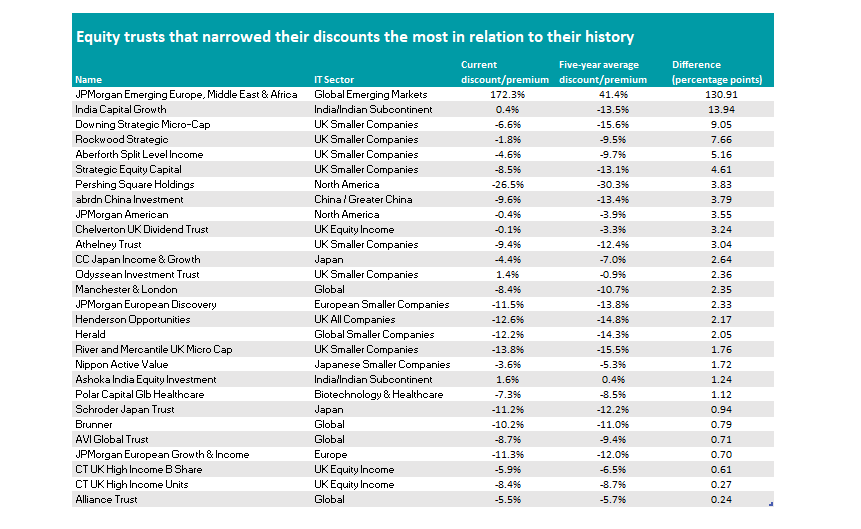

Premiums are rare in the investment trusts industry, which suffers from chronic discounts, but there are still some trusts that have caught investors’ eyes and garnered traction over the past five years, according to data from QuotedData.

Earlier this morning, we looked at the trusts that are trading at their widest discounts compared to their five-year average. Now, we do the same for premiums.

Starting with equity trusts, the first portfolio is exceptionally expensive – JPMorgan Emerging Europe, Middle East & Africa (formerly JPMorgan Russian Securities) has been on an average five-year premium of 41.4% which has recently steepened to reach an eye-watering 172.3%. Yet five years ago, it traded on an 11.3% discount.

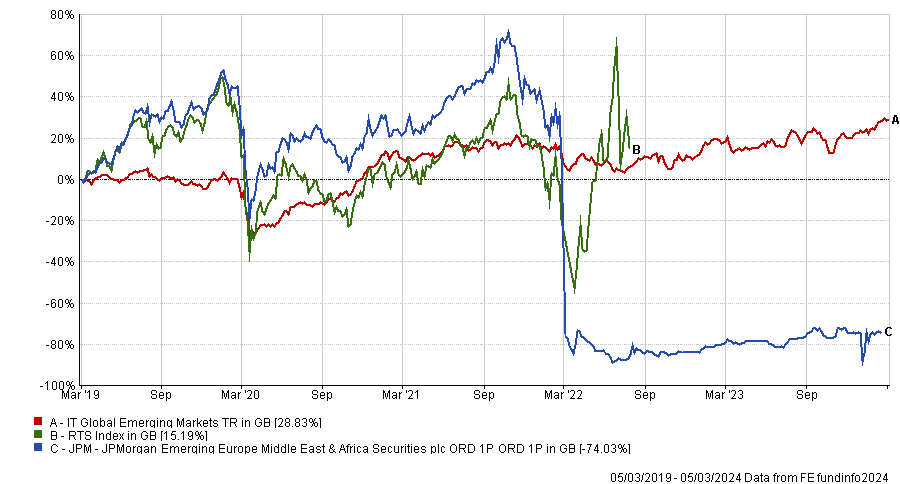

Since Russia’s invasion of Ukraine, the Moscow Exchange has been closed to overseas investors and the trust has been prohibited from trading its Russian securities. This prevents any measurable performance activity (despite the now broadened investment horizon) and the situation has unusually generated a premium, which the board attributes to a difference in the view of the value of the company’s net assets.

This however “should not be interpreted as an indication that investors are more likely to derive any value from the company’s Russian shareholdings”, it said.

Performance of fund against sector and index over 1yr

Source: FE Analytics

Moving on to less troubled waters, India Capital Growth is now 13.9 percentage points more expensive than it was in the past five years thanks to successful discount-control policies.

