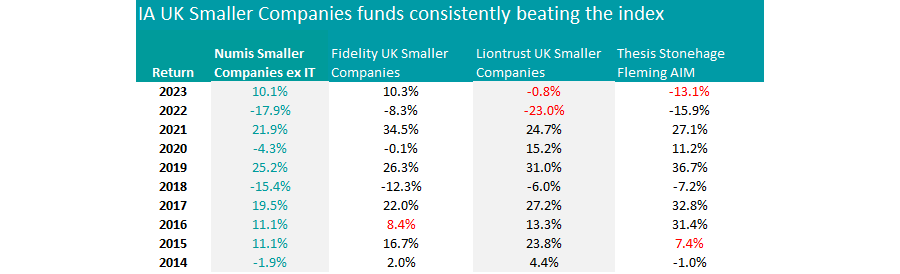

Fidelity, Liontrust and Stonehage Fleming offer the most consistent UK small-cap funds on the market over the past 10 years, data from FE Analytics has shown.

They proved better than every other peer at regularly outperforming the Numis Smaller Companies (Excluding Investment Trusts) index, the most common benchmark of the IA UK Smaller Companies sector.

Of the three, Fidelity UK Smaller Companies fund stood out as it has done a better job at staying ahead of the competition, outperforming in nine of the past 10 years, failing only in 2016. No other fund achieved this result.

The vehicle has a FE fundinfo Crown Rating of five and is managed by Jonathan Winton, whose goal is to identify companies that have gone through a period of underperformance but have unrecognised growth possibilities.

This contrarian style is combined with a value bias, for which the manager focuses on taking advantage of market inefficiencies at pricing companies, which can be even more stark in the under-researched small-cap space.

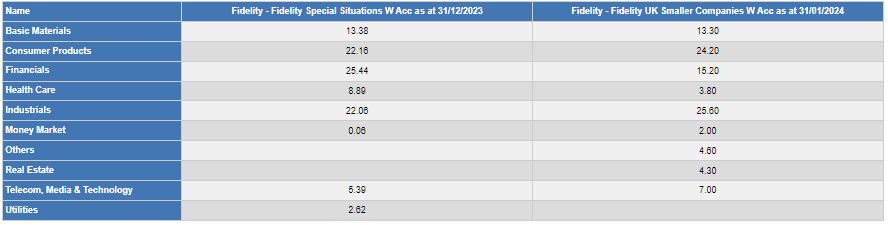

For these characteristics, the fund is similar to the popular Fidelity Special Situations portfolio managed by Alex Wright, to which it is 95% correlated.

Sector Weightings

Source: FE Analytics

The next-best funds are Liontrust UK Smaller Companies and Thesis Stonehage Fleming AIM, both of which struggled in 2023 as well as one other year over the past decade, giving them outperformance over the benchmark in eight years.

The £1bn Liontrust fund is run by a team including FE fundinfo Alpha Managers Anthony Cross and Julian Fosh, who invest in a concentrated portfolio of 62 UK companies in the mid and small-cap space, including those listed on the Alternative Investment Market (AIM).

The investment process follows Liontrust’s ‘Economic Advantage’ philosophy, through which the managers select stocks that should continue to grow thanks to competitive advantages such as intellectual property and other intangible assets that provide barriers to entry.

Performance has proved worthy of the second quartile of its sector over the past one and three years but it has leapt into the top quartile over the past five and 10. Since 2014, the fund has been the top performer of the entire peer group.

Coming in as the second-best performer of the past 10 years is the £76m Thesis Stonehage Fleming AIM fund, although short-term performance has been less spectacular. The fund falls into the second quartile over five years, third quartile over three years and fourth quartile (ranking 47th out 48 funds) over 12 months.

The difference is not just in total return terms, but also in investment case, as Stonehage Fleming’s Paul Mumford and Nick Burchett focus on AIM companies, which can carry a higher risk and may be less liquid than shares listed on other exchanges, resulting in greater volatility.

The worst year for the fund was 2023, when it lost 13.1% against the 10.1% gain of the Numis index, while the greatest outperformance was in 2016, when it was 20 percentage points ahead.

Source: Trustnet

This article is part of an ongoing series on consistency. Find the previous instalments here: IA Global, Europe, IA UK Equity, IA UK Equity Income.