The City of London Investment Trust has been a reliable ally for income investors, having raised its dividend annually for 57 years.

The £2bn portfolio has a value tilt, with the managers – Job Curtis and David Smith from Janus Henderson Investors – principally investing in large UK companies deriving their earnings from overseas.

This style of investment as well as UK stocks have generally been out of favour since the Global Financial Crisis. As a result, City of London has slightly lagged its benchmark over the past decade, although capital growth is arguably not the primary reason why investors buy shares in this investment trust.

Jason Hollands, managing director at Bestinvest, said: “I would describe City of London’s approach as fairly defensive, with the portfolio comprising of blue-chip companies with solid balance sheets that pay decent dividends.”

Below, experts explain how investors can use this strategy in their portfolio, when to expect outperformance or underperformance and how to complement it.

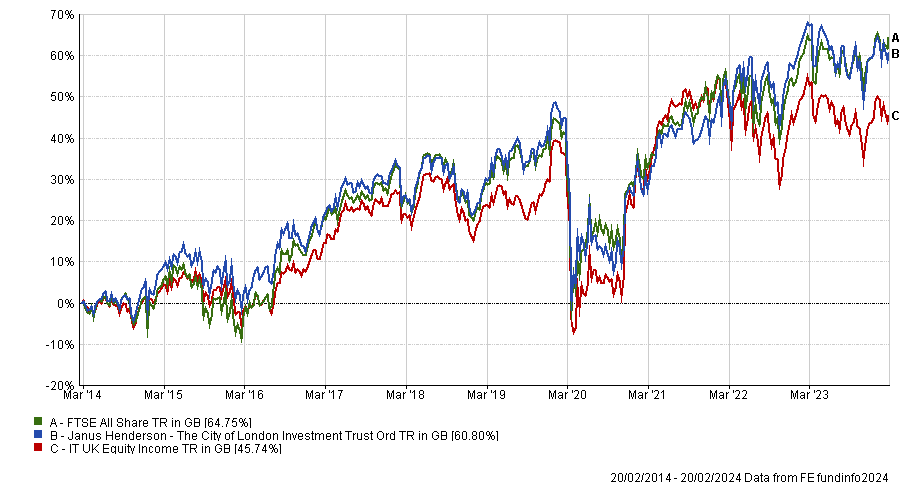

Performance of trust over 10yrs vs sector and benchmark

Source: FE Analytics

When to expect outperformance and underperformance

Investors are likely to hold City of London for the reliability of its income rather than for the total return aspect.

If income is what investors are after, City of London will likely fulfil its mission regardless of the macroeconomic environment.

Jim Harrison, investment director at Chancery Lane Income Planners, said: “City of London has increased its dividend annually for 57 years. In those years, we've had varying macroeconomic and world issues, which suggests to me that it does well in all market conditions.”

Nonetheless, the UK equity income trust tends to deliver its best results when its value style of investment is in favour.

That was the case in 2022, for example, when The City of London Investment Trust fared reasonably well amid the surge in inflation, while many other strategies took a beating.

Performance of trust in 2022 vs sector and benchmark

Source: FE Analytics

Ben Yearsley, director at Fairview Investing, believes that the trust could also thrive going forward as the UK economy is slowing, which means investors will focus more on companies with strong balance sheets.

However, the City of London Investment Trust is likely to struggle in bull markets, when tech and other growth-flavoured stocks are in favour.

Hollands said: “In a bull market, the trust will typically lag more aggressive strategies, but its steady eddy approach is well suited to tougher periods for the economy and therefore in the current environment, with the UK in a shallow recession, this is the type of environment when the strategy should really show its true colours.”

David Holder, senior investment research analyst at Square Mile Investment Consulting and Research, pointed out that the portfolio has material sector divergences relative to its benchmark, which could impact the trust’s relative performance.

That includes overweights in consumer staples, financials and utilities, while the portfolio has underweights in consumer discretionary, energy and healthcare.

Holder also stressed that the trust has little exposure to domestically-focused companies and UK small- and mid-caps. While that has been helpful for recent relative performance, he said the portfolio may not fully participate if sentiment toward these parts of the UK market improves.

What should investors consider before buying shares in the trust?

City of London has a tendency to trade above par (although the trust was trading on a 0.4% discount at the time of writing), which may or may not please bargain investors.

Harrison said: “It usually trades on a premium of 1% to 2%, so you are in effect paying slightly more for the underlying holdings. The trust issues shares to control that.”

The trust is also modestly geared (5.34%), which is a double-edged sword, as it can amplify returns when markets rise, but enhance losses when markets fall.

Harrison added: “The good thing about City of London’s gearing is that the majority of it consists of fairly long-term, low-rate notes. There's not a big hangover of 10% coupons from 30 years ago.”

Holder also said that the trust’s manager, Job Curtis, is a “conservative”, “relatively cautious” investor. As a result, his portfolio typically exhibits a lower level of volatility relative to the major UK indices.

