are all growth-stock biased.

The JPMorgan Japanese Investment Trust ticks all the boxes on the analyst’s checklist and is “a natural fit” for its strong bias to Japanese growth companies and its 8% discount.

Performance of fund against sector and index over 1yr

Source: FE Analytics

“The discount is not the widest in the sector, but it still offers sufficient upside, especially when one considers that the trust traded on a premium during the 2021 growth rally,” Johnson concluded.