The UK is one of the few developed markets that did not hit a record high last week, making it an ideal hunting ground to unearth treasure troves of value, which sounds like the sort of adventure that the Famous Five would enjoy.

Just like Enid Blyton’s three fictional siblings, their cousin George and her dog, Timmy, these five quintessentially British companies are embarking on new adventures, as Alexandra Jackson, manager of the Rathbone UK Opportunities fund, explains.

The publisher

Bloomsbury Publishing has an impressive track record for spotting new authors as well as a portfolio of established brands, led by J.K. Rowling’s Harry Potter novels. The play Harry Potter and the Cursed Child and the computer game Hogwarts Legacy have renewed interest in the franchise and an upcoming TV series is likely to spur sales.

Bloomsbury is also benefitting from buzz generated by BookTok for its bestselling authors, such as Sarah J. Maas. TikTok users are hosting virtual book clubs on BookTok, encouraging everyone to buy and read the same book. “It really does drive sales in a way we’ve never seen in that industry before,” Jackson said. “If you get into that virtuous circle, it really can be very virtuous.”

Bloomsbury also has a digital publishing business with a cache of theatrical recordings. Theatre and drama students can use the service to watch a range of actors playing a specific part. The recordings are licenced to universities and schools for an upfront fee. This software-as-a-service licence model has “added a really nice, interesting optionality to the investment case,” Jackson said.

The kitchen

Howden Joinery’s business model is set up to cater to professional builders, who are its core customers. It provides a next day service, delivering any additional or replacement parts to the local depot or on site the following day, whereas other kitchen suppliers sometimes take weeks.

“The other thing builders love is that there are no prices on Howdens’ website,” Jackson continued. Builders have the latitude to add their own fees at their discretion and “that is exactly what builders want and need,” she explained. “All of these things sound quite simple but the competition is nowhere near.”

Howdens is moving into bedrooms, something it attempted unsuccessfully under a previous chief executive but this time around, the company has optimised the way it stacks products in its warehouses so it can run an in-stock model and generate cash faster.

The business delivers high returns, generates a lot of cash, pays a dividend of 2.6% and is shareholder friendly with a “sensible” balance sheet, she continued.

With a £4.4bn market capitalisation, the stock has just entered the FTSE 100 index. “I hear a lot of global fund managers talking about it,” Jackson said. For “global investors who like quality, it really does stand out”.

Howdens is, however, a cyclical business. Given that people tend to install a new kitchen roughly six months after moving house, demand is linked to housing transactions, which have slowed given the higher mortgage rates. Howdens has managed this situation well and has been able to grow its market share, she said.

“This is how you can own a cyclical business, if it can take market share,” Jackson said. “It doesn’t matter if the pie is growing or, horror of horrors, it’s shrinking a bit, if you can take a bigger slice of the pie.”

Howden Joinery’s share price over 5yrs

Source: Google Finance

The baker

Talking of pies, Greggs of Gosworth was founded as a Newcastle bakery in 1939 and today, the high street favourite still has a cheeky Geordie irreverence. The company's marketing excels because Greggs “knows what it’s worth” and “exactly who they are”, Jackson said.

“The value offer is incredible”, she continued, with a hot meal costing about the same as a supermarket meal deal.

In fact, Greggs has increased its prices by 12% in the past two years “with no impact on volume at all” which shows that customers still perceive Greggs as offering good value and the company has pricing power.

“I think it’s the hot thing. The British weather definitely lends itself to wanting something hot for breakfast, lunch and after school,” she added.

Greggs has started opening later to cater to the after-school crowd. Adding a couple of hours to the working day comes at a small expense, often just one person’s wage, spread across a cost base that Greggs would be paying anyway (rent, etc.) meaning that any sales deliver incremental profits.

Greggs pays its staff relatively well and awards them a bonus and profit share, so turnover and training costs are lower than competitors.

The price of natural gas has halved since September, which will reduce Greggs’ huge electricity bill and should add about £30m to its £180m profit base this year, Jackson said.

Greggs’ share price over 5yrs

Source: Google Finance

The drinks company

Natural gas is a significant component of the glass-making process so Fever-Tree, whose drinks are sold in glass bottles, will also benefit from the price fall.

Having saturated the UK’s tonic market, Fever-Tree has ventured into the US where “it has managed to really grab the zeitgeist,” Jackson said. Paloma, a popular Tequila cocktail, is driving sales of Fever-Tree’s attractively-packaged sparkling pink grapefruit juice.

All that said, Fever-Tree is recovering from a rough couple of years. The company was bottling its drinks in the UK then shipping them to the US, which was expensive, and higher natural gas prices were a huge headwind. “It really did hit every branch on the way down”, Jackson said, but now, “those issues are melting away”. She thinks Fever-Tree could double its earnings this year.

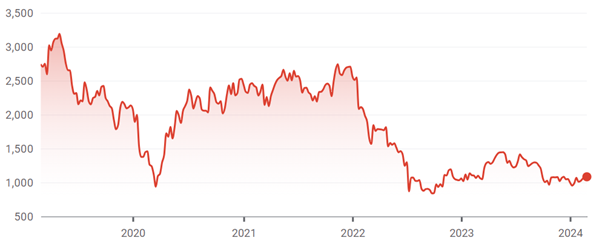

Fever-Tree’s share price over 5yrs

Source: Google Finance

The travel retailer

WHSmith is shedding its tired high street past and transforming itself into a high growth airport retailer, Jackson said.

WHSmith has branched out into health and beauty shops, as well as electronics through InMotion, which it acquired in 2018. Then in 2019 it bought Marshall Retail Group, which runs locally-branded stores in US airports.

The stock is trading at 15 times earnings so is cheaper than travel food company SSP Group, which also specialises in airports.