Harrison stressed that Curtis rarely has more than 4% of the portfolio in any one holding, which enables the portfolio to avoid overexposure to single stocks.

Finally, the trust will seldom hold more than 80 stocks at any one time.

Harrison said: “It means Curtis has the capacity to know what's in his portfolio. If you're a manager running a portfolio of 500 stocks, I would suggest that you don't know all 500 companies intimately.”

Alternatives to City of London

While City of London has an enviable track record of raising its dividend, Harrison suggested that Curtis’ cautious stance means he is likely to underperform more aggressive investors during rising markets.

“When he gets good capital return, he tends to trim profit and reinvest it, while other managers may let it run a little bit longer,” Harrison said.

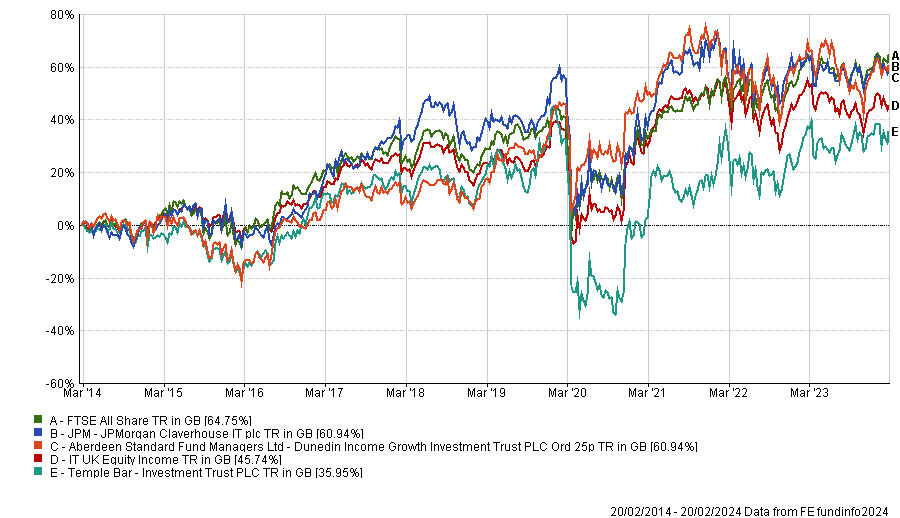

As a result, Harrison suggested JPMorgan Claverhouse, Dunedin Income Growth and Temple Bar as either alternatives or complements to City of London.

Performance of trusts over 10yrs vs sector and benchmark

Source: FE Analytics

“They're doing much of the same, but you're getting slightly different approaches, analyst teams and opinions. You would hope that between them, you would have your bases covered,” Harrison said.

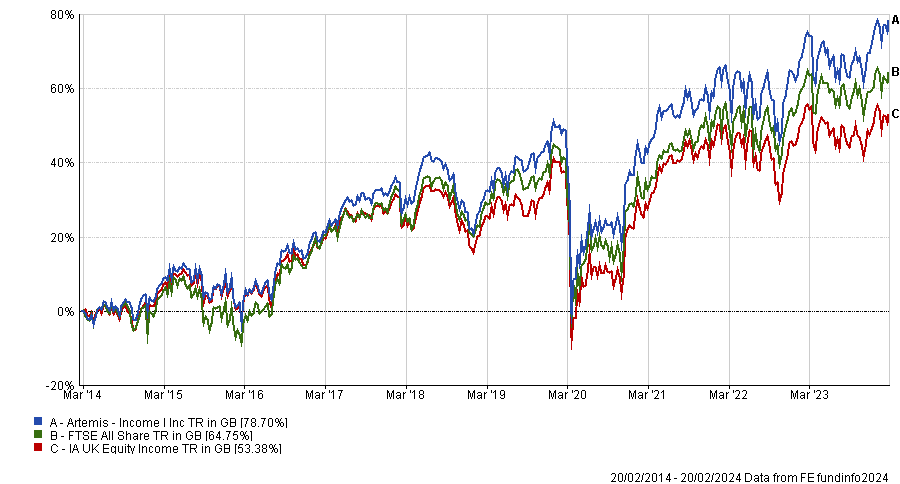

Holder picked Artemis Income as an alternative to City of London, highlighting the experience of manager Adrian Frost.

“The fund is managed using a fairly simple but active investment philosophy, with a focus on free cash flow generation as a bedrock of a company’s total return dynamic,” he explained.

“The fund’s managers are less concerned with their investee companies’ ability to pay a high level of dividends, and instead focus on finding companies that have the potential to benefit from share price growth, as well as boosting cash flows in order to facilitate future growth.”

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

While the portfolio shares some similarities in sector positioning and style, Holder noted that Artemis Income is more concentrated by number of stocks and is marginally less large-cap orientated than City of London.

Finally, Hollands tipped WS Evenlode Income and BlackRock UK Income as alternatives to City of London for investors seeking a UK equity income strategy giving exposure to large-cap companies with high overseas earnings, while Yearsley suggested Merchants Trust and Ninety One UK Equity Income.