In November 2023, the trust announced a £5m buyback programme, prompting the discount to narrow from 13.5% to 4.9% in December. Now, it trades at a 0.4% premium, which was facilitated by a bi-annual redemption facility.

Manager Gaurav Narain uses a bottom-up stock-picking process to create a concentrated portfolio (34 holdings) of best ideas, unconstrained by a benchmark.

Source: QuotedData

Four IT UK Smaller Companies trusts followed, all of which trade on a small discount that they managed to narrow in the past five years.

With a market capitalisation of £193.6m, the Aberforth Split Level Income Trust is the largest of the four.

In January 2024, it was down by 2.6%, compared with the 2% decline of its benchmark and behind the FTSE All‐Share’s 1.3% fall. The managing team attributed their underperformance to headwinds following a higher-than-expected inflation reading at the beginning of the year, which caused rate cut expectations to be pushed further into the future, favouring large companies over small-caps.

Other sector constituents also appear further down the list, including Odyssean, which featured in Numis’ selection of trusts for 2024 and trusts for loving the unloved UK market. It was also highlighted in Winterflood’s recommended list and picked more recently as a good option for young investors in this Trustnet’s piece.

Remaining in the UK, Henderson Opportunities and CT UK High Income stood out.

The former managed to close its discount by 2.2 percentage points against its five-year average. In 2023, the discount widened from 13.3% to 16.4% for its underperformance attributed to weak sentiment to domestic smaller companies, to which the fund was overweight. Since then, the discount narrowed further to 12.6%.

In the IT North America sector, Pershing Square Holdings and JPMorgan American made the list.

Both narrowed their historic discount by more than 3.5 percentage points, but while the former remains on a double-digit discount (26.5%), the latter trades close to par, at – 0.4%.

JPMorgan American has been managed since 2019 by Jonathan Simon and Timothy Parton, with the fund split between large-caps run by the former and small-caps by the latter. The duo was broken up on 1 March 2024 when Parton retired.

Jonathan Simon remains responsible for the large-cap value stocks in the portfolio, while being flanked by Felise Agranoff, who was appointed as portfolio manager for the growth part and with the intention that she would become the sole manager responsible for the growth stocks in the large-cap portfolio upon Parton's retirement.

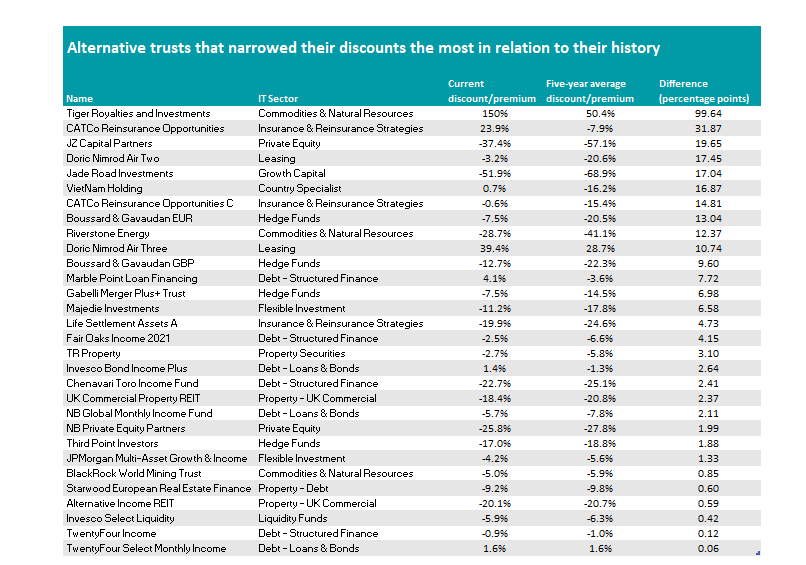

Finally, a similar number of alternative trusts also managed to narrow their discount, as the table below shows.

Source: FE Analytics

Here, many debt trusts made the list, including Invesco Bond Income Plus, TwentyFour Select Monthly Income and M&G Credit Income Investment.

The country specialist VietNam Holding closed its 17.3% discount of five years ago and now trades at a 0.7% premium.

In the IT Flexible Investment sector, Majedie Investments and JPMorgan Multi-Asset Growth & Income were of note.