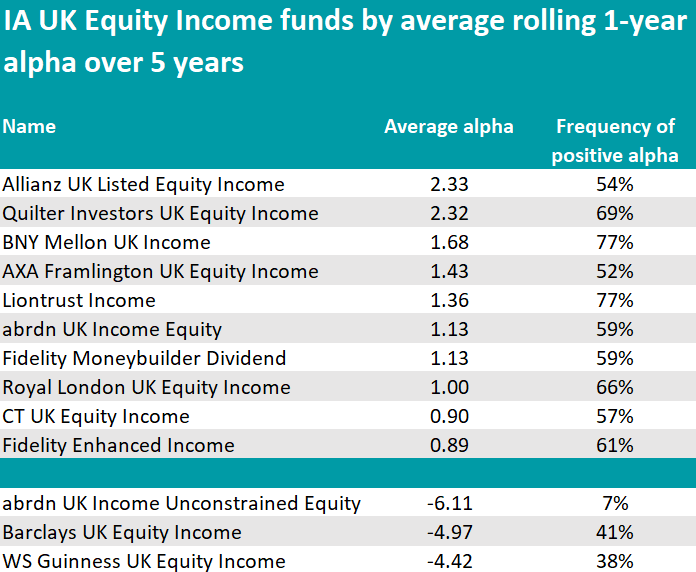

Allianz Global Investors and Quilter Investors offer the two IA UK Equity Income funds with the highest average alpha of the past five years, data from FinXL has shown.

The Allianz UK Listed Equity Income and Quilter Investors UK Equity Income funds were the best at generating returns, not just by passively riding along with the growth of the benchmark, but from active stock picking.

These findings emerged from a Trustnet analysis which calculated the average alpha of IA UK Equity Income funds in 61 12-month periods starting in January 2018 and measured every month until the end of 2023.

The Allianz fund had a marginally higher average alpha (2.33 instead of 2.32), but Quilter was more consistent, with its alpha remaining positive in 42 of the 61 periods considered, instead of just 33.

The £271.6m Allianz UK Listed Equity Income fund is co-managed by Simon Gergel and, since 2020, Richard Knight. The duo targets not only income, but also capital growth, using the FTSE All Share index as benchmark. Their top three holdings are GSK, British American Tobacco and Shell.

Source: FinXL

Much smaller than the Allianz fund, Quilter Investors UK Equity Income (£66.7m) also aims to generate capital growth alongside income and its top-three holdings are FTSE 250-constituent Drax Group, WhiteBread and BP.

The third place on the list is occupied by BNY Mellon UK Income, which has grown 50% in size since November 2022, reaching the current £1.5bn of assets under management.

Tim Lucas has been at the helm of the fund since November 2021 and was joined by David Cumming in April 2022, so the current managers are only partially responsible for the achievements highlighted here.

The fund had a positive alpha for 77% of the five years in our analysis, the highest figure on the list – and on a par with the next fund, Liontrust Income.

A concentrated portfolio of 45 holdings, Liontrust Income is co-managed by Dan Ekstein and Sam Bealing, who joined the firm with the acquisition of Majedie Asset Management in 2022. The average alpha of the fund was 1.36 and during the managers’ tenure, performance has been strong both against the sector and the benchmark. The team made 15.5% compared with 9.6% for their average peer and 11.5% for the FTSE All Share.

The next fund on the list, abrdn UK Income Equity, has been led by Charles Luke since 2016.

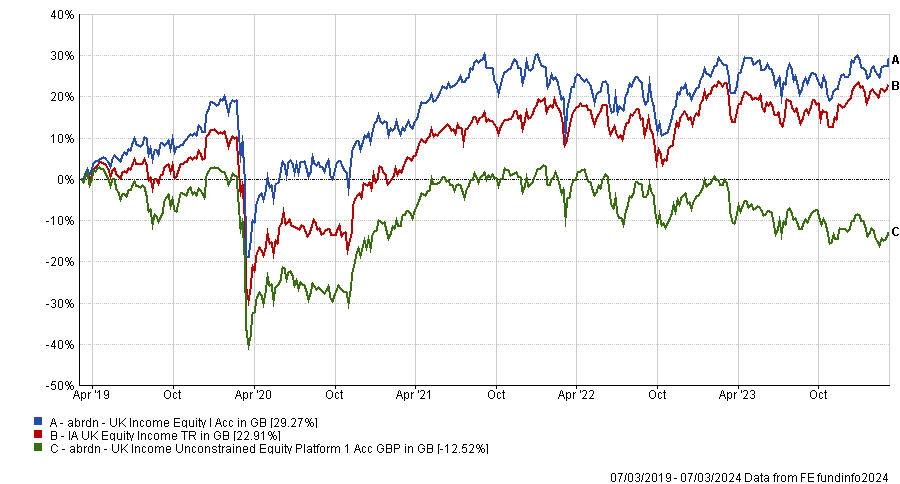

However, another abrdn fund had the worst alpha of the whole study; the abrdn UK Income Unconstrained Equity fund’s average alpha was -6.11. It only had a positive alpha in four of the 61 year-long periods in consideration.

Performance of funds against sector and index over 1yr

Source: FE Analytics

To conclude the bottom-three ranking, Barclays UK Equity Income and WS Guinness UK Equity Income also had negative average alphas: -5 and -4.4, respectively.

Beyond abrdn, the only other investment manager with two funds that made the list was Fidelity, which stood out for the Fidelity Moneybuilder Dividend and the Fidelity Enhanced Income funds.

Both strategies were managed by Michael Clark until his retirement at the end of 2022, and his co-manager Rupert Gifford, who has since then been the sole manager – flanked by David Jehan for the derivatives component of the Enhanced Income fund.

In March 2024, both strategies received a ‘positive prospect’ rating from Square Mile, which praised their approach to investing in steady companies that have coped well with difficult economic conditions.

The analysts suggested the former fund for a more defensive investor and the latter for those who value higher income today over capital appreciation in the long term.

AXA Framlington UK Equity Income, Royal London UK Equity Income and CT UK Equity Income also stood out.

The Columbia Threadneedle strategy is a £3.2bn giant that Rayner Spencer Mills Research (RSMR) analysts highlight as a core income fund managed by “a large, experienced and talented team”.

“The team use a portfolio manager/analyst model with valuation at its core. All research ideas are presented, challenged and debated by the whole team, which provides a formal peer review of all stock opportunities,” RSMR analysts said.

“Drawing on the team’s diverse strengths and perspectives enhances the quality of their conclusions, providing investors with a well-diversified portfolio capable of delivering consistent and superior risk-adjusted returns through the cycle.”

Royal London UK Equity Income is only a fraction of the size and the team is small “but successful”, according to RSMR’s analysts, which allows for “quick and decisive stock selection”.

AXA Framlington UK Equity Income completes the list with just £75.6m of assets under management.

IA Sectors previously in this series: UK All Companies, Global.